Systemic Crisis, Systemic Fear: An Exchange

Andrew Kliman, Shimshon Bichler and Jonathan Nitzan

New York, Jerusalem and Montreal

February 2011

Preamble

The exchange below concerns Shimshon Bichler and Jonathan Nitzan’s article ‘Systemic Fear, Modern Finance and the Future of Capitalism’ (2010). The first paper, by Andrew Kliman, was posted on February 6, 2011 on the website of the Marxist-Humanist Initiative. The second paper is a rejoinder by Bichler and Nitzan.

Value and Crisis: Bichler & Nitzan versus Marx

Andrew Kliman, February 6, 2011

This article responds to recent works by Jonathan Nitzan and Shimshon Bichler, influential radical political-economic thinkers who teach, respectively, at York University in Toronto and at colleges in Israel. Part I, below, responds to Bichler and Nitzan’s (B&N) ‘Systemic Fear, Modern Finance and the Future of Capitalism’ (Bichler and Nitzan 2010). In this paper, they argue that (1) ‘systemic fear’ – fear of the death of the capitalism – has gripped capitalists during the last decade, but (2) capitalists’ belief that their system is eternal is necessary for its continued existence. So (3) the alleged systemic fear is itself a threat to the system. And thus we have yet another version of the notion that capital itself may be the historical Subject that will bring it down.

B&N claim that fear of the system’s death has gripped capitalists only during two periods in recent history – the Great Depression and the 2000s. Their evidence for this claim consists entirely of the alleged fact that these two periods of crisis were the only periods since World War I in which equity (stock) prices and current profits were strongly correlated, i.e. the only periods in which they closely moved up and down together.[1] However, using the exact same methods and the exact same data as B&N, I show below that that equity prices and current profits were also strongly correlated from the early 1950s through 1973 – during the so-called golden age of capitalism!

In Parts II and III of this article, which will appear here later this month, I will respond to the critique of Marx’s value theory that pervades Nitzan and Bichler’s 2009 book, Capital as Power. In this book, they allege that Marx’s value theory is practically useless for the study of accumulation. So my response will show, among other things, that his theory sheds significant light on the long decline in the rate of accumulation (investment) that contributed to ever-increasing debt burdens in the U.S. and helped set the stage for the recent Great Recession.

Part I

In November, Nitzan presented his and Bichler’s ‘systemic fear’ thesis – including the correlation data that supposedly supports it – in a presentation to a joint session of the prestigious Harvard Law School and Harvard’s equally prestigious Kennedy School of Government. And a different version of the same argument, featuring the same correlation data, appeared earlier in an article they published in Dollars & Sense, a left-liberal economics magazine.

But since their data actually show that equity prices and current profits were also strongly correlated from the early 1950s through 1973 – during the so-called golden age of capitalism! – we should doubt their claim that systemic fear has prevailed in recent years. After presenting and discussing these data, I will argue that flaws in B&N’s reasoning should also cause us to doubt their claim that capitalists are normally convinced that capitalism is eternal, as well as their claim that this conviction is crucial to its continued existence. But if the future of capitalism doesn’t hinge on the conviction that the system is eternal, it also doesn’t much matter whether capitalists have recently been gripped by systemic fear in B&N’s sense.

Good old regular fear, ‘the dread and apprehension that regularly puncture [capitalists'] habitual greed’ (Bichler and Nitzan 2010, p. 18), is another matter. There can be little doubt that good old regular fear was intense at the start of the last decade, and even more intense at the end. I believe that this good old regular fear was justified and that it remains so. The underlying long-run economic problems that led to the recent Great Recession, and to the weakness of the subsequent recovery, have not been resolved. As I will discuss in Part II of this article, slow growth of employment relative to investment during the last six decades has led to a persistent fall in the rate of profit; the fall in the rate of profit has caused capital accumulation and economic growth to be sluggish for decades; and this sluggishness has led to mounting debt burdens. I doubt that the fall in the rate of profit can be reversed or that the debt problem can be solved without much more destruction of capital value – i.e. falling prices of real estate, securities, and means of production, as well as physical destruction – than has taken place to date. And if these problems remain unresolved, the economy will continue to be relatively stagnant and prone to crisis.

But it is difficult to discuss these ideas with B&N, or at all, because they and others like them contend that the theory on which the ideas are based, Marx’s value theory, is internally inconsistent and circular. An internally inconsistent theory cannot possibly be correct.[2] All ideas resting upon such a foundation can thus be disqualified at the starting gate, without further ado. In order to clear the ground for a genuine discussion – one in which B&N’s approach to questions of crisis and the future of capitalism is compared with and contrasted to something rather than nothing – Parts II and II of this article will respond to the main criticisms of Marx’s value theory.

* * *

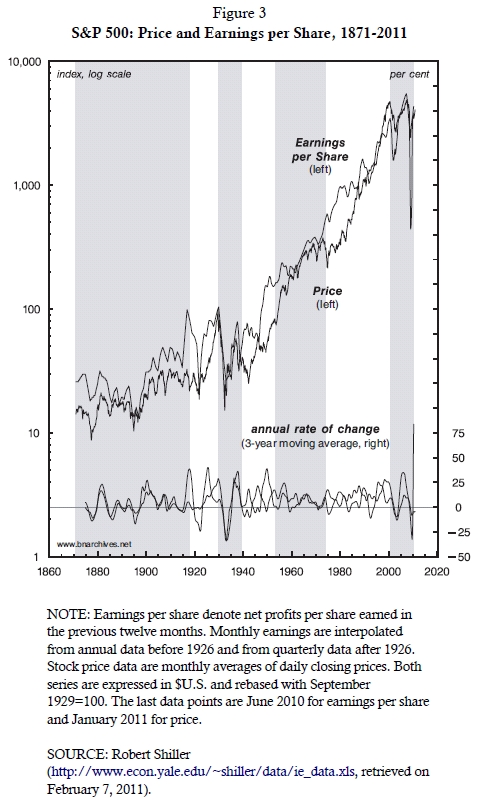

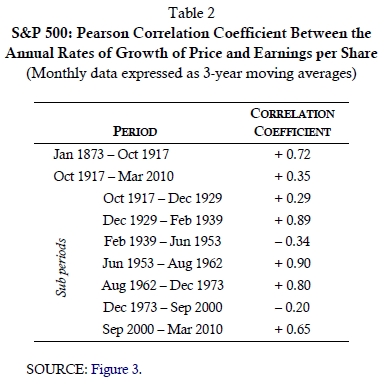

B&N (2010, p. 17, emphasis in original) note that ‘if we adhere to the scriptures of modern finance, we should expect to see no systematic association between equity prices and current profits.’ And they claim that equity prices have indeed become decoupled from current profits since 1917, except during two brief and exceptional periods. ‘Figure 2 and Table 2 show two clear exceptions to the rule: the first occurred during the 1930s, the second during the 2000s. In both periods … equity prices moved together – and tightly so – with current earnings’ (Bichler and Nitzan 2011, p. 17 emphasis altered).

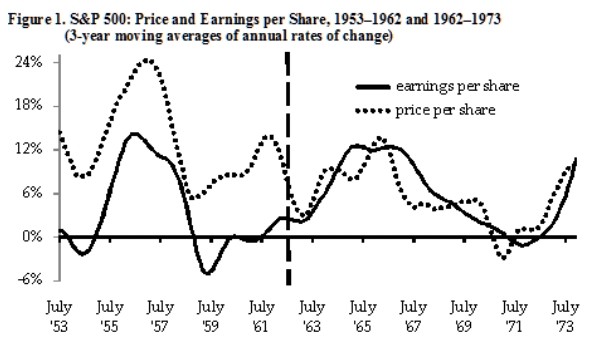

However, their Figure 2 actually shows four clear exceptions to the alleged rule. Equity prices also moved together with current earnings – and tightly so – from the early 1950s to the early 1960s, and from the early 1960s to the early 1970s (see my Figure 1).

