recasp

Review of Capital as Power

Suggested citation:

Jonthan Nitzan and Shimshon Bichler (2014), ‘Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis’, Review of Capital as Power, Vol. 1, No. 1, pp. 110-155.

Can Capitalists Afford Recovery?

Three Views on Economic Policy in Times of Crisis

Jonathan Nitzan and Shimshon Bichler [1]

Abstract

Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to be how to get out of it. The purpose of our paper is to ask a very different question that few if any seem concerned with: can capitalists afford recovery in the first place? The article contextualizes and examines this question from the viewpoint of economic policy. The analysis is divided into three parts. The first part deals with the mainstream macroeconomic perspective. This approach claims to have already solved all the theoretical riddles, so the main emphasis here is on the practical question of how to engineer a recovery. The second part deals with the Marxist view. Marxists stress the inherent contradictions of accumulation, so the question for them is the very possibility of sustained growth. The third and final part takes the view of capital as power. Capitalized power hinges not on growth, but on strategic sabotage. So from this viewpoint, the key question is not how capitalists can achieve and sustain a recovery, but whether they can afford it to start with.

Keywords. capitalist crisis; income distribution; mainstream economics; Marxism; capital as power; dominant capital

* * *

Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to be how to get out of it. The purpose of our paper is to ask a very different question that few if any seem concerned with: can capitalists afford recovery in the first place?

Our starting point is very different from the conventional creed, both mainstream and heterodox (Nitzan and Bichler 2009a; Bichler and Nitzan 2012b). Liberals and Marxists see capital as an economic entity and capitalism as a mode of production and consumption, so for them, the accumulation crisis is anchored in the economics of production and consumption. By contrast, we see capital as a symbolic representation of power and capitalism as a mode of power, so for us, the crisis of accumulation is a crisis of capitalized power. Furthermore, whereas the economic viewpoint, particularly the Marxist, sees the current crisis as the symptom and culmination of a long process of weakening accumulation, for us it is the consequence of capital having reached unprecedented strength (Bichler and Nitzan 2008, 2009; Nitzan and Bichler 2009b; Bichler and Nitzan 2010; Kliman, Bichler, and Nitzan 2011).

According to our research, the accumulation of capital-read-power might be approaching its asymptotes, or limits (Bichler and Nitzan 2012a). The closer capitalized power is to its asymptotes, the more difficult it is to augment it further. Capitalists, though, have no choice. They are conditioned and compelled to increase their capitalized power without end, and that relentless drive breeds conflict. It forces capitalists to increase their threats, escalate their sabotage and intensify their use of force – and this intensification is in turn bound to trigger stronger resistance, contestations, uprisings and more.

By the early 2000s, capitalists began to realize the unfolding of this asymptotic scenario. They started to sense that their power is nearing its limits and that accumulation is becoming ever more difficult to achieve and might be reversed. And given that capitalization is forward-looking, the result has been a major bear market. Measured in constant dollars, stock prices are still below their peak levels of fifteen years ago: in August 2014, the Datastream World Index was still 2 per cent shy of its 1999 level, while the U.S. S&P 500 was 14 per cent lower.

The present paper contextualizes and examines this process from the viewpoint of economic policy. Thematically, the analysis is divided into three parts. The first part deals with the mainstream macroeconomic perspective. This approach claims to have already solved the key theoretical riddles, so the main emphasis here is on the practical question of how to engineer a recovery. The answer to this question, though, remains elusive. The recent crisis has undermined the self-confidence of policymakers: they are no longer certain of their theoretical models, they mistrust their policy-tools, and they feel increasingly short on policy ammunition. The second part examines the Marxist view. Marxists stress the inherent contradictions of accumulation, so the question for them is the very possibility of sustained growth. This approach offers very important insights, but its application to contemporary capitalism is hampered by conceptual quandaries and empirical inconsistencies. Mainstream and Marxist economics obviously are very different from each other in framework and goals. Nonetheless, they share a common premise: they both consider capitalism a mode of production and consumption. From this common viewpoint, crises, although sometimes trigged and further complicated by financial, political and societal factors, are ultimately about the ‘real economy’. The third and final part challenges this common premise by taking the view that capital is not a ‘real’ productive entity but commodified power, and that capitalism is not a mode of production and consumption but a mode of power. Capitalized power, we argue, hinges not on growth, but on strategic sabotage. So from this viewpoint, the key question to ask is not how capitalists can achieve and sustain a recovery, but whether they can afford it to start with. Our answer to this question is negative, at least for the United States. We show that, contrary to popular conviction, over the past century the U.S. capitalist income share-read-power thrived not on prosperity and the growth of employment but on crisis and rising unemployment. U.S. policymakers therefore are locked into a conceptual and practical corner: if they act on their conventional belief and boost the capitalist income share to trigger economic growth, they would achieve the very opposite result; and if they manage to rekindle growth, they would end up undermining the accumulation-read-power of capitalists.

Mainstream Macroeconomics

The stock market crash of 2008 and the ensuing Great Recession heighted the systemic fear of the ruling class – the sense that capitalism itself might be in danger and that they, the rulers, might be losing their grip over the situation (Bichler and Nitzan 2010; Kliman, Bichler, and Nitzan 2011). The quotes in Box 1 suggest that this fear continues unabated. In 2008, former Fed Chairperson Alan Greenspan spoke of himself and his like being in a state of ‘shocked disbelief’ after their ‘whole intellectual edifice’ had collapsed, while journalist Gillian Tett of the Financial Times described a sense of total confusion, as capitalists, policymakers and smaller investors realized that their ‘intellectual compass’ had been broken. The next five years have done little to ease this systemic fear. In 2013, central bankers admitted quite openly that they have no clue as to what is going on – or, in their own words, that they are in ‘uncharted territory’ which they do not ‘fully understand’, and that they are ‘flying blind when steering their economies’. In that same year, Lawrence Summers, a former Treasury Secretary and until recently a keen promoter of neoliberalism, wondered whether stagnation might prove to be the ‘new normal’, while in 2014, Nobel Laureate Edmund Phelps, an unrelenting proponent of free markets, conjured up the spectre of ‘regulation’ and ‘corporatist values’ to explain why, despite neoliberalism, capitalism has lost its ‘past dynamism’.

Systemic Fear

Alan Greenspan:

The whole intellectual edifice . . . collapsed in the summer of last year. . . . [T]hose of us who have looked to the self-interest of lending institutions to protect shareholder’s equity (myself especially) are in a state of shocked disbelief. Such counterparty surveillance is a central pillar of our financial markets’ state of balance. If it fails, as occurred this year, market stability is undermined (Andrews 2008; U.S. Congress 2008, emphases added).

Financial Times Editorial:

Uncertainty is the only certain thing in this crisis. . . . a dense fog of confusion has . . . descended, obscuring where we are – falling fast, slowly, bumping along the bottom, or finally turning the corner. . . . Economies are behaving unpredictably and will continue to do so. The instability is both cause and consequence of the great uncertainty that has been spreading out from the financial markets. Fearful and confused, people react erratically to changing news, reinforcing confused market behaviour. It doesn’t help that our economic theories were constructed for a different world. Most models depict economies close to equilibrium. . . . And unlike what most models assume, prices are not properly clearing all markets. . . . (Editors 2009, emphasis added).

Gillian Tett:

[T]he pillars of faith on which this new financial capitalism were built have all but collapsed, and that collapse has left everyone from finance minister or central banker to small investor or pension holder bereft of an intellectual compass, dazed and confused (Tett 2009, emphasis added).

Chris Giles:

[Some] of the leading figures in central banking conceded they were flying blind when steering their economies. Lorenzo Bini Smaghi, the former member of the European Central Bank’s executive board, captured the mood at the IMF’s spring meeting, saying: ‘We don’t fully understand what is happening in advanced economies’. In this environment of uncertainty about the way economies work and how to influence recoveries with policy, Sir Mervyn King, the outgoing governor of the Bank of England, said that ‘there is the risk of appearing to promise too much or allowing too much to be expected of us’. . . . The central bankers were clear that they had got it wrong before the crisis, allowing themselves to be lulled, by stable inflation, into thinking they had eliminated financial vulnerabilities. . . . The question now was whether central bankers are making the same mistake in their efforts to secure a recovery. Might they be storing up financial distortions that will bite in the future?. . . . ‘Put simply, we are in uncharted territory’, said [vice chairman of the Federal Reserve] Mr Viñals. . . . The problem outlined by Sir Mervyn was that the uncertainty is so pervasive that no one can be sure that the expansionary monetary policy is appropriate in a world where nations are learning they are poorer than they expected, but are not sure by how much. How can we be sure ‘we really are [not] running the risk of reigniting the problems that led to the financial crisis in the first place?’ Mr Bean asked the IMF panel (Giles 2013, emphases added).

Lawrence Summers:

Why stagnation might prove to be the new normal: In the past decade, before the crisis, bubbles and loose credit were only sufficient to drive moderate growth. . . . Is it possible that the US and other major global economies might not return to full employment and strong growth without the help of unconventional policy support?. . . . [T]he presumption that normal economic and policy conditions will return at some point cannot be maintained (Summers 2013, emphases added).

Edmund Phelps:

Lethargic growth, widespread job dissatisfaction and staggering debt – such is life in a western world that seems to have lost the habit of innovation that energised it for more than a century. . . . It is urgent that these nations find a way back to their past dynamism. . . . The blame for the losses of innovation behind slowdowns in productivity lies with the spread of corporatist values, particularly solidarity, security and stability. Politicians have introduced regulation that stifles competition; patronised interest groups through pork-barrel contracts; and lent direction to the economy through industrial policy. In the process they have impeded those who would innovate or reduce their incentives to try (Phelps 2014, emphasis added).

The Great Slide

What underpins this systemic fear? Why does the ruling class feel ‘bereft of an intellectual compass’? Why do policymakers admit that they are ‘flying blind’? Why do the ideologues of neoliberalism resign themselves to the ‘new normal’ of secular stagnation and lost ‘dynamism’?

