Peak oil?: Oil supply and accumulation

| By D. T. Cochrane • January 4th, 2008 |

For the past few years the buzz about ‘peak oil’ has largely been confined to activist circles. The possibility of oil’s disappearance as a viable energy source was a cause for both dread - what horrible things might happen within a society deprived of its energy gluttonous toys? - and celebration - what desirable changes might occur? However, talk of the theory is increasingly finding its way into the mainstream. Most recently, the Toronto Star featured the article “Is oil supply at its peak?” on the front page of its business section. One of the experts included in the article was Jeff Rubin, chief economist of CIBC World Markets. Hardly a radical, Rubin says that oil output will likely fall in the near future. Although this does not mean the disappearance of oil as an energy source, or even its immediate demotion from the top spot among energy sources, it will translate into an upward trend of oil and gas prices. As well, the prices will likely fluctuate much more drastically. Among the changes this will motivate, according to Rubin, is an increase in regional economies and decrease in ‘globalisation.’ This scenario certainly holds appeal for progressives and radicals for whom corporate globalisation was ‘Enemy No. 1′ during the 1990s and early 2000s.

Although a peak and decline in oil production is a geological certainty, we should question whether it is actually occurring right now. The supply of oil within the global market depends on much more than the geological realities of production. Governments of all sorts - Iran, Saudi Arabia, Venezuela, the United States, Russia - are heavily involved. Its corporate players are among the world’s most powerful and profitable businesses. The goings-on within the market are of interest to every other business. Speculation is rife. Examination of recent price increases need to consider these factors and many more.

One of the pieces of evidence offered by advocates of the theory is the uncertainty surrounding the actual quantity of oil in the Middle East. The size of the reserves controlled by the big oil exporting countries is unknown. There is some evidence that Saudi Arabia, in particular, has routinely overstated the amount of known reserves. However, although these countries do not want to lose the political clout they enjoy from their control of the great global lubricant, it is not difficult to see how they benefit from such uncertainty. Uncertainty drives up prices; higher prices, higher earnings.

Another source of uncertainty has been the invasion and occupation of Iraq. This one-sided war is routinely labelled as a ‘War for Oil’ by its critics. The standard idea behind the slogan is that the U.S. wishes to control the global oil supply in order to ensure the easy access required by its corporations. However, the war has hardly brought an increase in supply. Instead, it has coincided with a rather drastic increase in oil and gas prices. The oil exporting countries are hardly the only beneficiaries. The oil companies have been enjoying record profits.

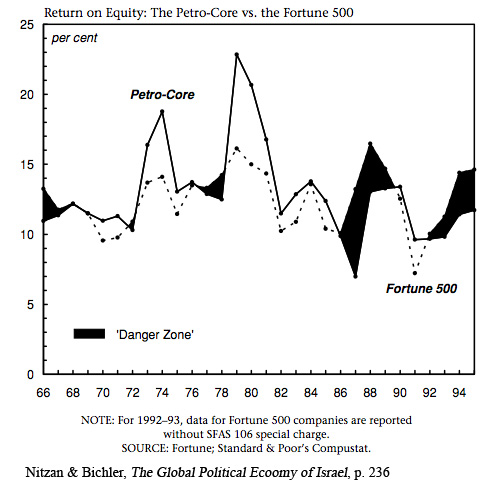

An increase in prices, rather than supply, as an outcome of the invasion, was predicted by political economists Jonathan Nitzan and Shimshon Bichler in their 2003 article “It’s all about oil.” The pair challenged the conventional wisdom that the war was meant to undermine OPEC (Organization of Petroleum Exporting Countries) and ensure the free flow of oil. They demonstrated that the fortunes of the oil companies and OPEC move together. Far from seeking to loosen the supposed iron grip of the dictators who control the global oil supply, the corporate petroleum giants have benefitted from their interventions. In fact, the invasion of Iraq was partially motivated by the the oil cartel’s ineffectiveness at raising prices. Nitzan and Bichler have shown that ‘energy wars’ in the Middle East have followed upon periods of deaccumulation by the oil giants relative to the members of what they call ‘dominant capital.’ For example, in 1988, although the return on equity of what Nitzan and Bichler call the ‘Petro-Core’ was more than 12%, the Fortune 500 - a proxy for dominant capital - had returns greater than 15%. This means that the oil giants fell behind their capitalist cohorts: they failed to beat the average. For the entire second half of the 80s the Petro-Core lost ground. The situation was not reversed until the early 90s when Bush the First invaded Iraq (see Nitzan and Bichler, 2002, ch. 5).

However, from the differential perspective it becomes clear that the interests of other capitalists are not being served by the wars in the Middle East. When the oil companies are accumulating relative to dominant capital as a whole, others must be losing - although we cannot tell exactly who unless we disaggregate the picture. An end to the U.S. occupation will likely come when the (relative) losers within dominant capital finally exert sufficient pressure upon the politicians in Washington. The oil companies realize that they cannot hold court indefinitely and it is likely the political-military tide will turn against them. Yet, they would like to retain their accumulatory advantage. If military adventures can no longer drive up oil prices, then perhaps talk of diminishing supplies will.