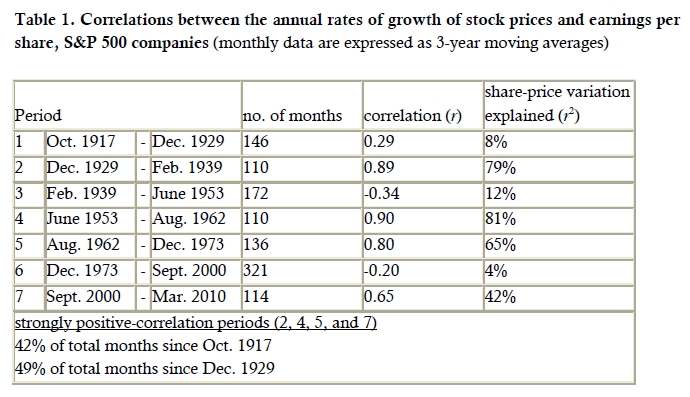

During the first of these additional ‘exceptional’ periods, period 4 of Table 1, below, the correlation between equity prices and current earnings was stronger than during the Great Depression (period 2). During the other ‘exceptional’ period that B&N fail to bring to our attention, period 5, the correlation was lower, but still considerably stronger than during the 2000s (period 7).[3] The percentage of the variation in one variable that is ‘explained’ by, or attributable to, the variation in the other is the square of the correlation coefficient, r2. Thus, as Table 1 shows, only about two-fifths of the variation in share prices during period 7 is attributable to variations in current profits; the explained variation during period 4 is almost twice as great, while the explained variation during period 5 is more than 50% greater.[4]

Table 1 also shows that share prices have been strongly and positively correlated with current profits more than 40% of the time since 1917, and almost half the time since 1929. So the ‘exceptions’ are not exceptional; the ‘rule’ that share prices and current profits have become decoupled is no rule at all.

But B&N haven’t merely gotten their facts wrong. Because their facts are wrong, so is their paper’s key claim that we can infer that investors are gripped by ‘systemic fear’ when the relationship between current profits and equity prices is strong and positive. They tell us that the two periods in which systemic fear prevailed were two periods of acute crisis, the Great Depression and the 2000s. If a strongly positive correlation between current profits and share prices were another exceptional feature of these periods of crisis, then the notion that we can infer the existence of systemic fear from the positive correlation might be plausible. But the 1930s and 2000s were not exceptional in that respect, as we have seen. And the other two strongly positive-correlation periods, which run from the early 1950s through the early 1970s, cannot plausibly be characterized as a time of systemic fear. On the contrary, that era was the so-called golden age of capitalism.[5] So a strongly positive correlation between current profits and equity prices does not allow us to infer the existence of systemic fear.

But the correlation data are B&N’s only evidence that capitalists were gripped by systemic fear in the 1930s and 2000s. (The statements by the Financial Times, Alan Greenspan, Bernie Sucher, Gillian Tett, and Mervyn King quoted in their paper discuss a highly uncertain environment, economic crisis, and discredited economic theory and ideology, not fear of the death of capitalism.) So they have not given us a good reason to accept that claim.

* * *

Nor do they give us a good reason to accept that the opposite of systemic fear – the conviction that capitalism is eternal – is the norm. Their ‘demonstrat[ion]’ that capitalists are almost always guided by this conviction is fatally flawed. And since the same demonstration is the basis upon which B&N (2010, p. 3) claim that ‘[t]his … conviction is necessary for the existence of modern capitalism, at least in its present form,’ they also fail to give us a good reason to accept this latter claim.

The most glaring flaw in their ‘demonstration’ comes at the end, when they write, ‘the fact that capitalists invest shows that they expect … that the value of their assets will grow, not contract – and that expectation means that, consciously or not, they also think that the ritual that valuates their assets will never end’ (Bichler and Nitzan 2010, pp. 3-4, emphasis added). The italicized clause is simply false. Just as some people buy lottery tickets even if they don’t expect to hit the jackpot, some people buy shares of stock even if they don’t expect their prices to rise. A large enough jackpot or a large enough potential capital gain more than makes up for a low probability of success. Hence, the fact that people invest does not mean that they normally expect capitalism to last forever.

Imagine, for instance, that you think that there’s only a 50-50 chance that capitalism will exist a year from now, and that you are considering buying shares of stock for $10,000 today. If capitalism doesn’t survive, you’ll lose the whole $10,000, so it would be better to spend the $10,000 now, not invest it. You believe that this outcome is as likely as not, but you also believe that if capitalism does survive, the shares will be worth $500,000 a year from now. If you are like most people, you’ll go ahead and invest.

Secondly, dozens upon dozens of experiments conducted by Nobel laureate Vernon Smith and colleagues (e.g. Smith, Suchanek, and Williams 1988; Porter and Smith 2003) during the past quarter century have demonstrated conclusively that people frequently invest in assets even when know that ‘capitalism’ (i.e., its experimental equivalent) will soon perish. Participants in the experiments are given some cash and some shares of an imaginary equity. They are told that the shares will pay dividends for a fixed length of time, such as fifteen periods, and that the experiment will then end, at which point the shares will be worthless. The current fundamental value of a share – the sum of the average per-period dividends throughout the remainder of the experiment – is announced at the start of each period.[6] Participants can buy additional shares from other participants, sell their shares, or hold onto them and collect their dividends. At the end of the experiment, they get to keep their initial cash endowments, dividends, and any net capital gains they have obtained.

Now, B&N (2010, p. 3) claim to demonstrate that if capitalists believed that the system ‘would cease to exist at some future point,’ then share prices ‘would have no-where to trend but down,’ and capitalists would therefore be unwilling to buy additional shares. But even though participants in the experiments are absolutely certain that the system (i.e., the experiment) will soon cease to exist and that the asset’s fundamental value is continually falling, share prices typically rise throughout much or most of the experiment – big bubbles are formed – and the volume of investment in additional shares is typically heavy. This has been the routine outcome even when the participants in the experiments are over-the-counter stock dealers, businesspeople, or students at the California Institute of Technology or the Wharton School.

Research into why this ‘perverse’ behavior occurs is still ongoing, but the basic reason why people buy shares that eventually become worthless, and whose prices must therefore eventually fall, is obvious. People think that they may well make a substantial profit in the meantime, by reselling the shares at prices higher than those they paid.

Finally, even if the rest of B&N’s ‘demonstration’ were sound, it would not prove that capitalists are normally guided by the conviction that capitalism is eternal. At least it wouldn’t prove this if we use the word ‘conviction’ in the normal way. B&N are undoubtedly aware that it would not, since they write that ‘consciously or not, [capitalists] also think that the ritual that valuates their assets will never end’ (emphasis added). I doubt that ‘unconscious conviction’ is a coherent concept, but even if it is, B&N’s appeal to it turns what started out as a provocative and straightforward claim into a piece of unfalsifiable Freudian speculation.[7]

Endnotes

[1] They interpret a strong influence of current profits on share prices as evidence that investors are acting on the basis of the current situation, having abandoned their supposedly normal “conviction” that the shares will yield returns ad infinitum because capitalism is eternal.

[2] An internally inconsistent theory may happen by accident to hit upon correct conclusions, but the arguments it provides in support of these conclusions are always invalid.

[3] The correlation was negative between February 1961 and May 1964. If we count this as a distinct period and shorten periods 4 and 5 accordingly, the correlations during these periods increase to 0.92 and 0.82.

[4] I computed a correlation of 0.65 for period 7, while B&N report a correlation of 0.64. My other results match theirs, so this slight discrepancy may be due to a recent revision of the data set, published by Robert Shiller on his website.

[5] Since I, like B&N, computed the correlations between 3-year average values, periods 4 and 5 use data from August 1950 through December 1973, which is almost exactly coextensive with the golden age as defined by Skidelsky (2010, p. 24) the period ‘from 1951 to 1973’.

[6] In some experiments, shares pay a fixed dividend. In others, participants are told what the possible dividends are and the probabilities that each will be paid.

[7] As William James (1890, p. 163, emphasis omitted) noted, ‘the distinction … between the unconscious and the conscious being of the mental state … is the sovereign means for believing what one likes in psychology and of turning what might become a science into a tumbling ground for whimsies.’

References

Bichler, Shimshon and Jonathan Nitzan. 2010. Systemic Fear, Modern Finance and the Future of Capitalism, July.