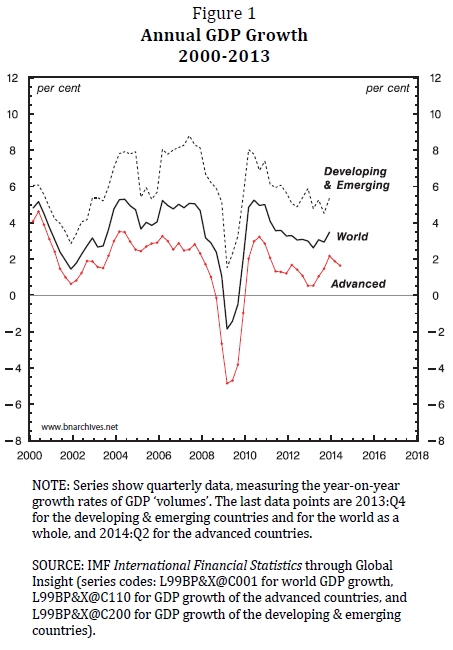

Figure 1 provides the broad context. The chart is a snapshot of the ‘state of the world economy’ since the beginning of the systemic crisis in the early 2000s. The figure shows three annual GDP growth rates: (1) the dotted red line is for the advanced countries, (2) the dashed line is for the developing world, and (3) the solid line is for the world as a whole. We can see the first downturn in 2000-2002. The developing world and emerging markets recovered briskly from this decline, but the advanced countries showed a very feeble recovery. Then came the 2008-9 drop. This downturn was much more serious (–5 per cent for the developed world and –3 per cent for the world as a whole), and the recovery from it limited and brief. By 2010, both regions – and the world as whole – began to decelerate rapidly.

Policymakers looking at this chart must get the shivers. Despite massive policy intervention – including unorthodox measures that only a few years back would have been considered unthinkable – the world economy has been largely unresponsive. In 2013, the advanced countries showed a modest uptick, but growth soon decelerated, and many now fear the uptick was a ‘dead cat bounce’.

The Real/Nominal Dichotomy

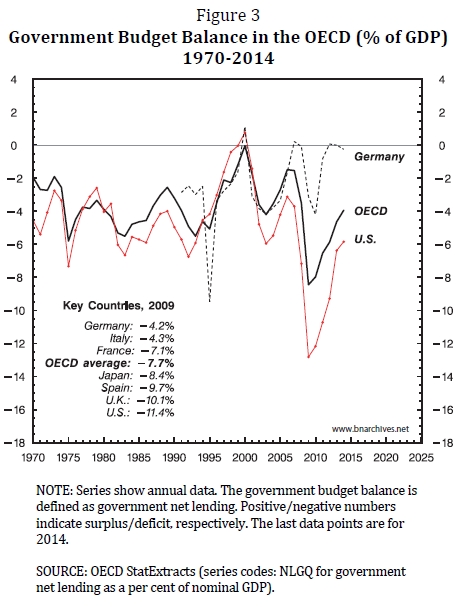

To understand the gravity of the situation for policymakers, and for the ruling class more broadly, it is useful to provide some theoretical background. Consider the simple decomposition offered in Equation 1:

The equation starts with the total dollar value, or nominal value of GDP (which we call Y). This value is the product of two components: the quantity of commodities being produced, which economists call ‘real’ GDP (denoted as Q in the equation), and the average nominal or dollar price of those commodities, which is given by the GDP deflator (and marked by P in the equation).

This decomposition, which goes back to David Hume’s classical dichotomy between the ‘real’ and the ‘nominal’ spheres of economic life, underlies the national accounts everywhere. We consider this bifurcation to be deeply problematic, both theoretically and empirically (Nitzan 1989; Nitzan and Bichler 2009a: Ch. 8). But since most if not all economists, both mainstream and heterodox, seem to accept the real/nominal duality as an article of faith, and given that we are concerned here with their views, not ours, we shall use it in this paper without further qualification.

The Keynesian Revolution

Until the 1930s, the conventional liberal dogma was that government intervention was unnecessary and harmful: it was unnecessary because the market mechanism was self-correcting, which, in today’s lingo, means that real GDP tends to oscillate near its optimal, full-employment value to begin with; and it was harmful because it led to distortions, misallocation and undue inflation or deflation. Now, although the pre-1930s economists did not think in explicitly macroeconomic terms, we can use Equation 1 to translate their argument into contemporary jargon. In a nutshell, their claim was that government intervention cannot raise real GDP (Q), which is already at its maximal level (although it certainly can lower it). This inability means that any intervention can only inflate or deflate nominal GDP (Y) by raising or lowering prices (P). Parenthetically, we should add here that this view was also shared by Marx, who thought that a large state would undermine accumulation by taxing away part of the surplus value (Baran and Sweezy 1966: 142-143).

The crisis of the 1930s shattered this belief. A large chunk of the labour force was unemployed, productive capacity was lying idle and the invisible hand did nothing to put them back to work. This much was obvious to anyone who could see. But the economists could see only through their theory, and that theory asserted that persistent unemployment was impossible.

And that is where Keynes came into the picture. His great achievement was to persuade economists (1) that the real economy can get stuck at less than full employment; and (2) that, in terms of Equation 1, the government can remedy the situation because it can impact not only the nominal price level (P), but also the real level of output (Q).

Keynes identified two key problems, both anchored in base instincts. The first problem was a mismatch of investment and savings. As society grows richer, he argued, the propensity to invest declines while the propensity to save rises. And since saving and investment decisions are made by different agents, the result of this mismatch is ‘deficient demand’ and a tendency for stagnation and unemployment. The second problem was that investment decisions are governed by the highly erratic and largely unpredictable ‘animal spirits’ of investors, which make capitalism inherently unstable.

Now, given that capitalism tends to stagnation and instability, and given that the government can affect the real economy as well as prices, it made sense for governments to intervene in order to save capitalists – and capitalism more generally – from their own folly.

The Keynesian Record

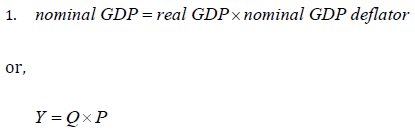

The historical record seems to confirm this view. Figure 2 shows the U.S. rate of unemployment and GDP growth since the late 1880s. Unemployment is plotted against the right-hand scale and GDP growth against the left-hand scale. The data are divided into two sub-periods: until 1946 and from 1946 onward.

To explain what we have done here, consider the rate of unemployment. We have taken the period until 1946, and for this period we have computed the series mean and standard deviation. The top dashed red line is equal to the mean of the series plus one standard deviation (which, in this case, adds up to 11.4 per cent), while the bottom dashed line is equal to the mean minus one standard deviation (2.4 per cent). According to the statisticians, the 9 per cent range between these two lines, equivalent to two standard deviations, should contain roughly two thirds of the squared variation of the unemployment rate during 1886-1946 and therefore gives us a rough sense of the series’ volatility in that period. The same procedure has been applied to the period from 1946 onwards, and, as we can see, the volatility here is almost three times smaller: the top dashed line is at 7.4 per cent while the bottom one is at 4.1 per cent, yielding a range of only 3.3 per cent. The same calculations are shown for the GDP growth series, and here, too, we can see a marked decline in volatility between the two periods.

This record, which is probably representative of what happened in other countries, seems pretty clear. The data serve to explain why, during the early 1970s, both Milton Friedman and Richard Nixon proclaimed that ‘we are all Keynesian now’.[2] Governments seem to have learnt how to ‘manage’ their economies. Not only have they prevented a repeat of the Great Depression, they have also significantly reduced the instability that radical political economists had predicted would shatter capitalism.

The Monetarist Counter-Revolution

But that was also the problem. The success of Keynesian ‘demand management’ meant that capitalists were no longer in the driver’s seat. If they misbehaved – either by not investing enough or by acting erratically – governments could step in and fix things up. Worst still, Keynesian policymaking could be pitted against the capitalists, particularly through higher corporate tax rates and progressive personal taxation. This is exactly what happened in the United States after the Second World War, with the result being that the national income share of corporations stagnated and the distribution of personal income became more equal.

In short, Keynes had to be undone, and this is where Milton Friedman and his monetarist counter-revolution came into the picture. Monetarism – and the new-classical macroeconomic theories that developed in its wake – claims that the pre-1930s neoclassicists had it right all along. There were only two little things missing from their framework: (1) the natural rate of unemployment and (2) expectations.

The natural rate of unemployment is like the Emperor’s New Clothes: only the monetarists and the new-classicists can see it. For the old, pre-1930s economists, the basic rule was ‘what you see is what you get’. If the statistics said that unemployment was zero or oscillating close to zero, then the economy must be functioning as well as it should. Alternatively, if the statistics said that unemployment was stuck at over 20 per cent – as was the case during the Great Depression – then the theory, which predicted that unemployment should quickly decline, must be wrong.

Not so for the monetarists and new-classical economists. Appearances can be very deceiving, they warn us; particularly if you are unversed in new-classical monetarism. But those who can see the emperor’s new clothes know better. They know that, in fact, most unemployment is not unemployment at all. It consists of people looking for better jobs, people upgrading their skills, or people who are temporarily caught in the friction of blessed technical change. This unemployment – whose precise magnitude can change with circumstances – is part and parcel of a vibrant, ever-changing capitalism. It is natural and therefore desirable; and things that are natural and desirable should not be messed with by government.[3]

Government policy can reduce unemployment below its natural rate – but only by cheating. In terms of Equation 1, the monetarist position is that, if economic agents have full information and act rationally, the government can only affect prices (P). It cannot affect the real economy (Q). Unfortunately, though, information is not always fully available and agents sometimes act irrationally, so there is always the temptation for government to try to fool them in order to reduce their unemployment below its natural rate.

The ‘efficacy of fooling’ (our term) depends on expectations. In Friedman’s naïve version (1968b, 1977), expectations adapt only slowly, so unemployment can be reduced below its natural rate for a certain period – although there is always a price to pay. Eventually, agents smarten up; and when they do, Equation 1 ascertains that the entire policy boost (through a higher Y) ends up raising prices (P). In later versions, such as those of Robert Lucas (1972; 1973; 1978) and Thomas Sargent (1973), expectations are rational, so expansionary policy cannot affect the real economy (Q) even in the short run and is immediately translated into higher inflation (by raising P). A more recent instalment of this logic, issued by Edward Prescott and Finn Kydland (1982), suggests that the entire business cycle is a natural, supply-side process and therefore impervious to Keynesian demand policy to start with.