Peak oil will come. When it does, its effects on the global economy are uncertain. In the meantime, the oil companies must keep the following plates spinning: faith in oil as the energy source of capitalism, a high enough price to remain on top of the corporate world, a low enough and steady enough price to avoid contributing to a lengthy recession, or even a depression. While the differential perspective on accumulation makes it clear that growth is not synonymous with the corporate interest - as long as everyone else is declining faster than you, then you are differentially accumulating - depressions are dangerous for their unpredictability and their potential to threaten the capitalist status quo (see, Nitzan, 2001). Undoubtedly, one of these plates will drop. The question is: which one? The consequences of the answer to that question will come more immediately than the geologically necessary peak in production and should be of greater concern.

Nitzan, Jonathan. (2001). “Regimes of differential accumulation:mergers, stagflation and the logic of globalization.” Review of International Political Economy, Vol. 8, No. 2, pp. 226-274.

Nitzan, Jonathan & Shimshon Bichler. (2002). “The Weapondollar-Petrodollar Coalition.” The Global Political Economy of Israel. London: Pluto Press.

—–. (2003). “It’s all about oil.” News From Within, Vol. 19, No. 1, pp. 8-11.

Hamilton, Tyler. (January 3, 2008). “Is oil supply at its peak?” Toronto Star, B1, B4.

D. T. Cochrane

is a new father who thinks about business, power and social economic

change. His profile picture is of the Crab Nebula. It is the remnants

of a supernova. Current scientific theory says that they seed the

Universe with the ingredients of life.

Email this author | Profile and posts by D. T. Cochrane

| « On Anarcho-Syndicalism:... | To Pay or Not to Pay?... » |

That’s an interesting and persuasive argument that Nitzan and Bichler make about the intentions and purpose of intervention into the Middle East. Provides a bit more context and data to a recent interview I saw, where Garry Kasparov argued that the war pushed up oil prices and in doing so increased the power and influence weilded by Putin (www.youtube.com/watch?v=H…) – and, Kasparov argues, decreased the potential for new forms of democratic governance in the region. Needless to say, Kasparov has been arrested since then.

I think you touch on a key point in oil price determination: speculative pressure on future oil prices in mercantile exchanges. This is a point that is raised (and predictably disregarded) in a recent OECD Report. There is a lot of money to be made from a volatile, rising oil price, by parties other than oil companies or exporters, and consequently an incentive to ignore fundamentals, such as proven reserves, etc. Specific compartments of finance capital - namely unregulated hedge funds always seek money where it can be made easiest, and with huge sums of capital at their disposal, they feed on volatile commodities like oil.

However, while it is well known that certain aspects of capital will always be at odds with another as a result of “differential accumulatory interests”, as you put it, I would be wary of asserting that a change in the group of capital currently “capturing” the will of Washington will necessarily, or even likely, lead to an end of the occupation in Iraq (moreover, almost all US oil firms are Fortune 500 companies). It is well known where the allegiances of the Bush administration lie, but a saturated US market and tightening credit will increase the push of many blue chip ‘losers’ to look for markets and profits elsewhere. Given the current state of Iraq, continued US occupation to ensure that market relations are able to materialize ‘naturally’ is forseeable even after big oil falls out of favor in Washington.

But you are right on the money when you note that a crisis in the current regime of capitalist accumulation will loom long before the peak oil question. One only needs to read one of the many year-end summaries of US markets to see a contradiction arising. Check out this one as it pointedly calls 2007 the “Year of Extremes”. As the elasticity (pardon the economic pun) of the market vacillates in increasingly destructive and decreasingly creative ways (recall Schumpeter), a growing tension and dissatisfaction will certainly break the current order. The question is when. ‘Something’s Got to Give’, and it wont be Marilyn Monroe this time around.

Political fractures within dominant capital are certainly not highlighted by its members. As such, you are right that there will not be a sudden, or drastic reversal in Iraq. However, these differences are an important component of real competition (as opposed to the imaginary dominance of price competition as imagined by mainstream economists). The government’s hawkish tone, with its focus on warring abroad and its massive spending in the defense sector, is undermining the accumulatory interests of some of the non-Petrodollar/Weapondollar factions. I expect at the very least a large reduction in defense spending, if not a change in foreign policy. Some pretense for withdrawal will be offered. Spending will be diverted to other sectors.

I think that Naomi Klein got the picture half right with her concept of disaster capital, but it is certainly not a universal benefit among the corporate elite for the world to be in destructive turmoil. A certain amount of stability and contentment is required for widespread conspicuous consumption. My guess is that we’ll see a bigger push on the ‘green consumption’ front.

I will offer one caveat: lack of well-paying jobs. Many manufacturing jobs were fairly well paying. Blue collar workers became solidly middle-class. They made excellent consumptive emulators. The Big Union-Big Manufacturing accord of the 50s and 60s has broken down. Manufacturing jobs have transferred elsewhere. Perhaps capital will see its need for consumers served by improving the pay for service work. Perhaps they’ll simply turn to the broader, although poorer, base of consumers in other countries. It’s unclear. Of course, all of this is merely speculation.