James, William. 1890. The Principles of Psychology, Vol. 1. New York. Henry Holt and Co.

Nitzan, Jonathan and Shimson Bichler. 2009. Capital as Power: A study of order and creorder. London and New York: Routledge.

Porter, David P. and Vernon L. Smith. 2003. Stock Market Bubbles in the Laboratory, Journal of Behavioral Finance 4:1, 7-20.

Skidelsky, Robert. 2010. Keynes: The Return of the Master. London: Allen Lane.

Smith, Vernon L., Gerry L. Suchanek, and Arlington W. Williams. 1988. Bubbles, Crashes, and Endogenous Expectations in Experimental Spot Asset Markets, Econometrica 56:5, 1119-1151.

Systemic Crisis, Systemic Fear: A Rejoinder

Shimshon Bichler and Jonathan Nitzan, February 21, 2011

Kliman’s paper isn’t exactly a critique. The author doesn’t engage our argument, and he shows no concern for the broader theoretical and historical context in which this argument is made. Instead, he looks for inconsistencies, discrepancies and incompatibilities – faults that in his view pull the rug out from under our entire analysis and make such engagement unnecessary to begin with. The gist of his complaint can be summarized as follows:

1. Bichler and Nitzan, he argues, draw conclusions that their own data refute. They claim that in capitalism systemic fear is revealed solely by the breakdown of capitalization, with stock prices being positively and tightly correlated with current earnings; they then argue that such a breakdown occurred only during the 1930s and 2000s; and they use this observation to infer that during these periods capitalists have been gripped by systemic fear. However, according to the evidence that they themselves marshal, a positive and tight correlation also existed from the early 1950s to the early 1970s. And since the latter period wasn’t one of crisis – in fact, it is commonly seen as the ‘golden age’ of capitalism – the notion that we can use price-earnings correlations as indicative of systemic fear breaks down.

2. Bichler and Nitzan erroneously assume that capitalism requires capitalists to believe that the system will continue forever. The error here is both logical and empirical. Simple probability theory suggests that, for a high enough reward, most people will invest even when they believe that the capitalist system is very likely to collapse. And laboratory experiments, including those reported by Nobel laureates, show that people will continue to buy stocks that they know will become worthless by the end of the experiment. In other words, capitalists act like capitalists regardless of what they think about the future of capitalism.

3. The very notion of systemic fear is entirely subjective and therefore useless for a scientific inquiry. Nitzan and Bichler pretend to show that capital is a historical subject capable of bringing capitalism down, but their alleged demonstration relies on incoherent terminology and unfalsifiable Freudian speculations. Instead, they should go back to the ‘good old fear’ that capitalists feel when struck by a real crisis of real profit (as Marx already and perfectly explains in Das Kapital).

The Sleepwalkers

Kliman’s first point is correct, and we are grateful to him for having pointed it out to us. The positive correlation between share prices and current earnings indeed is not unique to the 1930s and 2000s. As he indicates, a similar correlation exists from the early 1950s to the early 1970s – a correlation that we overlooked and failed to mention in our paper. However, as this rejoinder shall show, the oversight is hardly critical. It can be easily corrected in a manner consistent with both our systemic-fear hypothesis and our broader notion of the capitalist mode of power.

To begin with, Kliman’s personal anxieties notwithstanding, inconsistency need not be lethal. Note that we are dealing here not with the heteronomous, irrefutable dogma of a frozen academic church, but with the autonomous, living process of an ever-changing science.[1] And scientific discovery, unlike religious reiteration of eternal truths, is littered with oversights and errors. They are the bread and butter of the creative process, the serendipitous leeway that gives scientists the ability to tease order out of chaos. For academics concerned with the health of their career, errors are a recipe for disaster, a risk best avoided by limiting oneself to ‘adoptions’, ‘interpretations’ and ‘critiques’. But for creative scientists, making errors – and negating them – is the only path to breakthroughs.

The Pythagoreans erred in their belief that every magnitude can be expressed as a rational number. This erroneous conviction, though, helped launch the remarkable triangle of democracy-science-philosophy, and the eventual refutation of that conviction created a much larger mathematics that incorporated irrational as well as rational numbers. And the list continues. Kepler’s astronomical research was bogged down for a decade by his supposition that celestial orbits were circular rather than elliptical, but that mistake sharpened his inquiry and hardly invalidated his broader thesis. Delambre and Méchain’s mission to measure the standard meter was full of baffling inaccuracies, but those inaccuracies helped trigger the mathematical development of statistical estimates. Einstein’s belief in a stationary universe didn’t sit well with his relativity theory, creating an inconsistency that he solved by inventing a ‘cosmological constant’; later on, when he accepted that the universe was expanding, the inconsistency disappeared and the constant became unnecessary (erroneous?); and nowadays, talk of an accelerating universe may end up giving the constant yet another lease on life. The works of Gardiner Means on administered prices and on the separation of corporate control from ownership, although subject to intense empirical criticism, remain two of the most fruitful starting points in twentieth-century economics.[2] Andrew Wiles’ proof of Fermat’s Last Theorem took seven years to produce, only to be found fatally flawed. But two years later, the error was corrected, the proof was accepted, and mathematics benefitted from novel hypotheses and new areas of inquiry that Wiles’ torturous journey helped open up. Yutaka Taniyama, one of the greatest sleepwalkers of modern mathematics, was described by his collaborator Guro Shimura as sloppy to the point of laziness: ‘He was gifted with the special capability of making many mistakes, mostly in the right direction. I envied him for this and tried in vain to imitate him, but found it quite difficult to make good mistakes’. This willingness to go astray enabled Taniyama to come up with a most fantastic conjecture on the symmetry between modular forms and elliptical equations, a conjecture that opened up multiple new mathematical horizons well before it was finally proven.[3]

We, too, sleepwalked. Our concern was systemic fear and systemic crisis, not ‘business as usual’. We wanted to understand what happens not when capitalists are sure of their rule, but when they lose their confidence. We wanted to know how they act not when capitalism seems certain, but when it is put into question. And so we overlooked what in retrospect seems obvious.

The Broad Context: The Capitalist Mode of Power, Capitalization and the Stock Market

Kliman clings to a technical oversight, presenting it as a ‘make-or-break’ error for our broader argument. But by ignoring the argument itself and the overall framework in which it is developed, he ends up with a misleading caricature.

So let us reiterate the broad picture, if only in outline, and in the process try to clarify our argument and put things right. Our focus on the twin notion of systemic fear and systemic crisis didn’t come out of the blue. It emerged as part of a new approach to capitalism – an approach that offers an alternative to both neoclassical and Marxian political economies and that we have articulated in many articles and books, including our recent Capital as Power (Nitzan and Bichler 2009a). In 2008, we began to write a paper series on the contours of crisis, a series that we hope to continue and eventually develop into a book (Bichler and Nitzan 2008, 2009; Nitzan and Bichler 2009b). The article ‘Systemic Fear, Modern Finance and the Future of Capitalism‘ (Bichler and Nitzan 2010) is an expanded version of the third installment in that series. The series introduces and develops the notions of systemic crisis and systemic fear – but it does so in steps, gradually rearticulating and refining the terms as the story continues to unfold.

Mainstream and Marxist political economies see capitalism as a mode of production and/or consumption. Consequently, they both adhere to a double separation – one between politics and economics; and another between the so-called real and nominal spheres of the economy itself. In this framework, the nominal sphere of money, credit and finance is merely a mirror – accurate for the neoclassicists, distortive for the Marxists – of the underlying ‘economic reality’. From this viewpoint, the only true crises are ‘real’ ones: crises of employment, production and consumption; crises of real profitability; crises of real accumulation, crisis of real investment, etc. These crises can be trigged by many causes, including government intervention, natural disaster, war, and, of course, finance. But whatever their origins, they become meaningful only insofar as they materialize in the underlying ‘reality’ of the economy.

Our framework is very different. Capitalism is not a mode of production and consumption, but a mode of power. To understand it, we start not from the narrow ‘material’ sphere of economics, but from the broad architecture of social power. And even when we deal with so-called economic processes, we focus not on productivity and well-being, but on the power to control productivity and well-being. In this framework, capital is not a technological/productive entity that is merely ‘reflected’ in finance. It is not machines, structures and work in progess, but a pure quantitative code of power. And that code is financial and only financial.