Friedman, Phelps, Lucas, Sargent, Kydland and Prescott all won Nobel Memorial Prizes, and for a good reason: they managed to undo Keynes. They created a new dogma that states not only that macroeconomic policy cannot affect the real economy, but, more importantly, that the real economy does not need to be affected in the first place. In their laissez faire economy, the rate of unemployment will settle at its natural rate, whether it is 6, 8 or 20 per cent. The only thing the government should do is keep prices stable over the longer haul, by letting the money supply grow at the same rate as the long-term growth of the real economy.

This was the dogma in 2008.

And then came the stock market crash and the Great Recession. Protected by academic tenure and heavy subsidization, the economics profession has remained largely unfazed, but the policymakers have panicked, in unison. Within a few years, they have lost all confidence in their own dogma. Instead of sitting tight and letting the market ‘fix itself’, they have ‘intervened’, massively, breaking almost every rule in their book.

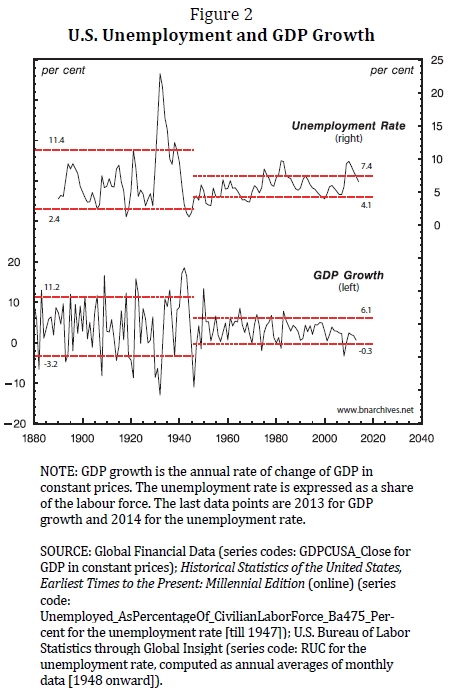

Fiscal Policy

On the fiscal side, policymakers have let budget deficits skyrocket. Figure 3 shows the budget balance in the OECD countries, with positive numbers indicating a surplus and negative numbers showing a deficit. We can see that, since the early 1990s, with monetarist neoliberalism in full swing, deficits tended to shrink, and that in some countries they reverted to small surpluses. But the first crash of the millennium, in 2000, reversed that trend, and in 2008, it was as if all hell had broken loose. The average OECD government deficit rose to nearly 8 per cent of GDP, and in the U.S., the bastion of neoliberalism, the deficit reached 12 per cent.

Of course, this was not exactly a return to Keynesianism, with its emphasis on planning through high taxes and even higher spending (on the rise and decline of 'Keynesianism' in the current crisis, see Farrell and Quiggin 2012). Instead, it was a quick-and-dirty, ‘hands-off intervention’, based mostly on tax cuts and automatic stabilizers. And as we can see, it was hastily reversed. In the early 2010s, policymakers started to talk about ‘austerity’, ‘belt tightening’ and ‘fiscal cliffs’. And their U-Turn came not because their economies were finally booming or because the economists had come up with some new theoretical insight, but because of the public debt.

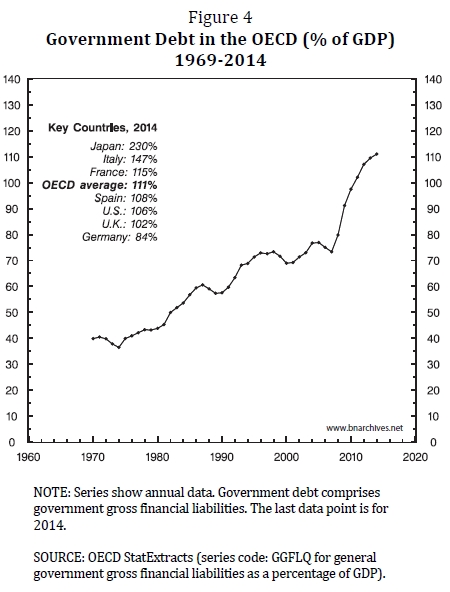

Figure 4 shows the ratio of government debt to GDP in the OECD. With deficits soaring and GDP stagnating, governments had to borrow massively, causing the debt/GDP ratio to rise by nearly 50 per cent in only 5 years! And with the ratio currently exceeding 110 per cent – up from 40 per cent in the 1970s – policymakers now warn us they are running out of fiscal ammunition.[4]

Monetary Policy

The situation with monetary policy looks equally demoralizing. Until 2008, the monetarist mantra spoke about fixed ‘policy rules’ that central bankers should obey. In 2008, these rules were thrown out of the window. Instead of letting the money supply grow at the same rate as the so-called real economy, central banks embarked on what they called ‘quantitative easing’. Or, in simpler words, they began to print money, and in large quantities.

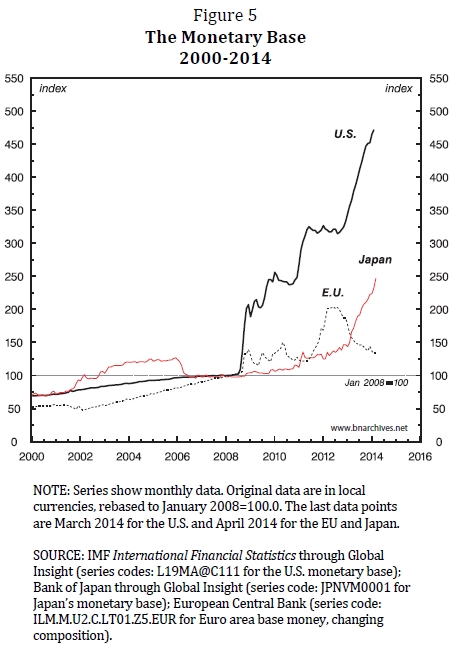

This process is shown in Figure 5. The graph plots the monetary base – which measures the amount of notes and coins in circulation – in the United States, the European Union and Japan. The numbers are denominated in local currencies and normalized to January 2008=100 so they can be compared easily.

The watershed is 2008. Before 2008, the expansion of the money supply was relatively orderly, particularly in the European Union and the United States. This pattern changed drastically after the crash, with the United States leading the way. Since 2008, the U.S. Fed has nearly quintupled the money supply. The European Central Bank quickly followed – though compared to the American ‘bull in a china store’, it trod carefully, choosing fine-tuning over indiscriminate printing. The Japanese, who were first to toy with this policy in the early 2000s, are only now re-joining the bandwagon: in early 2013 they announced plans to double their monetary base in two years, a target they are soon to achieve.

This massive money printing is remarkable primarily because it seems to have had little or no effect, nominal or real. Begin with the nominal side. From a Keynesian perspective, the deep crisis of 2008-9, should have produced deflation, while, from a monetarist viewpoint, the massive quantitative easing should have generated hyperinflation. Yet neither of these outcomes has materialized. Over the past decade, core inflation in the developed countries – that is, inflation excluding changes in food and energy prices – has remained remarkably stable at around 1-2 per cent.[5]

And the picture is equally embarrassing on the real side. Keynesians had hoped that making money cheaper would boost investment and kick-start the economy. However, that hasn’t happened. Since the beginning of the crisis, green-field investment as a share of GDP in the OECD countries has plummeted to its lowest level in 50 years: this share stood at 25 per cent in the early 1970s; it fell to 21 per cent in 2007 and it currently stands on 18 per cent (World Bank Online).

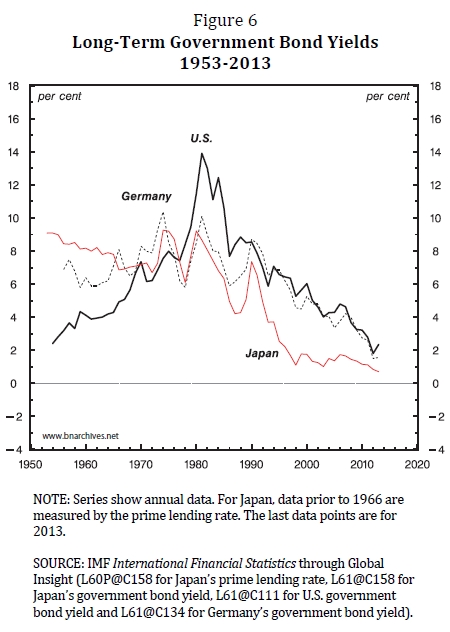

Moreover, looking at Figure 6, it is hard to see why Keynesians should have expected monetary policy to reverse this downtrend. The chart shows long-term government bond yields in the three leading OECD countries. These rates were already very low when the crisis started, and now, at close to zero, they are lower than at any other time since the 1950s. In this case, printing more money is like ‘pushing on a string’, as Keynes reputedly put it. It should have little or no effect on interest rates and therefore none on real investment.

This brief exposition should make it clear why the ruling class feels bereft of an intellectual compass and why its policymakers admit that they are flying blind when stirring their economies. Their dogma has collapsed. Not only did they abandon this dogma in a panic when the 2008 crisis struck, but their makeshift solutions have failed to generate meaningful results, let alone the expected ones. Moreover, they seem to have run out of ammunition. With massive debt, further fiscal expansion becomes impossible; and with interest rates close to zero, monetary expansion is useless. Another crisis today would find them empty handed.

The Marxist Perspective

For the Marxists, the key question is not how to bring about a recovery, but whether sustained growth is possible to begin with. According to Marx, the answer to this question is negative. Accumulation for him is rooted in and generated through class conflict, and this conflict makes capitalism inherently unstable, prone to crisis and, eventually, destined for breakdown.