It truly is speculation, but that’s really all we can do if we want to go beyond merely describing the empirics. I would be the last to say that all capitalists are war mongerers, and it wasn’t my intention to imply that US military occuption will be a fact of life for Iraqi citizens indefinitely. But capital requires ’stable’ markets to reproduce itself, and Iraq certainly does not represent the ideal marketplace. I think you already saw a hint of a likely future policy if either Clinton or Obama gets into the whitehouse: back in 2006, when the calls for troop withdrawal peaked, immediately after winning the congressional elections the more ‘mainstream’ democrats distanced themselves from this. Of course, this position always get couched in the rhetoric of prudency and humanitarianism, and maybe this is sincere, but the effect is always the same - stability for capital accumulation and social reproduction.

I think you’re right when you say that we will likely see a change in defense spending, foreign policy and sectoral spending. Virtually every presidential candidate in the running now will not be able to continue on as Bush has done (though pay close attention to McCain’s alignment with the ‘new’ Bush policies). But since as far back as Nixon (or the end of the Fordist comprimise as you describe), both parties only pay lip service to protectionism while advancing the project of neoliberal globalization. I expect alot of money to go to Wall St. and insurance companies as part of a bail-out package if the Dems get into power (though Clinton is the only candidate for whom I would say this is a certainty). But given the amount of money that has been funnelled into stabilizing Iraq, I see a continued occupation until there is at least a modicum of strengthening of Iraqi state capacity, or things degenerate to the point where they are air lifting troops out of the green zone like in Vietnam. Perhaps, in the vein of Naomi Klein, the US will abandon Iraq and turn it into a kind of “Failed State Disneyland” for adventure tourists. In any event, its not that I disagreed with your overall message, just that the nature of shareholder capitalism coupled with the discourse of economism lead politicians down the path of predatory policy, whether at home or abroad.

As a postscript, I’ve long thought that Bush breeds a kind of “uncomfortable” capitalism for most in the business world. To imagine what this is like, consider you put together a dinner party and invite your closest friends, along with your grumpy old boss, your local MP, some media personnel, etc. As you sit down to dinner, your child acts up so much (and I don’t mean to make this analogy personal at all) that it consistently jars the dinner conversation. Everyone can go on with their meal quite smoothly, and your close friends all smile understandingly - with children of their own, this doesn’t bother them at all. But your awkward guests, with whom you know you need to court in conversation in order to break the tension do begin to get grumpy. No one stops eating their meal just yet, but at some point - maybe when your kid makes some rude comment about your boss - a line may be crossed, and out the door go your dinner guests, along with your promotion. This silly reversed analogy is only meant to hihglight that industry would much rather have “social peace” than the polarizing kind of politics that Bush has cultivated. In sum, and I’m sure you will pick up this nuance, they would prefer a politics that is much less ‘political’. I think this goes for the vast majority of U.S capitalists concerned about their own economic interests (excepting of course, the growing sector of finance capital and consultant firms that thrive on war, suffering and chaos).

@Lymburner: I think you have misunderstood Nitzan and Bichler’s point here (or are unaware of the extensive theory behind these assertions about differential accumulation). I would point you to the Bichler/Nitzan archives to read up on exactly what differential accumulation is, but, suffice to say, it isn’t merely “speculation”, and that is not “all we can do”. In a sentence: strategic sabotage is a method of limiting production (of the social process), which is required because capital must be measured differentially, in the sense that capitalists must “beat the average”.

Quinn - I apologize for any claim I may have made that implied that I am an expert on Nitzan and Bichler’s theory of differential accumulation, for I am not. I had assumed that by putting my only reference to the theory in scare quotes, I had made my unfamiliarity with it quite clear. Indeed, my intention was not to parrot the theoretical perspective advanced in the article - that is not the point of a critique. Rather, it was to take up the terms of reference (oil supply & pricing, assertions about the sectoral configuration of capital power, the relationship between state policy and capital interests, etc.) under the aegis of a different theoretical perspective. Nor, in fact, was I specifically critiquing the theory itself - I take for granted that there are winners and losers within the capitalist class that necessarily relate (i.e.: compete with) to one another.

Since you fail to specifically mention what it is that I didn’t understand about the theory, I can’t respond much beyond this at present. I will look into the theory more deeply in the near future, and we can certainly discuss it within its own terms of reference then. I will say, however, that my quote was significantly taken out of context if you are implying that I was referring to the theory itself. As you’ll see, I was referring to the comment prior to mine regarding making future predictions about the global political economy. As I’m sure you will appreciate, the element of agency present in social life precludes social “science” and its theory from making absolute or certain predictions. We can, and should, develop theories to account for social life, and often those theories will prove correct, but they can never operate like some kind of platonic form, lest our arrogance best us. Moreover, my comment was aimed at the descriptive or discursive realm, rather than at the existing political economy. There are many, many things we can do to alter the capitalist dynamic, but that must be the subject of another discussion!