The central and by now all-pervasive algorithm of the capitalist mode of power is capitalization: the discounting to present value of risk-adjusted expected future income. This is the ritual that constantly creorders – or creates the order – of capitalism’s power institutions and process. Over the past century, capitalization has expanded to encompass numerous aspects of social life – from the mindset and genetic code of individuals, to social organizations and institutions, to the ecological future of humanity. But the most distilled and perfected form of capitalization was and remains the stock market. This is the chief symbolic barometer of the capitalist outlook; it is the mechanism through which capitalists increasingly organize their world of strategic sabotage and differential accumulation; and it is the main yardstick with which they gauge their success and failure.

Major Bear Markets

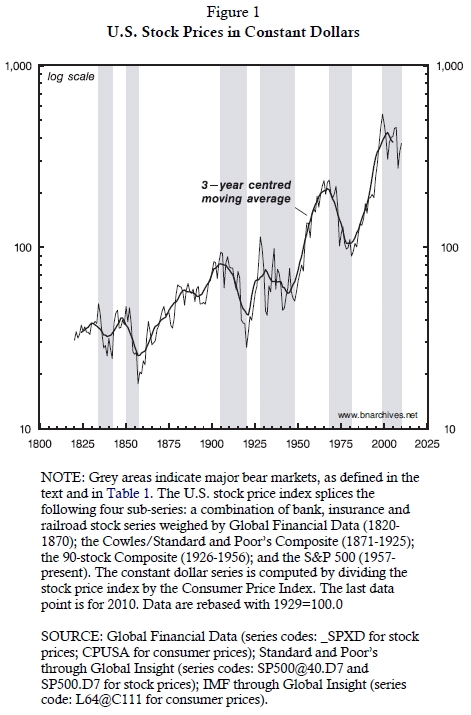

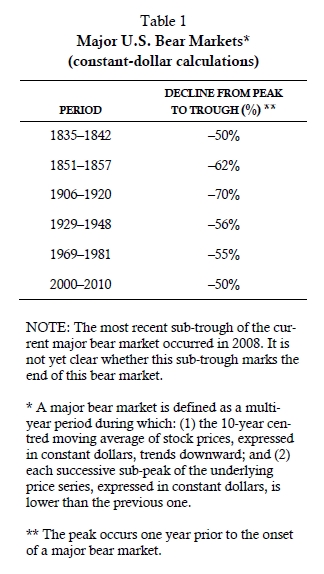

Systemic crisis is one that threatens the very future of capitalism. The first necessary feature of such a crisis is the existence of a major bear market. That was the starting point of our paper series. In ‘Contours of Crisis: Plus ça change, plus c'est pareil?’ (Bichler and Nitzan 2008), we explained what we mean by such crises, identified their occurrence in the United States, characterized their features and speculated about their relationship to broad societal transformations.

Since there is no agreed-upon definition for a bear market – let alone a ‘major’ one – we devised our own:

A major bear market denotes a multi-year period during which: (1) the 10-year centred moving average of stock prices, expressed in constant dollars, trends downward; and (2) each successive sub-peak of the underlying price series, expressed in constant dollars, is lower than the previous one.[4]

The reason for expressing stock prices in ‘constant dollars’ is that the capitalist outlook is always differential. Modern capitalists do not seek simply to increase their dollar assets, but to increase them faster than the assets of others. Now, one of the most basic benchmarks for such comparisons is the standard basket of consumer goods and services. If the price of equities rises faster than the price of that basket, equity price inflation ends up being higher than overall CPI inflation; the so-called ‘constant dollar’ price of equities increases; and equity owners end up doing better than the average basket owner.[5] (Of course, beating CPI inflation is merely the first step in a long sequence, whose ultimate achievement is beating the increase of every existing basket, but these further steps should not concern us here.)

According the above definition, over the past two centuries, the United States has experienced six major bear markets. These periods are marked by the grey areas in Figure 1 and are listed in Table 1, along with the cumulative declines in stock prices.

Clearly, the 1950s and 1960s did not fulfill this first criterion of a systemic crisis: there was no bear market, let alone a major one. Although much of the emphasis during that period, epitomized in the triumphalist books of John Kenneth Galbraith (1958; 1967), was on the rising welfare-warfare state, the self-financing ability of the leading industrial corporations and the alleged demise of finance, the stock market actually boomed – and at growth rates that would make today’s neoliberals envious. Capitalism was not in crisis, and capitalists certainly had no reason to fear for its future. That is obvious enough.

Major Bear Markets and Societal Transformations

Now, ‘Plus ça change, plus c'est pareil?’ wasn’t merely technical. It further argued that the long-term ups and downs of the stock market, no matter how stylized and patterned, are not self-generating. They don’t just happen on their own. Each of them has a reason, and that reason is deeply social and historically unique. Note that, during the twentieth century, every oscillation from a major bear market to a bull market was accompanied by a systemic societal transformation:

• The crisis of 1906–1920 marked the closing of the American Frontier, the shift from robber-baron capitalism to large-scale business enterprise and the beginning of synchronized finance.

• The crisis of 1929–1948 signaled the end of ‘unregulated’ capitalism and the emergence of large governments and the welfare-warfare state.

• The crisis of 1969–1981 marked the closing of the Keynesian era, the resumption of worldwide capital flows and the onset of neoliberal globalization.

Moreover, the article pointed out that none of these transformations were ‘in the cards’. Most observers in the 1900s didn’t expect managerial capitalism to take hold; few in the 1920s anticipated the welfare-warfare state; and not too many in the 1960s predicted neoliberal regulation. All three transformations involved a complex set of conflicts, their trajectories were fuzzy, and their outcomes were all but impossible to anticipate.

In other words, underneath the seemingly oscillating long-term patterns of the market lies an open-ended and inherently unpredictable creordering of the entire political economy. Although past bear markets have always given way to long bull runs, these transitions were never automatic. Each and every one of them reflected a profound transformation of the underlying societal structure. This quantitative-qualitative correspondence, we noted, still holds. In order for the current crisis to end and a new long-term upswing to begin, the social structure must be transformed, and the key aspect of that transformation is the creordering of capitalist power.

The Capitalist Mode of Power: Hitting the Glass Ceiling

While systemic crisis is always accompanied by a major bear market transformation, the reverse is not necessarily true: a major bear market does not have to be associated with systemic crisis. Systemic crises are ones that threaten the very future of capitalism, and these threats arise only when capitalist power hits a glass ceiling and it becomes difficult if not impossible for capitalist power to increase under existing circumstances. These conditions are fairly rare, and they need not exist – and usually do not exist – in every major bear market.

How do we know that capitalist power is approaching its glass ceiling? The answer begins with the nature of capitalist power. Private ownership is created, augmented and protected through organized exclusion, and organized exclusion is always a matter of power: it requires strategic sabotage and the threat and occasional use of force. Now, capitalism is historically unique in that everything that can be owned can be priced. And since ownership is based on power, relative prices quantify the relative power of owners: the greater the relative magnitude of the owned assets, the greater the power of their owner. In this sense, capitalism is deeply differential, and that differentiality is not static, but dynamic. Caught in a never-ending power struggle, capitalists are compelled to think of accumulation not absolutely, but relatively. They seek not to meet the average, but to beat it; not to keep their distributive share, but to raise it; not to run with the herd, but to butt ahead of it.

As we indicated in ‘Systemic Fear’, though, power is deeply dialectical. As an institution of power, private ownership is inherently conflictual: it requires organized exclusion, strategic sabotage and the differential exercise of force. And since capitalists are conditioned to accumulate differentially, their quest for further redistribution forces them to exclude more, inflict greater sabotage and increase the dose of force. But there is a built-in limit: no single capitalist or group of capitalists can ever own more than what there is to own. So from a certain point onward, further forceful redistribution is bound to run into mounting resistance; it gradually grows more difficult to achieve; and, eventually, it reaches its own envelope and becomes impossible to sustain.

This is the glass ceiling, the point of hubris to which we alluded in ‘Systemic Fear’. It is the societal point where the rulers, having reached their maximum power, seem completely confident in the obedience of the ruled. And it is the point from where their power and confidence has no where to go but down.