Marx himself did not offer a coherent theory of crisis. He did generate, however, several key principles that in his view were crucial for understanding the inherent crisis tendencies of capitalism. These insights later gave rise to a huge Marxist literature on crises, to which we cannot do justice here. Our purpose, rather, is simply to highlight some of Marx’s insights, as well as the difficulties they give rise to. We focus on three theories, which we will examine in turn: (1) the tendency of the rate of profit to fall; (2) the interaction between the reserve army of the unemployed and the real wage; and (3) underconsumption (for critical reviews and overviews of Marxist crisis theories, see, for example, Sweezy 1942: Part III; Wright 1977; Shaikh 1978; Weisskopf 1978, 1991; Laibman 1999-2000; Agnoletto 2013).

The Tendency of the Rate of Profit to Fall

Profit for Marx is the source of accumulation. As a class, capitalists can only reinvest what they appropriate in profit; so if the rate of profit tends to fall, so must the maximum rate at which capital can accumulate. Now, according to Marx, and here we come to the first theory, this downward tendency is built into the very logic of capitalism.

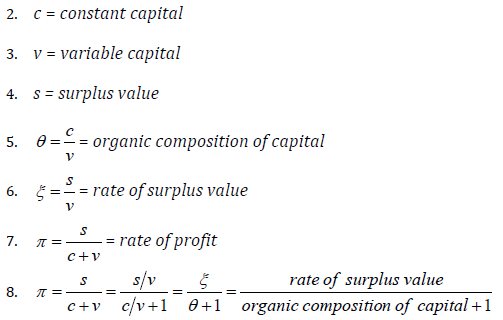

To see why this is so, let us review the basic Marxist accounting in Equations 2-8 below. Begin with c, v and s, which are measured in terms of socially necessary abstract labour time. If we denote constant capital by c, variable capital by v and surplus value by s, we can express the following three relationships. The organic composition of capital θ is the ratio of c/v; the rate of surplus value ξ is the ratio of s/v; and the rate of profit π is the ratio of s/(c+v). If we now divide the numerator and denominator of the rate of profit by v, we can express the rate of profit π as a ratio between the rate of surplus value ξ and the organic composition of capital θ plus 1.[6]

This framework, says Marx, enables us to understand one of the key built-in limitations of capitalism. Competition compels profit-maximizing capitalists to constantly mechanize their production, and this relentless process causes the organic composition to rise over time. Capitalists are also driven to raise the rate of surplus value (although it is not entirely clear why, under competitive conditions, they should succeed in doing so). In Marx’s opinion – which he himself was never completely convinced of – the organic composition tends to rise, and it tends to rise faster than the rate of surplus value, assuming that this rate trends upward as well (on Marx's life-long attempt to grapple with this process, see Heinrich 2013; for contesting views, see Heinrich et al. 2013). The progressive growth of the organic composition is offset by counter-tendencies; but according to Marx, over the longer-haul the former process is stronger, causing the rate of profit to trend downward. Over time, therefore, accumulation tends to decelerate, crises multiply and capitalism becomes ever more difficult to sustain.

The problems with these propositions are legion, and here we highlight three (for a more detailed account, see Nitzan and Bichler 2009a, Chs. 6-8). The first problem is with the unit of measurement. Labour values, which Marx’s variables are denominated in, cannot be observed or examined directly, making their empirical inquiry difficult if not impossible. The second problem is that mechanization per se can tell us nothing about labour values. Even if we accept Marx’s value scheme, it is entirely possible for technical change to devalue constant capital faster than the rate at which capitalists augment their ‘physical machinery’ (however measured). If that happens, the organic composition will fall rather than rise. Third and finally, for Marx, the economy is bifurcated into productive and unproductive activity. The former produces surplus value, while the latter uses it – yet there is no objective basis to deciding which economic activity is productive and which is not.

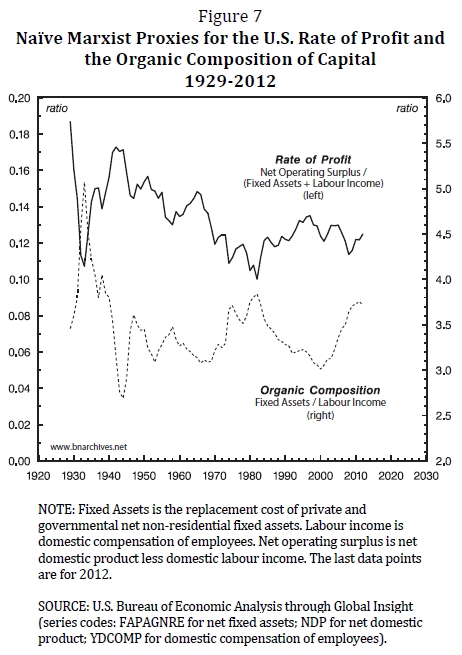

The consequences of this last problem are illustrated in Figures 7 and 8, which pertain to the United States. Since labour values cannot be observed, in both charts we assume – as most Marxists do in their empirical analysis – that these values are more or less equal to market prices. Of course, if this assumption is incorrect, the estimates we present here are meaningless.

Figure 7 takes a naïve perspective. It is naïve because in this chart we do not pretend to be able to distinguish productive from unproductive labour, and instead assume, contrary to most Marxists, that all economic activity is productive of surplus value. The dashed line approximates the organic composition of capital. It is estimated by taking the ratio between the current (replacement) dollar cost of all non-residential fixed assets and the dollar value of employee compensation. The solid line measures the Marxist rate of profit, computed as the ratio of net operating surplus (which is net domestic product less employee compensation) and the sum of the current dollar cost of fixed assets and employee compensation.[7]

Now, on the face of it, the current crisis seems consistent with Marx’s theory. We can see that, since the early 2000s, the organic composition has risen and the rate of profit has dropped. Moreover, this inverse relationship seems to hold – at least cyclically – for the entire period since the 1930s.

Technically, this inverse cyclicality is not entirely surprising. Since fixed assets appear in the numerator of one ratio (the organic composition) and the denominator of the other (the rate of profit), their variations will cause the two ratios to move inversely, by definition.

The difficulty with this figure lies in the longer-term trends. The rate of profit in the chart seems to trend downward, in line with Marx’s theory. But this decline is supposed to be caused by a rising organic composition of capital, whereas in the chart this composition seems to have fallen over time. In other words, the long-term decline in the rate of profit – assuming we accept its definition here – must have been caused by factors other than the organic composition of capital.

Now, adherents of the falling tendency theory would likely contest our naïveté here. In order to properly compute the organic composition and the rate of profit, they would argue, we must first differentiate between productive activity that produces surplus value and unproductive activity that uses surplus value. This, though, is easier said than done. And since nobody knows exactly which labour activity is productive and which is not, Marxists take a shortcut. They identify entire sectors that they deem to be productive and separate them from all other sectors, which they classify as unproductive (see, for example, Shaikh and Tonak 1994; Carchedi 2011).

Figure 8 follows this standard Marxist practice. It identifies four sectors as the productive core of the U.S. economy: agriculture, mining, construction and manufacturing.[8] The remaining sectors are considered unproductive. With this bifurcation, the organic composition of capital is calculated not for the economy as a whole, but only for the four sectors that produce surplus value. Part of this surplus value is appropriated by capitalists in these productive sectors; the rest is appropriated by the capitalists and workers of the unproductive sectors. To calculate the overall surplus value we subtract from net domestic income the wage bill of the productive sectors.[9] We then divide this surplus value by the sum of the fixed assets and wages of the productive sectors, to get the rate of profit.

Now, unlike in Figure 7, in this chart the organic composition trends upward, as it should – but, then, so does the rate of profit! In Marxist terms, this relationship means that there are counter-tendencies that more than offset the long-term impact of the rising organic composition. Proponents of this theory may again contest that our particular choice of productive and unproductive sectors is inappropriate, and maybe they are right. Unfortunately, though, there is no way to objectively delineate the two sectors, and this inability creates the temptation to choose the particular bifurcation whose results happen to be consistent with the theory. Finally, we should reiterate that (1) we are using neoclassical price data rather than (unavailable) Marxist labour values, so what we see in these charts might have nothing do with Marx’s theory to begin with; and (2) since labour values remain unknown, there is no way to know whether our findings support or undermine Marx’s theory.

The Reserve Army of the Unemployed and the Real Wage

Another driver of crisis in Marx is the relationship between the reserve army of unemployed and the real wage. For Marx, unemployment is the regulatory mechanism that ascertains that wages gravitate toward their subsistence level. During a boom, the bargaining power of workers strengthens, so the real wage tends to rise above its labour value. This rise squeezes profit, causing capitalists to invest less. A crisis then ensues, unemployment rises, and the real wage is compressed back to subsistence.

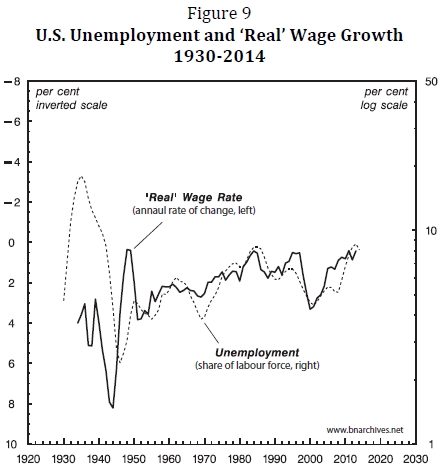

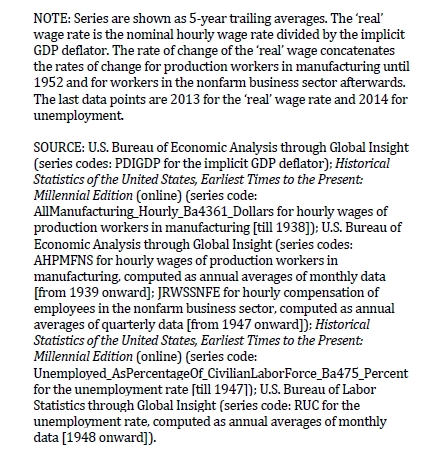

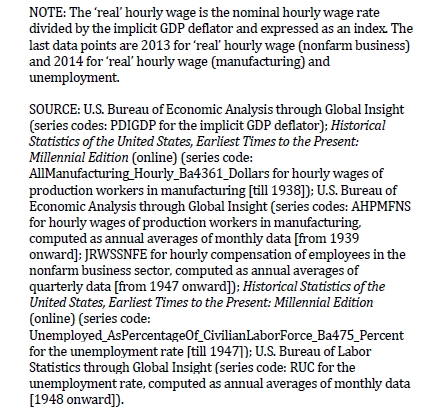

Figure 9 examines this process with respect to the United States. The chart shows two series. The rate of unemployment, represented by the dashed line, is plotted against the right logarithmic scale. The rate of change of the real wage is shown by the solid line and is plotted against the left inverted scale. The inversion means that a downward movement of this series in the chart represents a rise in the rate of growth of the real wage. Note that both series are smoothed as 5-year trailing averages.