Have U.S. capitalists reached this point of hubris? In the second part of ‘Systemic Fear’, we noted that much of the postwar increase in stock prices was accounted for by the self-reinforcing convergence of redistributional power processes. During that period, there was a rise in the gross profit and interest share of capitalists in national income; a drop in corporate taxation; a decline of profit volatility that reduced risk perceptions; and, since the early 1980s, a fall in the rate of interest that boosted corporate profit relative to interest payments and lowered the discount rate. Now, since these processes are self-exhaustive, the question is: at what point do they become impossible to maintain, and how far is the U.S. political economy from reaching that point?

One way to address this question is to examine the size distribution of income. This measure is far from ideal. Limited to income size, it says nothing explicit about the distribution between capitalists and non-capitalists (although it is reasonable to assume that much of the top income is earned by capitalists); it ignores the differential processes of accumulation that affect the distribution of income and assets within capital; and it tell us little about the non-income power underpinnings of capitalization.[6] But the size distributional measure has one major advantage: thanks to the painstaking work of a few researchers, its data are available for an extended period, from 1917 to 2008.

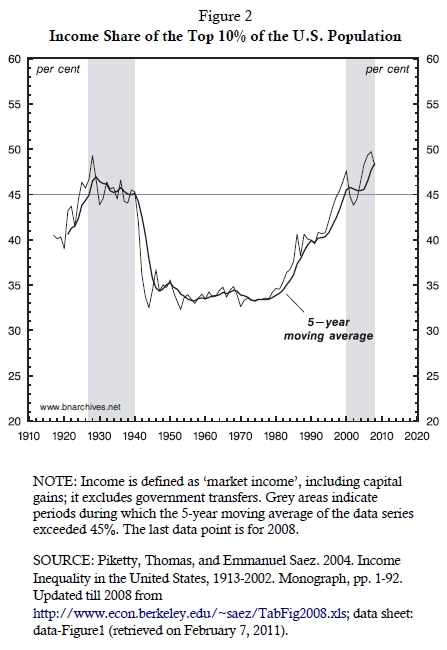

Such data are presented in Figure 2. The thin line shows the per cent share of ‘market income’, inclusive of capital gains, accounted for by the top 10% of the U.S. population. The thick line expresses the 5-year moving average of the underlying series.

The numbers draw a striking U-pattern, with its twin peaks marked by the 1930s on the left and the 2000s on the right. In both periods, the income share of the top 10% of the population averaged over 45% and at some point approached 50%. And both periods are unique. In between, from the early 1940s to the early 1980s, the numbers are far lower, averaging less than 35% and hardly changing from year to year.

Although there is no way to know for sure, it seems that 45% is fairly close to the glass ceiling for this measure. The bull market of the 1980s and 1990s was associated with a rise of more than 40% in the top’s income share (from 33% to 47%, and to nearly 50% more recently). Everything else remaining the same, a similar bull run from here onward would require the top income share to rise to 70%. Such an increase is highly improbable – that is, unless the U.S. turns into a dictatorship of the kind described in Jack London’s Iron Heel (1907) or Vladimir Sorokin’s Day of the Oprichnik (2011). And given that in the 1930s the top income share peaked at around current levels, it seems reasonable to take 45% as the cutoff point beyond which the ruling class enters hubris territory: confident in its enormous power, but aware that this power cannot increase much further.[7]

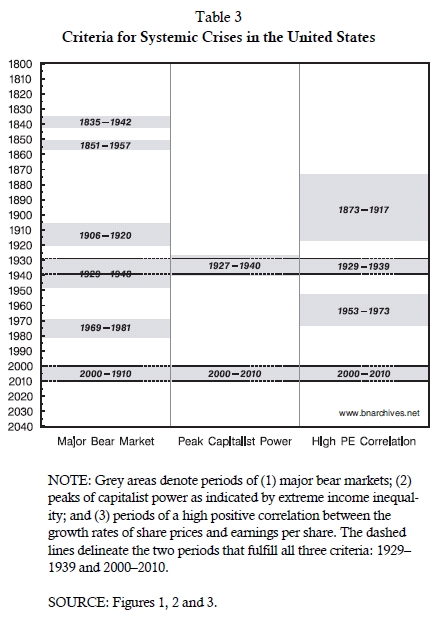

So now we have two criteria for systemic crisis: (1) a major bear market; and (2) extreme income and asset inequality, indicative of peak capitalist power and an inability to increase that power significantly. It is at this point, when these two conditions of systemic crisis are fulfilled, that systemic fear – fear for the very future of capitalism – becomes possible. And according to the available data, these two conditions have only coincided twice since the First World War: during the the late 1920s and 1930s, and again during the 2000s.

The Dominant Dogma and Forward-Looking Capitalization

Now, note that these two conditions imply a potential for systemic fear. To know whether capitalists have actually been struck by such fear, we need a third condition. And that third condition is the breakdown of forward-looking capitalization.

In our ‘Systemic Fear’, we argued that, under the normal circumstances of ‘business as usual’, capitalists are conditioned by their dominant dogma to follow the ritual of capitalization; that, in following this ritual, they express their belief that their system is eternal; and that this belief in turn implies that they are confident in their rule and in the obedience of the ruled (we deal with Kliman’s objection to this point later in the article).

However, in times of systemic crisis – i.e., when capitalism is mired in a major bear market, and when extreme inequalities, having pushed capital toward its envelope, make further increases in power difficult if not impossible to achieve – there arises the prospect of systemic fear. If that fear takes hold, with capitalists no longer certain of the future of their system, their ability to look forward is seriously impaired. And when looking into the future becomes impossible, the ritual of forward-looking finance breaks down.

One indication of such a breakdown, we argued in our paper, is a tight, positive correlation between the rates of change of stock prices and current earnings. When capitalists adhere to the capitalization ritual, they price stocks based on the earnings trend all the way to the deep future (from the ‘standpoint of eternity’, as finance guru Benjamin Graham put it). But when capitalists are struck by systemic fear, the ritual breaks down, by definition. With the future of capitalism deeply uncertain, the long-term earnings trend becomes undefined, and undefined earnings cannot be incorporated into the capitalization formula. So capitalists have to look for an alternative. They need something they are sure of and which is visible here and now. And that something, we argued, is current earnings.

Now note the causal direction here: systemic fear creates a tight positive correlation between the growth rates of equity prices and current earnings. But the reverse isn’t necessarily true: in and of itself, a positive correlation between the growth rates of equity prices and current earnings does not necessarily mean that capitalists have been struck by systemic fear.

This point wasn’t properly articulated in our paper, so it is important to clarify it. To reiterate, according to the forward-looking capitalization formula, equity prices discount the long-term earnings trend. Current earnings do not appear in the capitalization formula, so in principle they should have no direct impact on share prices.[8] However, current earnings can still have an indirect, apparent effect. During certain periods, one or more of the capitalization components can become correlated with current earnings, and if that happens, we may end up with a spurious correlation. For instance, changes in current earnings could be – and sometimes are – correlated negatively with changes in the rate of interest. And since the rate of interest features in capitalization, the result could be a spurious correlation between the growth rates of current earnings and stock prices. Indeed, there is nothing to prevent such a spurious correlation from cropping up during periods of systemic fear; and if it does crop up, the impact of current earnings on equity prices may become more difficult to disentangle.[9]

For this reason, the correlation between the growth rates of stock prices and current earnings becomes meaningful only in times of systemic crisis. It is only then, when capitalism is pulled down by a major bear market and capitalists are approaching their hubris point of peak power, that such a correlation could be taken as indicative of systemic fear.

Figure 3 shows the levels and rates of change of equity prices and earnings per share (with rates of change expressed as 3-year moving averages). The grey areas indicate periods of high positive correlation between the rate-of-growth series at the bottom of the figures (including the period pointed out by Kliman). The correlation coefficients for the different periods are listed in Table 2.

The data show four periods of high positive correlation: the period till 1917; the 1930s; the early 1950s to the early 1970s; and, finally, the 2000s. But based on our earlier discussion, only two of these periods can be associated with systemic fear. This association is summarized in the timeline of Table 3, which provide data on our three criteria for systemic fear. The table covers the period from the 1820s to the present, although the data coverage is uneven and allows conclusions to be drawn only from 1917 onwards.

• The first criterion is a major bear market, based on the long-term trend and pattern of the stock market expressed in ‘constant dollars’. Based on these considerations, the United States has experienced six major bear markets since the 1820s.

• The second criterion is peak capitalist power, based on extreme income inequality. This condition has been fulfilled twice since 1917: from 1927 to 1940 and from 2000 to 2008 (with the stock market having recovered since 2008, it is not far fetched to assume that income inequality continues to hover at peak levels). Combining these two conditions, we can conclude that only two of the four major bear markets since the beginning of the twentieth century have contained a systemic crisis: the periods from 1929 to 1940 and the period from 2000 to 2010.

• The criterion for systemic fear is systemic crisis during which the rates of change of stock prices and current earnings are tightly and positively correlated. Such positive correlation existed during four periods since the 1890s. But only two of these periods were ones of systemic crisis: 1929-1939 and 2000-2010.[10]

In sum. Kliman found an oversight in our paper on ‘Systemic Fear’ and celebrated it as if it pulled the rug out from under our entire argument. But that oversight, although inconvenient and regrettable, hardly dents our broad argument. Capitalism remains the first mode of power to offer a quantitative indicator for systemic fear. This indicator involves the convergence of three conditions that we have discussed at great length in our work: a major bear market, a glass ceiling of peak capitalist power, and the breakdown of the dominant dogma of forwarding-looking finance. And these conditions have coincided only in the two periods indicated in ‘Systemic Fear’ – the 1930s and the 2000s.

But Kliman is non-relenting. The problem, he claims, is not only empirical; it’s also theoretical. Think of a situation, he says, in which ‘you’ (the investor?) believe that capitalism is about to collapse, but you are not entirely sure (the probability of collapse is less than 100 per cent). Next, assume that someone comes along and offers you to make a small investment that will yield an extremely high rate of return. If capitalism collapses, you lose your investment (no pain, no gain); but if it doesn’t, you become fabulously rich (fulfilling your mission on earth). Now, between you and me (wink), wouldn’t you grab this golden opportunity and invest? And given that you will go ahead and invest (assuming you are like most people – i.e. most capitalists), isn’t your decision a clear proof that the future of capitalism is irrelevant for capitalists (like you)?

And if the logic of greed isn’t enough, there are the scientific experiments. According to Kliman, these experiments repeatedly show that ‘people’ (‘capitalists?) continue to invest in stocks, almost to the very end. They invest when earnings go up; they invest when earnings come down; in fact, they invest even when they know, with certainty, that earnings will converge to zero and that the equities they buy will become worthless at a definite point in time. And since these experiments show that the investment behaviour of people (capitalists?) is more or less independent of the future of their system (i.e., the end of the experiment), the very notion of ‘systemic fear’ – at least in the way that Bichler and Nitzan describe it – is irrelevant and in fact meaningless.

These are very interesting claims, particularly when coming from a fundamentalist Marxist.

Marxism correctly rejects the neoclassical dogma. The neoclassical tenets – egocentrism, the emphasis on individual rationality, the belief that the market is natural, the sanctification of private property and the rejection of societal planning, to name a few – are deemed by Marxists to be historically false, logically invalid and morally objectionable. According to Marxist epistemology, the autonomous, utility-maximizing individual is an oxymoron, an impossibility that can be concocted only by the misguided ideological servants of capital. From the viewpoint of Marxists, human beings are not stand-alone entities, but creatures of their society. They do have a certain freedom to think and act. But in the final analysis, their thoughts and actions are bounded by the class relations and forces of production of their own historical epoch.

Adhering to this epistemology, though, has proven easier said than done. Although critical of the liberals, Marxists have by and large failed to develop their own accounting system, their own unique data and their own dedicated research methods. And so, gradually, pressed by academic necessity and tempted by the available alternative, they have gravitated toward the ever-expanding databases and increasingly sophisticated methods of their class enemy, the bourgeoisie.

During the 1950s and 1960s, Marxist started to use the capitalist national accounts and measurements of the ‘capital stocks’. But there was a hefty price to pay: the derivation of these quantities relies on the very assumptions that Marxists correctly reject. ‘Real GDP’, for instance, is aggregated based on the supposition that the statistician knows equilibrium prices, and that these equilibrium prices reflect the relative utilities of the produced goods and services. Similarly with the ‘capital stock’: its magnitude, which many Marxists cite without a second thought, is taken to measure the util-generating capacity of the underlying machines and structures. And so, paradoxically, when Marxists routinely employ such measures to denote economic growth rates or the pace of capital accumulation, they end up endorsing the conceptual tools with which the ruling capitalist class manages society, as well as the individualistic-hedonic-equilibrium ideology that this ruling class imposes.[11]

And that is just for starters. In subsequent decades, many Marxists began using bourgeois econometrics, and in so doing abandoned the last vestige of dialectics. They developed closed models with mathematical propositions and proofs, and in so doing made their arguments increasingly ahistorical. They succumbed to the elegance of game theory, and in so doing accepted the rational-atomistic starting point of conventional economics (and indirectly also the realism of international relations). And now we learn from Kliman that it is perfectly fine for a Marxist to invoke the findings of experimental economics and behavioural finance.

Now, as noted, our own work starts from finance. This choice has nothing do with convenience or fashion. We start from finance because finance is the heart and brain of the modern capitalist mode of power. The capitalization ritual of finance is the algorithm with which capitalists creorder their society, and the relative magnitudes that emerge from that ritual map the ever-changing terrain of capitalized power. Deciphering modern finance is the initial step for any understanding of how modern capitalist power is organized, imposed and altered.

Kliman, though, lives in a totally different world. According to the Victorian scriptures he adheres to, the only real capital is means of production denominated in socially necessary abstract labour time. The rest – i.e., finance – is a speculative fiction that sometimes matches, sometimes mismatches the movement of actual capital. And whatever has to do with speculations, bubbles and other mismatches and distortions can be safely delegated to the neoclassical experiments of Noble laureates and the psychological analysis of behavioural finance.

But then, if this is the micro-Marxism Kliman has to offer, it is a strange one indeed: a representative experiment of representative gamblers, sans quotes, who serve to represent the universal human bourse, with no classes, no struggle, no dialectics, for ever and ever.

Note that the participants in Kliman’s experiments are not capitalists, but ‘people’ (in America everyone has an equal opportunity to buy up Microsoft or sleep under the bridge). These people are examined not in a real, power-based society, but in a laboratory ‘game’ for which they are hired or volunteer (since, at the moment, the experiment is still too complicated for rats). There is no ruling class, no power belt and no underlying population of workers, unemployed and the redundant. There is only a collection of Marshallian ‘representatives’. These ideal types play their game not in order to control their society and shape their world, but simply to make a buck (the universal drive of all people at all times, even if the buck happens to be hypothetical). And most importantly, the questions they face have no bearing on their own future, let alone on the future of their society. Once the experiment is over (capitalism ends) they can go home and forget all about it.

The ultimate purpose of these experiments is to discover, once and for all, the eternal human ‘nature’ of the universal investor – and in the process annul the very heart of Marxism. According to Alan Greenspan (2008), this human nature can be conventional, or perverse. What matters, he explains, is ‘not whether human response is rational or irrational, only that it is observable and systematic’. And perhaps Kliman feels that, as a Marxist, he should endorse these natural-state-of-things models that the capitalist rulers impose on themselves and on their subjects.

What remains unclear, though, is how any of this relates to the long-term outlook of the capitalist ruling class. To use simulated stock market experiments to tell us about the systemic confidence and fear of present-day capitalists is like using a chess game to understand the mindset of the French nobility during the French Revolution, or a board game of Monopoly to understand the anxiety of capitalists during the 1930s.