This relationship, which does not depend on knowing labour values, seems consistent with the spirit of Marx’s claims and looks highly robust. Whenever unemployment rises, the rate of change of the real wage falls – and vice versa when unemployment falls. Both series show a significant change in the run-up to the current crisis: unemployment fell since the early 1980s, and particularly during the 1990s, while the rate of change of the real wage accelerated in tandem with this fall. In light of these developments, the crisis of the 2000s could be interpreted, at least in part, as a classical Marxist backlash set in motion to rid capitalists of excessive wages squeezing their profit. And indeed, since the onset of the crisis, the rate of unemployment has soared and the rate of growth of the real wage has been reduced to a standstill. Whether this process is the principal driver of the crisis of course is hard to tell, but it is certainly consistent with it.

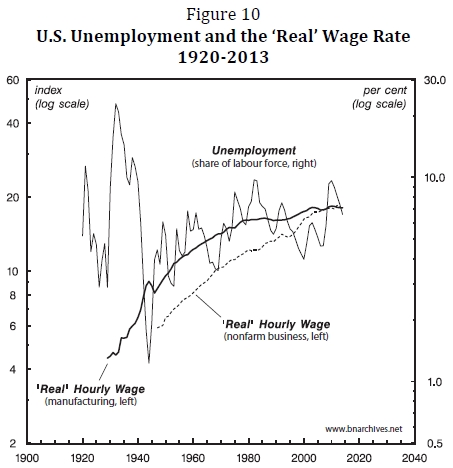

But the connection to Marx’s theory here, although intuitively appealing, is ultimately misleading. For Marx, the significance of the reserve army lies in its impact not on the rate of change of the real wage, but on its absolute level. Figure 10 examines this latter impact, and the picture it depicts is very different from that of Figure 9. The chart shows the rate of unemployment against the right log scale and the real wage level against the left log scale. We use two real-wage series – for production workers in manufacturing only and for all workers in the nonfarm business sector. Both series are expressed as indices.

Unlike Figure 9, this chart seems to present an anomaly. We can see that, as Marx might have expected, the level of real wages moved inversely with unemployment till the early 1940s – yet, from then onward, the relationship inverted. Unemployment started to rise and continued to do so till the early 1980s; but the real wage, instead of falling or at least stagnating, rose in tandem. Moreover, when unemployment stopped rising and even fell during the 1990s, the real wage, instead of rising, stagnated. From this viewpoint, the reserve army of the unemployed no longer seems to play the role that Marx allotted to it in the nineteenth century, at least not in any evident way. Compared to the earlier postwar era, the real wage during the 1990s and 2000s has hardly changed, so it is difficult to see it as a ‘profit squeezing’ factor underlying the current crisis.

Underconsumption

The third Marxist driver of crisis is underconsumption. Unlike the theory of the falling tendency of the rate of profit, which emphasizes the limits on the production of surplus value, underconsumption deals with the limits on the realization of surplus value. The starting point is the more or less universal fact that workers, because of their lower income, spend most if not all of that income on consumption. By contrast, capitalists, whose income is much higher, can afford – and are compelled by their social role as capitalists – to save most of it. So, all else remaining the same, an upward redistribution of income from workers to capitalists will tend to reduce the average share of consumption in aggregate spending. The consequence of this reduction, say the underconsumptionists, is a glut of unsold commodities, lower prices and lower profit. And since falling profit tends to lower investment spending, we end up with a generalized ‘realization crisis’.

Until the early twentieth century, this view was not particularly popular among Marxists, partly because Marx himself seemed rather ambivalent about it. But the rise of European imperialism in the latter half of the nineteenth century, the Great Depression of the 1930s, and the militarized boom of the Second World War changed this attitude. Following John Hobson’s pioneering work on Imperialism (1902), Marxists started to seriously contemplate the significance of realization for capitalist crisis (Hilferding 1910; Luxemburg 1913; Kautsky 1914; Lenin 1917). And with Keynes’ emphasis on deficient demand, Marxist underconsumption theories enjoyed a significant revival (for a critical analysis, see Bichler and Nitzan 2012c).

The most innovative contributor to this literature was the Polish political economist Michal Kalecki (for a posthumous edited collection, see Kalecki 1971). Writing in the early 1930s, Kalecki developed a class-based micro-macro model that anticipated and, in some important sense, went beyond Keynes. One of the key novelties of Kalecki’s model was the role played by the market structure and the consequences of that structure for the distribution of income and the level of aggregate demand (Kalecki 1933, 1939, 1943; Asimakopulos 1975, 1987). According to Kalecki, modern corporate structures tend to be highly concentrated. The extent of this concentration, he said, can be measured by the ‘degree of monopoly’, which he defined as (approximately) equal to the ratio of unit profit to unit price, or the share of capital in national income. All else being the same, he said, the higher the degree of monopoly – and therefore the higher the income share of capital – the lower the average share of consumption in aggregate spending, and hence the greater the tendency toward deficient demand and stagnation.

Later on, this insight became a key theoretical basis for the Monopoly Capital School. According to this school – led by Paul Baran and Paul Sweezy and others associated with the journal Monthly Review – oligopolistic capitalism tends to generate stagflation and needs wasteful spending – particularly military expenditures and financialization – to offset this tendency (Steindl 1952; Tsuru 1956; Baran and Sweezy 1966; Magdoff and Sweezy 1983; Foster and Szlajfer 1984).

Kalecki’s argument can be generalized beyond its original emphasis on capital versus labour. If the share of consumption in personal income is associated negatively with the level of personal income, then we should expect personal or household income inequality, regardless of its source, to be inversely correlated with the pace of economic activity.

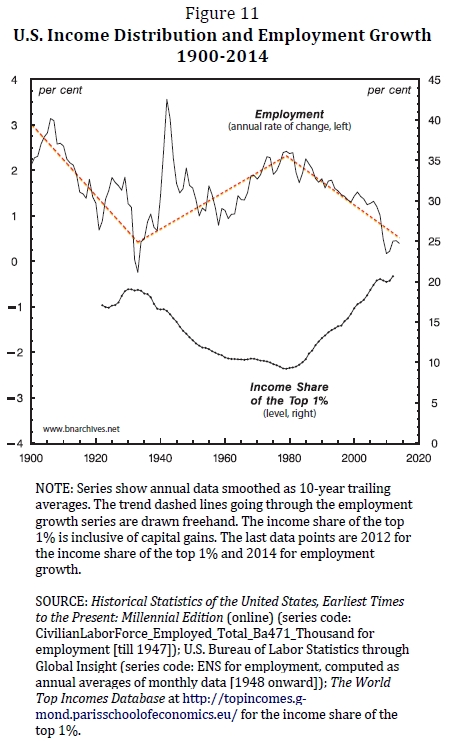

Figure 11 examines this proposition for the United States. The dotted line at the bottom shows the income share of the top 1 per cent of the U.S. population (for a comparative critical assessment of income-distribution data, see Burkhauser et al. 2012). The solid series at the top of the chart depicts the pace of economic activity, approximated here by the rate of growth of employment. Note that we use employment growth rather than overall economic growth. The reason is that, as it is commonly measured, overall growth is affected by both employment and productivity growth, but only the former responds directly to underconsumption. Both series are smoothed as 10-year trailing averages.

The relationship shown in the figure is rather remarkable. We can discern three distinct periods, indicated by the dashed, freely drawn line going through the employment series. The first period, from the turn of the century till the 1930s, is the so-called Gilded Age. Income inequality is rising (at least during the period for which data are available) and employment growth is plummeting.

The second period, from the Great Depression till the early 1980s, is marked by the Keynesian welfare-warfare state. Higher taxation and spending make distribution more equal, while employment growth accelerates. Note the massive acceleration of employment growth during the Second World War and its subsequent deceleration brought by postwar demobilization. Obviously these dramatic movements are unrelated to income inequality, but they do not alter the series’ overall upward trend.

The third period, from the early 1980s to the present, is marked by neoliberalism. In this period, monetarism assumes the commanding heights, inequality starts to soar, and employment growth plummets. The current rate of employment growth hovers around zero while the top 1 per cent appropriates 20 per cent of all income – similar to the numbers recorded during the Great Depression.

Figure 11 certainly seems consistent with the Monopoly Capital version of underconsumption. It suggests that the current crisis is the culmination of a systemic increase in inequality that began in the early 1980s, which in turn bred underconsumption tendencies and lowered employment growth to a standstill (for a survey of debates and evidence on the role of income inequality in the recent crisis, see van Treeck and Sturn 2012; on wage-led growth, see Lavoie and Stockhammer 2013).

For the underconsumptionists, getting out of this crisis now depends on what happens to inequality. If the distribution of income can be made more equal – as it was after the Great Depression – a new phase of growth may ensue. But if increasing inequality is inherent to the present logic of capital – for example, because of the drive toward greater exploitation or the imperative of higher concentration and centralization – then the crisis may be difficult if not impossible to resolve.

Note, though, that for the underconsptionists, accumulation and redistribution are two distinct processes. The goal is accumulation – or, in this case, averting an accumulation crisis – while redistribution is merely the means for achieving that goal. But then, what exactly do we mean by crisis? So far, we have treated this concept as if it were self-evident – but is it?

The Common Economic Underpinnings of Marxism and Liberalism

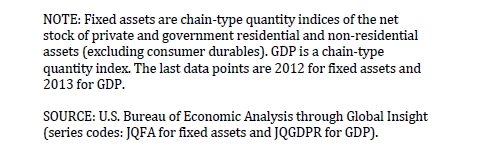

For Marxists as well as mainstream liberal economists, the engine of capitalism is the economy, and specifically the accumulation of capital and the growth of GDP. Accumulation and growth are seen as two sides of the same process. Accumulation generates growth, and growth sustains accumulation. Both are thought of as ‘economic’ processes, denominated in ‘real’ terms of production and consumption. From this viewpoint, crisis is a breakdown of both real accumulation and growth.

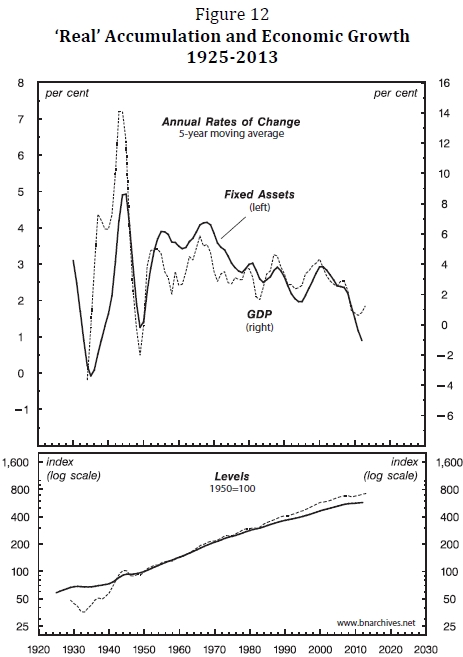

And that is what we see in Figure 12. The bottom panel of the figure shows the level of the U.S. real capital stock and GDP since 1929, while the top panel shows their respective rates of growth smoothed as 5-year trailing averages. Both the levels and rates of change of the two magnitudes move in tandem. And if we take the top panel at face value, our conclusion would be that the current crisis comes at the tail end of a prolonged deceleration that began in the late 1960s and has recently culminated in a near breakdown.

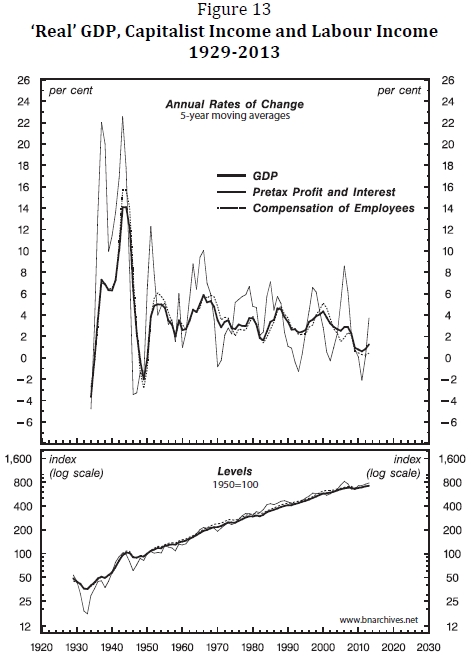

Considered in conjunction with evidence shown earlier in the paper, this process seems consistent with the Marxist claim that accumulation rests on class conflict, and that this conflict makes capitalism prone to crisis. But if we examine Figure 13, we can also see that, in terms of their so-called real incomes, the fate of both capitalists and workers goes hand in hand with the economy. The chart shows the levels and rates of growth of real labour income and real capitalist income (pretax profit and net interest), and both trace the level of real GDP and oscillate in tandem with its rate of growth.

In this very basic sense, then, Marxists and liberal economists sit on the same side of the fence. In both perspectives, the material interests of capitalists and workers depend on economic growth and capital accumulation, and if this twin engine fails, as it does during a crisis, both classes lose.

The difference between the two approaches lies in the reasons they give for the crisis and whether or not it can be averted. Mainstream economists root crises in imperfections, distortions and misguided intervention that can be solved or counteracted by adequate policy (primarily deregulatory), whereas Marxists claim that crises are built into the conflictual class logic of capitalism and therefore are difficult to fix and impossible to eliminate. But both agree on what constitutes a crisis in the first place: a sharp decline in real economic activity and income.

Capital as Power

The theory of capital as power differs radically from both Marxism and mainstream economics (Nitzan and Bichler 2009a; Bichler and Nitzan 2012b). Capital, it argues, is not an economic entity, but an institution of power. So, at its core, a crisis of accumulation is not a crisis of production or consumption, but a crisis of capitalist power (Bichler and Nitzan 2010; Kliman, Bichler, and Nitzan 2011; Bichler and Nitzan 2012a).

Now, what do we mean by capitalist power? Following the explicitly scientific notion of power, first articulated by Johannes Kepler in 1600, we see capitalist power not as a qualitative stand-alone entity, but as a quantified relationship between entities. In capitalism, this quantitative relationship is manifested through the distributional grid of incomes and assets between capitalist and non-capitalist classes, as well as among the capitalists themselves. In other words, for capitalists, redistribution is not a means to an end, but the end itself.

Based on this notion, we suggested in the late 1990s two tentative conditions for what constitutes a sustained regime of accumulation (Nitzan 1998). The first and key condition is non-negative differential accumulation; in other words, that the capitalization of dominant capital rises or at least remains stable relative to the capitalization of the average firm. This condition reflects both the power drive of accumulation as well as the necessity to exercise power in order to bring society under effective business control.

The second condition is a steady or rising capital share of income. This condition is partly an indirect result of the first condition; however, it also reflects the overall balance of power between capitalists and other societal groups. Unless this condition is fulfilled, the ‘capitalist’ nature of the system could be put into question.

Within this context, a significant violation of one or both criteria brings the threat of a major capitalist crisis.

Note that the operational definitions of these two conditions are open-ended. To make them precise, we need to clearly delineate capital income, define the boundaries of dominant capital and its referential average, and set the relevant time periods for computing the trajectories of the different measures. The remainder of this section presents a tentative, broad-brush approximation of these two power processes, examines their political-economic underpinnings, and assesses what they might mean for policymaking in a world where capital is power.

The Evolution of Capitalist Power in the United States

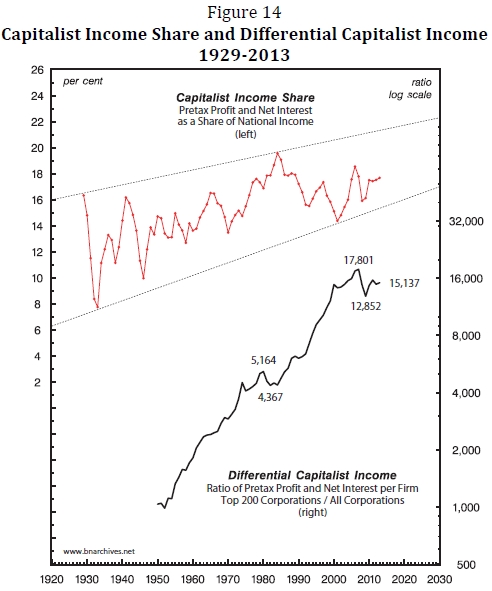

Figure 14 examines the historical evolution of our two criteria in the United States. The chart, which revises and updates research that we first presented in the late 1990s (Nitzan 1998), shows two comprehensive measures of capitalist income. Capitalist income is defined here as pretax profit and net interest – or what the accountants call EBIT, an acronym for ‘earnings before interest and taxes’.

Begin with the top dotted series. This series, plotted against the left arithmetic scale, shows the share of pretax profit and net interest in overall national income. The unmistakable trend of the series is up. Since 1929, the relative power of capitalists, measured here by their income share, has risen by one third – from roughly 12 per cent to about 16 per cent. Furthermore, the volatility of this share, indicated by the gradual convergence of the top and bottom dashed lines, has been reduced significantly. And if we take volatility as a proxy for risk, we would conclude that the risk facing capitalists has declined as well.

The bottom series, plotted against the right log scale, shows the differential capitalist income of the largest 200 U.S.-incorporated firms (we use income rather than capitalization here, since the latter measure is unavailable for most firms). This differential shows the EBIT of an average corporation in the top 200 group relative to the EBIT of an average U.S. corporation and is calculated in three steps: (1) by computing the average EBIT of the largest 200 firms; (2) by computing the sum of pretax profit and net interest for the average U.S. corporation; and (3) by dividing the former by the latter.

Here too the pattern is remarkable. Since we are using a log scale, the slope of the line is indicative of its rate of change. Overall, the differential income of the top 200 U.S.-based firms rose from about 1,000 in the early 1950s to nearly 18,000 by the mid 2000s, representing an average annual differential accumulation of over 4.5 per cent. [10]

Note that as we move from viewing capital as an economic entity to seeing it as relationship of power, the picture inverts. Whereas economic growth, the accumulation of so-called fixed assets and the growth of real labour and capital income have all decelerated since the 1960s, the differential power of capitalists in general and of dominant capital in particular has trended upward.

The Two Crises of Capital as Power

The increase in differential capitalist income since the 1950s has been relatively smooth – with two exceptions: two brief periods in which dominant capital experienced differential decumulation. (1) In the late 1970s, differential accumulation started to decelerate, and by the early 1980s, it suffered a deep, 15 per cent drop. However, with Ronald Reagan in the White House, monetarism back in the driver’s seat and neoliberalism in full swing, the increase quickly resumed and lasted for another twenty years. (2) During the early 2000s, the process again started to slow down, and in 2007 there was a marked decline: in the following two years, the top 200 firms saw their differential income drop by nearly 30 per cent; and although the differential has since risen, its 2013 level is still 15 per cent below its historical peak.

The late 2000s episode is different from the one in the early 1980s in two respects. First, in the 1980s, while dominant capital was suffering differential decumulation, the share of capital in national income was actually rising. By contrast, in the late 2000s, both differential accumulation and the capitalist share of income were falling. Second, and perhaps much more ominously for capitalists, nowadays both measures of power are probably more difficult to increase than they were during the 1980s.