In our paper, we claimed that capitalist belief in the permanence of capitalization is a prerequisite for investment. This is a foundational claim. It deals not with this or that profit flow, with this or that asset, or with this or that capitalist. Instead, it refers to the basic institution of the capitalist mode of power: the institution that makes finance in general and capitalist calculations in particular possible to begin with, the institution that pervades everything capitalists do, the institution that holds their power structure together. The validity of our claim is tied to the centrality of this institution, and that is why we expressed our claim hypothetically, as a thought experiment. This is also why we brought different historical examples of systemic collapse – from the fall of the last Babylonian emperor Belshazzar, to the French Revolution, to the collapse of the Soviet Union – instances during which a latent but deep crisis suddenly gave way to disintegration. The crises themselves had different causes; but what made them culmiate in collapse, we argued, was that the rulers were struck by systemic fear: they lost their confidence in their own dogma and their ability to rule. And that loss – as well as its consequences – are difficult if not impossible to predict.

‘[T]he future comes disguised’, says Coetzee; ‘if it came naked, we would be petrified by what we saw’ (1990: 163). To ask what will happen to capitalism if capitalists become convinced that capitalization is about to end is like asking what will happen to the ecosystem if the earth surface temperature rises by 25 per cent. No laboratory, even one run by a Nobel laureate, can replicate this process.

The Capitalist Subject

Finally, Kliman invokes the ‘S’-word: Bicher and Nitzan have turned capital into a ‘Subject’, capable of triggering its own demise, and they have voiced this claim using tongue-twisting concepts and irrefutable Freudian conjectures.

We prefer to remain silent on the second allegation. The interested reader can judge for herself by reading our articles and books. But we have to plead guilty to the first accusation. Capital is certainly a subject, and with a capital ‘S’ to boot. In fact, if we are to remain true to Marx, we should add that, save for rare revolutionary situations, capital is the only social subject, the entity that subjugates all else – capitalists as well as workers -- to its will and rage.

Marxists Contra Marx

Kliman seems to have been deeply offended by our position ‘versus Marx’, as he puts it, so a few closing comments about this subject may be in order.

We have the greatest admiration for Marx as a revolutionary scientist, and we have learned a great deal from his path-breaking work on the capitalist system. But like Marx (and unlike many Marxists), our real interest is not Marx, it’s capitalism.

Marx tried to trace the intricacies of human history, map its progressive breakthroughs and understand its regressive setbacks. He focused on the critical aspects of the capitalist regime, searching for weak points in the fortified walls that protected the capitalist rulers. He tried to anticipate the development of capitalism, the inner contradictions that would pave the way for a revolution.

But Marx’s work mirrored his own epoch. And as capitalism continued to develop and mutate, his theories, research and conclusions became less and less congruent with the ever-changing reality. As a result, radicals faced two mutually exclusive options. In the words of Cornelius Castoriadis, they had to decide whether to remain revolutionaries or ‘Marxists’. To choose the former meant to take from Marx what seemed true, insightful and useful – and to let go of the rest. To choose the latter meant to sanctify all of Marx’s writings and then constantly ‘reinterpret’ them to fit the shifting reality.

Some radicals chose the former path, but many more took the latter. After Marx’s death, there emerged numerous congregations and sects, each with its own theological interpretation. Until the 1960s and 1970s, the fault lines were largely geopolitical. The main debate was between Moscow and Beijing, with subsidiary interpretations emerging later on in lesser communist capitals, such Belgrade, Havana and Pyongyang.

The unravelling of Stalinism and Maoism and the winding down of the Cold War shifted the centre of gravity to the universities of Europe and North America. But that shift hasn’t liberated the Marxists from Marx. Instead of an open-ended scientific debate on the changing nature of capitalism, there developed a theological debate about the eternal nature of Marx’s writings (what Marx really meant). There are of course numerous exceptions, some of which are ingenious; but for many Marxists the key question has become how to appropriate the prophet’s writing and what should be done to fortify the faith.

The consequence is a minute division of labour, not unlike the neoclassical one, between different groups of Marxists and post-Marxists, each specializing in protecting a different section of the Great Marxist Wall. There are experts on the ‘young Marx’, on ‘Marxist philosophy’ and on ‘Marxist dialectics’. Some deal with the ‘Marxist theory of the state’, while others focus on ‘cultural Marxism’. There are pundits for ‘analytical Marxism’, ‘Marxism and game theory’, and ‘Marxist anthropology’. There are even those who claim to do ‘political Marxism’ (suggesting that Marxism can also be a-political). Within ‘Marxian economics’ proper, there are those who do ‘crisis’, others who do ‘regulation and the social structures of accumulation’, and still others who do ‘investment and profit rates’. There is even a specialization in ‘fictitious capital’ and its various distortions. The list goes on. Of course, not all of these specialists are defensive of the dogma, but many are.

At the analytical heart of these specialized endeavours stand the experts on Marx’s labour theory of value and surplus value. Most Marxists are unfamiliar with the intricacies of this theory, and most ‘productive labourers’, however defined, would probably find it impossible to understand – that is, assuming they even tried. But this theory is the foundation stone of Marx’s science.[12] It is the key to understanding capitalist exploitation, capitalist development, and, eventually, capitalism’s own demise. It has to be defended, if only in appearance.

This is the forte of Andrew Kliman. His own section in the Great Marxist Wall is the theory’s internal ‘consistency’. This section has been somewhat weakened since Bortkiewicz, but not to worry. A new and improved reading of the theory – the Temporal Single System Interpretation, or TSSI – has recently been applied to the weak points, and it works wonders. The method uses the fail-proof technique of revelation. The first conscientious application of this method is Thomas Aquinas’, whose starting point was the postulate that Jehovah-God ‘revealed’ himself to his prophet (or his messengers). The neoclassicists apply the very same method to their claim that utility (preferences) is revealed by price. And now it’s Kliman’s turn: Marx wrote somewhere that value is revealed by price (or vice versa), and Kliman insists that reiterating this claim not only renders it true, but also cures Marxism of many of the chronic illness that have weakened it for years.

For defenders such as Kliman, the key thing is to keep the dialectical faith unchallenged and the revolutionary laity free from heretical thoughts. Our 2009 Capital as Power contains a systematic critique of liberal and Marxist theories of capital and the elementary particles of utils and abstract labour on which these theories rest; it develops an alternative approach to capital based on power; and it offers an analytical, historical and empirical exposition of a new theory of differential accumulation and a new history of the capitalist mode of power. In short, it is an important book to ignore – and, indeed, so far no Marxist has reviewed it. Note that even Kliman, who apparently lost his nerve and broke the wall of silence, promises in his introduction not to deal with our own theory, but to defend his defence of Marx’s value theory – a defence that we dealt with only briefly in our book.

Sadly, the zeal to defend Marx has caused many of the defenders to lose their grip on reality. The period since 2000 has seen capitalism rocked by major turbulence, and the free-market dogma has been challenged openly from within and without. Liberal economics – including its macro and micro variants, its Keynesian and Monetarist inflections, its expectations and game theories – seems to have lost its intellectual compass, and there have been open calls on Nobel laureates to return their Sveriges Riksbank Prizes. This has been the historical opportunity Marxists have been waiting for since the 1930s, and they seem to have missed it. Instead of developing new theories and new research programmes, they were busy defending Marx and ridiculing or simply ignoring radicals who tried to transcend him. And when the time finally came, they were caught off guard. Marxists today talk of the falling tendency of the rate of profit and speculative-fictitious bubbles, of a too-weak or a too-strong state, of capitalist irrantionality, greed and corruption. But deep down inside, many of them know that these reiterations belong to the world of yesterday. They offer no serious challenge, let alone an alternative, to the current capitalist mode of power.

Endnotes

[1] The difference between heteronomy and autonomy is articulated in the social and philosophical writings of Cornelius Castoriadis – see, for example, his Philosophy, Politics, Autonomy (1991)

[2] Means’ claim that there were in fact two types of prices – administered prices as well as market prices – was brilliantly defended against empirical error charges levelled by Chicago School Nobel laureate George Stigler but eventually swept under the carpet by the economics profession. His empirical data on the separation of corporate control from ownership, on the other hand, were shown faulty by the relatively unknown Marxist Maurice Zeitlin but continue to inform mainstream business studies. See Adolf Berle and Gardiner Means (1932), Gardinder Means (1935; 1972), George Stigler (1970; 1973) and Maurice Zeitlin (1974).