With respect to differential accumulation, this greater difficulty is evident from the mere fact that the differential EBIT of the top 200 corporations is now roughly three times higher than it was in the 1980s. Pushing this magnitude even further – let alone having it grow at its average historical rate of 4.5% – will require an avalanche of mergers and acquisitions commensurate with the mammoth size of dominant capital and/or intense measures to increase differential markups more and more – an already tall order that will grow even taller with every further increase in the differential size of dominant capital (on strategies and regimes of differential accumulation, see Nitzan 2001; Nitzan and Bichler 2009a: Chs. 15-17).

Capital as Power and Strategic Sabotage

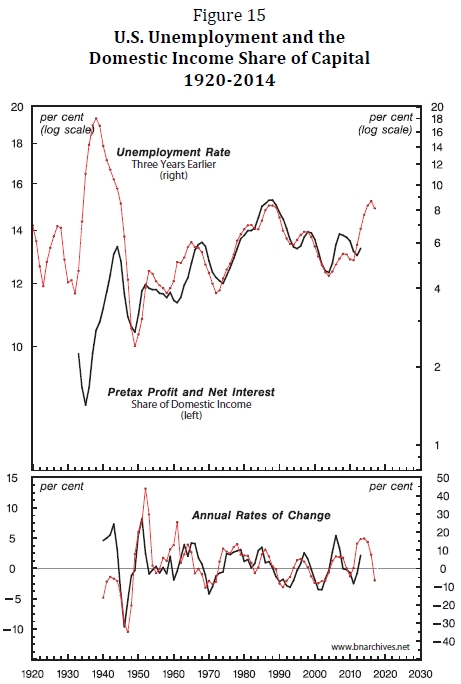

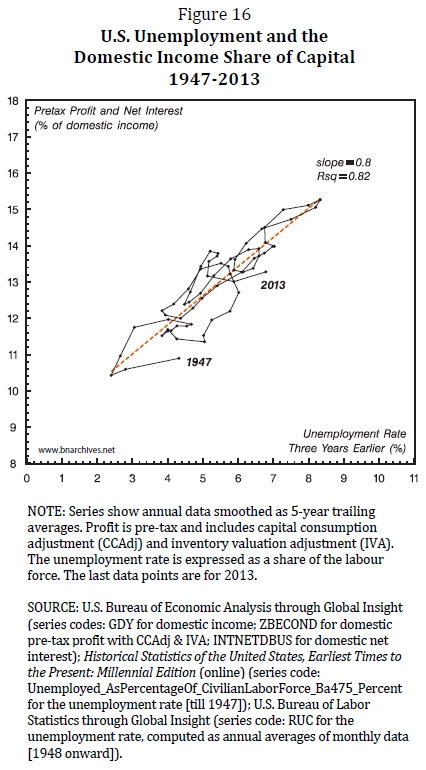

To understand the limits on the overall share of capital in national income, we turn now to the two last charts of the paper – Figures 15 and 16 (for the earliest presentation of this relationship, see Nitzan and Bichler 2000; for recent commentary, see Bichler and Nitzan 2014). The relationship presented in these figures might seem counter-intuitive – but only if you take your cue from the ‘economic’ understanding of capitalism. If you look at these relationships from the viewpoint of capital as power, the puzzle quickly disappears.

Figure 15 shows the overall share of capital in domestic income along with the rate of unemployment. The top panel displays the levels of the two variables, both smoothed as 5-year trailing averages. The solid line, plotted against the left log scale, shows pretax profit and net interest as a percent of domestic income. The dotted line, plotted against the right log scale, shows the rate of unemployment three years earlier. The bottom panel shows the annual rates of change of the two top variables since 1940.

The same relationship is displayed, somewhat differently, in Figure 16. This chart shows the two variables from Figure 15 for the 1947-2013 period – but instead of plotting them against time, it plots them against each other (for an analysis of the entire 1929-2013 period, see Bichler and Nitzan 2014). The capitalist share of domestic income is plotted against the vertical axis, while the rate of unemployment three years earlier is plotted against the horizontal axis.[11]

The direction and tightness of this relationship leave little to the imagination. If we regress the capitalist share of domestic income against the rate of unemployment three years earlier, we find that for every 1 per cent increase in unemployment, there is 0.8 per cent increase in the capitalist share of domestic income three years later (see the straight OLS regression line going through the observations). The R-squared of the regression indicates that, between 1947 and 2013 changes in the unemployment rate accounted for 82 per cent of the squared variations of capitalist income three years later.

Can Capitalists Afford Recovery?

What do Figures 15 and 16 tell us? From the viewpoint of both mainstream economics and Marxism, the relationships in these figures are highly counterintuitive (the conventional view is that the capital income share is pro-cyclical – see Giammarioli et al. 2002; Schneider 2011 – exactly the opposite of what we see in the figures). Because accumulation and growth are seen as two sides of the same process, unemployment is generally viewed as a curse for both capitalists and workers. As noted, Marx was prescient in identifying the role of rising unemployment in disciplining workers and reducing their wages back to their labour values. But this process is supposed to serve accumulation only for brief periods, particularly toward the peak of the business cycle. Over the longer haul, though, capitalists, just like workers, are interested in growth and therefore in low unemployment, not high unemployment.

Figures 15 and 16 portray a completely different process, with wide-ranging implications. Here, the driving force of capitalism is not absolute but relative: it is not economic growth and the accumulation of productive machines and structures that count, but the differential accumulation of capitalized power. Now, understood as a power process, differential accumulation requires strategic sabotage, and this sabotage can take different forms. We have explored many of these forms in our previous works, and there are now young researchers who are extending this inquiry into new fields and regions.[12] But as the charts vividly illustrate, of these many processes of sabotage, the threat and exercise of unemployment remains central and crucial – not only temporarily as Marx suggested, but permanently.

This claim has significant implications for economic policy. As it turns out, the problem of policymakers is not only that their dogma has collapsed and that their ammunition has run out, but also, and more importantly, that their very policy goal is self-contradictory. Capitalist policy is geared, first and foremost, toward accumulation. If accumulation recovers, argue both Marxists and liberals, economic growth will recover in tandem, and the tide of growth will then help lift up all boats – including those of workers – by lowering unemployment and raising the real wage.

This logic, though, is premised on capital being a ‘real’ economic entity. However, if we instead think of capital as power, there is no way for policymakers to achieve both goals simultaneously, and for a simple reason: capitalists cannot afford recovery. In order for policymakers to boost the capitalist share of income, they need not to lower unemployment, but to raise it.

With these thoughts in mind, the final question to ask is what lies ahead? If the relationship depicted in Figure 15 continues to hold, the share of capitalists in U.S. domestic income, expressed as a five-year trailing average, is set to rise further in the coming years. The crisis has raised unemployment to its highest level since the 1930s, so looking forward, this increase in strategic sabotage should boost the power of capital and therefore its distributive share of income.

But capitalists are never content with the status quo. Their regime compels them to augment their capitalized power further and further, and that means more strategic sabotage and therefore even greater unemployment. And it is this need for ever greater sabotage – and the risk of backlash that record levels of sabotage may trigger – that fuels the lingering systemic fear of both capitalists and their policymakers.

Endnotes

[1] This paper was first presented in Surplus, Solidarity, Sufficiency, The Eighth International Rethinking Marxism Conference, University of Massachusetts at Amherst, September 19–22, 2013. Jonathan Nitzan teaches political economy at York University in Toronto (nitzan@yorku.ca). Shimshon Bichler teaches political economy in colleges and universities in Israel (tookie@barak.net.il). All their publications are available from The Bichler & Nitzan Archives (http://bnarchives.net). Research for this paper was partly supported by the Social Sciences and Research Council of Canada.

[2] Friedman held onto both ends of the stick. ‘In some sense’, he wrote (1968a: 15), ‘we are all Keynesians now; in another, no one is a Keynesian any longer. We all use the Keynesian language and apparatus; none of us any longer accepts the initial Keynesian conclusions’. Nixon was less subtle, announcing that he was ‘now a Keynesian in economics’ (Anonymous 1971).

[3] The language is definitive. According to Nobel Memorial Prize winner Milton Friedman (1968b: 8), ‘At any moment of time there is some level of unemployment which has the property that it is consistent with equilibrium in the structure of real wage rates. . . . The “natural rate of unemployment”, in other words, is the level that would be ground out by the Walrasian system of general equilibrium equations, provided there is embedded in them the actual structural characteristics of the labor and commodity markets, including market imperfections, stochastic variability in demands and supplies, the cost of gathering information about job vacancies and labor availability, the costs of mobility, and so on’. For Edmund Phelps, another Nobelist of monetarist repute, a certain rate of unemployment is not only ‘natural’ but also desirable (provided it excludes tenured professors, of course). In his expert opinion, most of the so-called unemployed are merely ‘searching’ for a better job. ‘It would be as senselessly puritanical to wipe out unemployment as it would be to raise taxes in a deep depression’. There is nothing to worry about, he concludes. On the contrary: ‘Today’s unemployment is an investment in a better allocation of any given quantity of employed persons tomorrow’ (1970: 17). The very same point was reiterated by another monetarist of Nobelistic repute, Robert Lucas: ‘When we are unemployed’, he observed, ‘it is because we think we can do better’ (interviewed by Snowdon and Vane 2005: 290, emphases added). And that must be true. After all, it is well known that whenever Phelps and Lucas invested in their own unemployment, they always ended up making a bundle.

[4] A recent scandalized version of this warning was issued by Carmen Reinhart and Kenneth Rogoff, who claimed that ‘across both advanced countries and emerging markets, high debt/GDP levels (90 percent and above) are associated with notably lower growth outcomes’ (Reinhart and Rogoff 2010: 577). Coming from top pundits, this warning was happily leveraged in support of austerity measures, until a group of University of Massachusetts economists showed it to be based on faulty Excel sheet calculations. Once corrected, the computations showed debt/GDP levels to have had no discernable impact on growth (Herndon, Ash, and Pollin 2013). Needless to say, this correction has hardly dented the conviction of the debt fixers.

[5] One could of course argue that quantitative easing helped prevent depression and deflation and therefore vindicated both the Keynesian and monetarist positions. Such counterfactual claims, though, although appeasing to the policymakers, are inherently irrefutable.