[3] One of the first, and still unparalleled, histories of cosmology is Arthur Koestler’s The Sleepwalkers (1959), a story that is nicely complemented by Simon Singh’s more recent Big Bang (2004). On the measurement of the standard meter, see Alder’s The Measure of All Things (2002). The development of mathematics is told in Singh’s Fermat’s Last Theorem (1997). Shimura’s quote on Taniyama is taken from this book.

[4] This definition is more precise than the one in Bichler and Nitzan (2008). In the original article, we referred to a downtrend in stock prices. Here we operationalize this downtrend as a falling 10-year centred moving average.

[5] The measurement of ‘constant dollars’ involves significant theoretical and philosophical quandaries that economists are yet to solve. Our concern here, though, is not the logical underpinnings of the measurement, but the mindset of capitalists. And since capitalists take constant-dollar measures for granted, these difficulties need not detract us (for more on these issues, see Nitzan 1992: Chs. 5 and 7).

[6] On the differential ratio of net profit to wages, see Bichler and Nitzan’s ‘Elementary Particles of the Capitalist Mode of Power’ (2006: Figure 5). On capital’s share of national income, aggregate concentration and differential accumulation, see Nitzan and Bichler’s Capital as Power (2009a: Figure 13.1, p. 274, Figure 14.1, p. 318 and Figure 14.2, p. 320).

[7] Elsewhere in our work we examined the differential process by which capitalist power breaks through its geographic-societal ‘envelopes’ – from the industry, to the sector, to the national setting, and, finally, to the global arena (see, for example, Nitzan 2001; Nitzan and Bichler 2009a: Ch. 15) . In this process, the power of capitalists that are based in one region or country could expand by creating, altering and taking over capitalist power in other regions and countries. U.S.-based capitalists have done so after the 1930s, but a repeat of that process nowadays seems less likely.

[8] Current earnings feature in capitalization only insofar as they alter the long-term earnings trend. In the case of corporate equities, this impact is negligible and can be ignored.

[9] For example, during much of the period from the early 1950s to the early 1970s, the rates of change of equity prices and the rate of interest were negatively correlated (with interest rates measured by the tax-free yield on AAA municipal bonds). This negative association means that, during that period, the observed correlation between the rates of change of equity prices and current profits identified by Kliman may have been spurious. The same cannot be said about the 2000s, since the rates-of-change correlation between equity prices and the rate of interest during that period was positive. The case of the 1930s is more ambiguous. There was a negative correlation between the rates of change of prices and the rate of interest, but the variations of the rate of interest were very small relative to the variations in current earnings, suggesting that their impact on prices was probably far smaller than the impact of current earnings.

[10] Although it is probably too early to tell, the 2010 data in Figure 3 suggest that the correlation between the rates of change of stock prices and current earnings is no longer positive. A continuation of this situation would mean that capitalists no longer suffer from systemic fear.

[11] For more on the individualistic-hedonic-equilibrium assumptions of ‘real’ economic measurements, see for example Nitzan (1989) and Nitzan and Bichler (2009a: Chs. 5 and 8).

[12] Marx claimed his theory to be superior to the bourgeois alternatives, partly because it did something they couldn’t: it objectively derived the rate of profit from the material conditions of the labour process. Prices of production, writes Marx, ‘are conditioned on the existence of an average rate of profit’, which itself ‘must be deduced out of the values of commodities. . . . Without such a deduction, an average rate of profit (and consequently a price of production of commodities), remains a vague and senseless conception’ (Marx 1909, , Vol. 3: 185-86, emphasis added). This same point is reiterated by Engels: ‘These two great discoveries, the materialistic conception of history and the revelation of the secret of capitalist production through surplus value, we owe to Marx. With these discoveries socialism became a science. The next thing was to work out all its details and relations’ (Engels 1966: Section I, emphases added).

References

Alder, Ken. 2002. The Measure of All Things. The Seven-Year Odyssey and Hidden Error that Transformed the World. New York: Free Press.

Berle, Adolf Augustus, and Gardiner Coit Means. 1932. [1967]. The Modern Corporation and Private Property. Revised ed. New York: Harcourt, Brace & World.

Bichler, Shimshon, and Jonathan Nitzan. 2006. Elementary Particles of the Capitalist Mode of Power. Paper read at Rethinking Marxism, October 26-28, at University of Amherst, Mass.

Bichler, Shimshon, and Jonathan Nitzan. 2008. Contours of Crisis: Plus ça change, plus c'est pareil? Dollars & Sense, December 29.

Bichler, Shimshon, and Jonathan Nitzan. 2009. Contours of Crisis II: Fiction and Reality. Dollars & Sense, April 28.

Bichler, Shimshon, and Jonathan Nitzan. 2010. Systemic Fear, Modern Finance and the Future of Capitalism. Monograph, Jerusalem and Montreal (July), pp. 1-42.

Castoriadis, Cornelius. 1991. Philosophy, Politics, Autonomy. Essays in Political Philosophy. Series Edited by D. A. Curtis. New York and Oxford: Oxford University Press.

Coetzee, J. M. 1990. Age of Iron. 1st American ed. New York: Random House.

Engels, Friedrich. 1966. Herr Eugen Dühring's Revolution in Science (Anti-Dühring). Translated by Emile Burns; Edited by C. P. Dutt. New York: International Publishers.

Galbraith, John Kenneth. 1958. The Affluent Society. Boston: Houghton Mifflin.

Galbraith, John Kenneth. 1967. The New Industrial State. Boston: Houghton Mifflin Company.

Greenspan, Alan. 2008. We Will Never Have a Perfect Model of Risk. Financial Times, March 17, pp. 9.

Koestler, Arthur. 1959. [1964]. The Sleepwalkers. A History of Man's Changing Vision of the Universe. With an Introduction by Herbert Buttrefield, M.A. London: Hutchinson of London.

London, Jack. 1907. [1957]. The Iron Heel. New York: Hill and Wang.

Marx, Karl. 1909. Capital. A Critique of Political Economy. 3 vols. Chicago: Charles H. Kerr & Company.

Means, Gardiner C. 1935. Price Inflexibility and Requirements of a Stabilizing Monetary Policy. Journal of the American Statistical Association 30 (190, June): 401-413.

Means, Gardiner C. 1972. The Administered-Price Thesis Reconfirmed. The American Economic Review 62 (3, June): 292-306.

Nitzan, Jonathan. 1989. Price and Quantity Measurements: Theoretical Biases in Empirical Procedures. Working Paper 14/1989, Department of Economics, McGill University, Montreal, pp. 1-24.

Nitzan, Jonathan. 1992. Inflation as Restructuring. A Theoretical and Empirical Account of the U.S. Experience. Unpublished PhD Dissertation, Department of Economics, McGill University, Montreal.

Nitzan, Jonathan. 2001. Regimes of Differential Accumulation: Mergers, Stagflation and the Logic of Globalization. Review of International Political Economy 8 (2): 226-274.

Nitzan, Jonathan, and Shimshon Bichler. 2009a. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Nitzan, Jonathan, and Shimshon Bichler. 2009b. Contours of Crisis III: Systemic Fear and Forward-Looking Finance. Dollars & Sense, June 12.

Singh, Simon. 1997. Fermat's Last Theorem. The Story of a Riddle that Confounded the World's Greatest Minds for 358 Years. London: Fourth Estate.

Singh, Simon. 2004. Big Bang. The Most Important Scientific Discovery of All Time and Why You Need to Know About it. London and New York: Fourth Estate.

Sorokin, Vladimir. 2011. Day of the Oprichnik. Translated from the Russian by Jamey Gambrell. 1st American ed. New York: Farrar Straus and Giroux.

Stigler, George J., and James K. Kindahl. 1973. Industrial Prices, as Administered by Dr. Means. The American Economic Review 63 (4, September): 717-721.

Stigler, George Joseph, and James Keith Kindahl. 1970. The Behavior of Industrial Prices. New York: National Bureau of Economic Research; distributed by Columbia University Press.

Zeitlin, Maurice. 1974. Corporate Ownership and Control: The Large Corporation and the Capitalist Class. American Journal of Sociology 79 (5): 1073-1119.