[6] There is a debate among Marxists on whether the proper definition of C in these equations should include (1) the entire stock of constant capital being advanced, or (2) only the part that is used up in producing the commodity. In our presentation, we bypass this debate by defining the commodity to comprise the gross national product and the somewhat depreciated constant capital that remains at the end of the production cycle, so C satisfies both definitions (we are indebted to Moshé Machover for reminding us of this issue).

[7] We should note here that Marxists remain divided on whether ‘capital’ in the rate of profit should include both the physical capital stock and the wage bill, so π = s / (c + v), or only the physical capital stock, so π = s / c. Here we remain true to Marx’s original formulation (the former), although using the latter would yield the same conclusions. For the United States, the two rate-of-profit formulas result in different magnitudes, but these magnitudes correlate tightly in their long-term trends and short-term fluctuations.

[8] Marxists commonly consider utilities as a productive sector, but they often exclude it from their empirical analysis due to data problems. We follow this convention here.

[9] In their empirical analyses, some Marxists do not follow this proper method; instead, they approximate surplus value by subtracting the wage bill from the income not of all sectors, but of the productive sectors only (see for example, Carchedi 2011). Because this computation is analytically incorrect, its results are difficult to interpret.

[10] The very same pattern, although less steep, is depicted by the differential capital income of the top 0.01% of domestically incorporated U.S. firms. For further analysis of this latter group, see Bichler and Nitzan (2012a).

[11] The three-year lag between changes in unemployment and changes in the capitalist income share suggests that the redistributional impact of the underlying sabotage is not immediate. The precise mapping of this process, though, requires further investigation.

[12] See, for example, the edited volume of Tim Di Muzio (2013) on the capitalist mode of power. Other works include Syed Ozair Ali (2011) on stagflation in Pakistan, Joseph Baines (2013) on food profit and malnourishment, Jordan Brennan (2012) on dominant capital and income inequality in Canada, D.T. Cochrane and Jeff Monghan (2013) on differential accumulation and struggles in South Africa’s Apartheid, Tim Di Muzio (2012) on the ecological limits of differential accumulation, Sandy Brian Hager (2013a, 2013b) on the centralization of public debt ownership, Joseph Francis (2013) on regimes of differential accumulation in the United States and United Kingdom, Suhail Malik and Phillips Andrea (2012) on the art business, James McMahon (2013) on Hollywood’s risk reduction through standardization and Hyeng-Joon Park (2013b, 2013a) on differential accumulation in the development of modern South Korea.

References

Ali, Syed Ozair. 2011. Power, Profits and Inflation: A Study of Inflation and Influence in Pakistan. State Bank of Pakistan. SBP Working Paper Series (43, December): 1-23.

Andrews, Edmund L. 2008. Greenspan Concedes Error on Regulation. New York Times, October 23, pp. 1.

Anonymous. 1971. Nixon Reportedly Says He is Now a Keynesian. New York Times, January 7, pp. 19.

Baines, Joseph. 2013. Food Price Inflation as Redistribution: Towards a New Analysis of Corporate Power in the World Food System. New Political Economy: 1-34, published electronically on April 22.

Bichler, Shimshon, and Jonathan Nitzan. 2008. Contours of Crisis: Plus ça change, plus c'est pareil? Dollars & Sense, December 29.

Bichler, Shimshon, and Jonathan Nitzan. 2009. Contours of Crisis II: Fiction and Reality. Dollars & Sense, April 28.

Bichler, Shimshon, and Jonathan Nitzan. 2010. Systemic Fear, Modern Finance and the Future of Capitalism. Monograph, Jerusalem and Montreal (July), pp. 1-42.

Bichler, Shimshon, and Jonathan Nitzan. 2012a. The Asymptotes of Power. Real-World Economics Review (60, June): 18-53.

Bichler, Shimshon, and Jonathan Nitzan. 2012b. Capital as Power: Toward a New Cosmology of Capitalism. Real-World Economics Review (61, September): 65-84.

Bichler, Shimshon, and Jonathan Nitzan. 2012c. Imperialism and Financialism: The Story of a Nexus. Journal of Critical Globalization Studies (5, January): 42-78.

Bichler, Shimshon, and Jonathan Nitzan. 2014. Nonlinearities of the Sabotage-Redistribution Process. Research Note (May 19): 1-5.

Brennan, Jordan. 2012. The Power Underpinnings, and Some Distributional Consequences, of Trade and Investment Liberalisation in Canada. New Political Economy (iFirst): 1-33.

Burkhauser, Richard V., Shuaizhang Feng, Stephen P. Jenkins, and Jeff Larrimore. 2012. Recent Trends in Top Income Shares in the United States: Reconciling Estimates from March CPS and IRS Tax Return Data. The Review of Economics and Statistics XCIV (2, May): 371-388.

Carchedi, Guglielmo. 2011. Behind and Beyond the Crisis. International Socialism (132, October).

Cochrane, D.T., and Jeffrey Monaghan. 2013. 'A Degree of Control': Corporations and the Struggle Against South African Apartheid. In The Capitalist Mode of Power. Critical Engagements with the Power Theory of Value, edited by T. Di Muzio. London and New York: Routledge, pp. 82-98.

Di Muzio, Tim, ed. 2013. The Capitalist Mode of Power: Critical Engagements with the Power Theory of Value. RIPE Studies in Global Political Economy. London and New York: Routledge.

Editors. 2009. Sound and Fury in the World Economy. Financial Times, May 16, pp. 6.

Farrell, Henry, and John Quiggin. 2012. Consensus, Dissensus and Economic Ideas: The Rise and Fall of Keynesianism During the Economic Crisis.

Francis, Joseph. 2013. The Buy-to-Build Indicator: New Estimates for Britain and the United States. Review of Capital as Power 1 (1): 63-72.

Friedman, Milton. 1968b. The Role of Monetary Policy. The American Economic Review, Papers and Proceedings 58 (1): 1-17.

Giammarioli, Nicola, Julian Messina, Thomas Steinberger, and Chiara Strozzi. 2002. European Labor Share Dynamics: An Institutional Perspective. EUI Working Paper ECO No. 2002/13, Department of Economics, European University Institute, Badia Fiesolana, San Domenico (FI).

Giles, Chris. 2013. Central Bankers Say They Are Flying Blind. Financial Times, April 17.

Hager, Sandy Brian. 2013a. America's Real 'Debt Dilemma'. Review of Capital as Power 1 (1): 41-62.

Hager, Sandy Brian. 2013b. What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent. New Political Economy: 1-28, published electronically on April 16.

Heinrich, Michael. 2013. Crisis Theory, the Law of the Tendency of the Profit Rate to Fall, and Marx's Studies in the 1870s. Monthly Review 64 (1, April).

Heinrich, Michael, Shane Mage, Fred Moseley, Guglielmo Carchedi, and Michael Roberts. 2013. Exchange with Michael Heinrich on Marx's Crisis Theory. Monthly Review 65 (4, December).

Herndon, Thomas, Michael Ash, and Robert Pollin. 2013. Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff. Political Economy Research Institute Working Paper Series (322): 1-25.

Hilferding, Rudolf. 1910. [1981]. Finance Capital. A Study of the Latest Phase of Capitalist Development. Edited with an Introduction by Tom Bottomore, from a Translation by Morris Watnick and Sam Gordon. London: Routledge & Kegan Paul.

Hobson, John A. 1902. [1965]. Imperialism. A Study. Ann Arbor: University of Michigan Press.

Kautsky, Karl. 1914. [1970]. Ultra-Imperialism. Original German version published in 1914. New Left Review 59 (Jan/Feb): 41-46.

Kliman, Andrew, Shimshon Bichler, and Jonathan Nitzan. 2011. Systemic Crisis, Systemic Fear: An Exchange. Special Issue on 'Crisis'. Journal of Critical Globalization Studies (4, April): 61-118.

Kydland, Finn E., and Edward C. Prescott. 1982. Time to Build and Aggregate Fluctuations. Econometrica 50 (6, November): 1345-1370.

Lavoie, Marc, and Engelbert Stockhammer. 2013. Wage-Led Growth: Concepts, Theories and Policies. ILO Conditions of Work and Employment Series (41): 1-32.

Lenin, Vladimir I. 1917. [1987]. Imperialism, The Highest State of Capitalism. In Essential Works of Lenin. 'What Is to Be Done?' and Other Writings. New York: Dover Publications, Inc., pp. 177-270.

Lucas, Robert E. 1972. Expectations and the Neutrality of Money. Journal of Economic Theory 4 (April): 103-124.

Lucas, Robert E. 1978. Unemployment Policy. American Economic Review 68 (2, May): 353-57.

Lucas, Robert E. Jr. 1973. Some International Evidence on Output-Inflation Tradeoffs. American Economic Review 36 (3, June): 326-334.

Luxemburg, Rosa. 1913. [1951]. The Accumulation of Capital. With an Introduction by Joan Robinson. Translated by A. Schwarzschild. New Haven: Yale University Press.

Malik, Suhail, and Phillips Andrea. 2012. Tainted Love: Art's Ethos and Capitalization. In Contemporary Art and its Commercial Markets. A Report on Current Conditins and Future Scenarios, edited by M. Lind and O. Velthuis. Berlin: Sternberg Press, pp. 209-240.

McMahon, James. 2013. The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema. Review of Capital as Power 1 (1): 23-40.

Nitzan, Jonathan. 1989. Price and Quantity Measurements: Theoretical Biases in Empirical Procedures. Working Paper 14/1989, Department of Economics, McGill University, Montreal, pp. 1-24.

Nitzan, Jonathan. 1998. Differential Accumulation: Toward a New Political Economy of Capital. Review of International Political Economy 5 (2): 169-216.

Nitzan, Jonathan. 2001. Regimes of Differential Accumulation: Mergers, Stagflation and the Logic of Globalization. Review of International Political Economy 8 (2): 226-274.

Nitzan, Jonathan, and Shimshon Bichler. 2009a. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Nitzan, Jonathan, and Shimshon Bichler. 2009b. Contours of Crisis III: Systemic Fear and Forward-Looking Finance. Dollars & Sense, June 12.