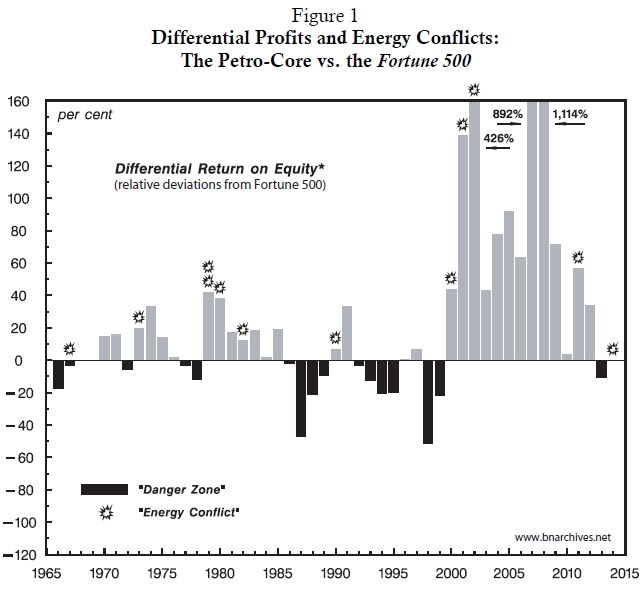

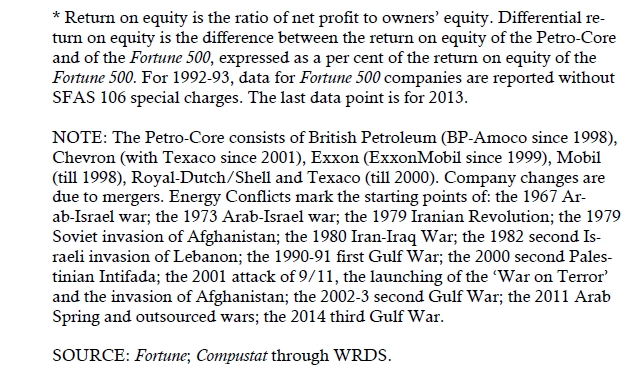

During the late 1980s and early 1990s, we identified a new phenomenon that we called ‘energy conflicts’ and showed that these conflicts were intimately linked to the differential profitability of the leading oil companies. Figure 1 below, which was first published in 1995, adds new data to bring this connection up to date.1

The chart displays the differential return on equity of the ‘Petro‑Core’, a group consisting of the world’s largest listed integrated oil companies. During early 1960s, the group included six firms – British Petroleum, Chevron, Exxon, Mobil, Royal‑Dutch/Shell and Texaco. The 1999 merger of Exxon and Mobil into ExxonMobil reduced this number to five, and the 2001 absorption of Texaco by Chevron truncated it to four (the current situation).

Now, each bar in the chart shows the Petro‑Core’s differential rate of return on equity. This differential is computed in two steps: first, by subtracting the return on equity of the Fortune 500 group of companies from the return on equity of the Petro‑Core; and second, by expressing the resulting difference as a per cent of the Fortune 500’s return on equity. Positive readings (grey bars) indicate differential accumulation: they measure the extent to which the Petro‑Core beats the Fortune 500 average; negative readings (black bars) show differential decumulation: they tell us by how much the Petro‑Core trails this average.

Differential decumulation creates a ‘danger zone’ – i.e., a high likelihood of a new energy conflict erupting in the Middle East. The actual breakout of a conflict is marked by an explosion sign. The individual conflicts are listed in the note underneath the chart.

The Stylized Patterns

The figure shows three stylized patterns that have remained practically unchanged for the past half‑century.

First, and most importantly, every energy conflict save one was preceded by the Petro‑Core trailing the average. In other words, for a Middle East energy conflict to erupt, the leading oil companies first have to differentially decumulate.2 The only exception to this rule is the 2011 burst of the ‘Arab Spring’ and the subsequent blooming of ‘outsourced wars’ (our term for the ongoing fighting in Lebanon‑Syria‑Iraq, which is financed and supported by a multitude of governments and organizations in and outside the region). This round erupted without prior differential deccumulation – although the Petro‑Core was very close to falling below the average. In 2010, its differential return on equity dropped to a mere 3.3 per cent, down from 71.5 per cent in 2009 and a whopping 1,114 per cent in 2008.

Second, every energy conflict was followed by the oil companies beating the average. In other words, war and conflict in the region – processes that are customarily blamed for rattling, distorting and undermining the aggregate economy – have served the differential interest of the large oil companies at the expense of leading non‑oil firms.3

Third and finally, with one exception, in 1996‑97, the Petro‑Core never managed to beat the average without there first being an energy conflict in the region.4 In other words, the differential performance of the oil companies depended not on production, but on the most extreme form of sabotage: war.5

The Universal Logic

These stylized patterns appear almost too simple, not to say simplistic – particularly when compared to sophisticated explanations of Middle East wars. And maybe this is their beauty.

The experts on this subject – whether conservative or radical, Marxist or postist, materialist or culturalist, international relationsist or regional punditist – are undoubtedly right. The Middle East defies any simple logic – or at least that’s what the rulers want us to think. No determinism can account for its cultural subtleties, no structural theory can explain its multilayered conflicts, no Eurocentric text can decipher its poststructural discourses.

And yet, somehow, this kaleidoscope of complex specificities gets enfolded into the universal logic of modern capitalism: the differential accumulation of capital. In the Middle East, we have argued, this process revolves around oil profits:

Obviously, the flow of arms to the region [and its associated conflicts] is anchored not in one particular cause but in the convergence of many: internal tensions [such as those leading to the Arab Spring], inter‑state confrontations [for example, the 1980‑88 Iraq‑Iran War], conflicts between coalitions of countries [the first, second and third Gulf Wars], superpower intervention [a permanent feature], radical and anti‑radical ideologies [the 1979 Iranian revolution, ISIS, etc.], nationalism [the Palestinian intifadas], clericalism [Iran, Egypt, Afghanistan, etc.], economic turbulence and business cycles [the unsatiated capitalist thirst for ‘cheap energy’]…. Yet, one way or another, these processes can be seen as already engulfed by and absorbed into the massive flow of the biggest prize of all: oil profits.6

Our analysis of this process has focused on what we called the ‘Weapondollar‑Petrodollar Coalition’ – a formidable albeit tenuous alliance between the largest armament contractors, the integrated oil companies, OPEC and various branches of western governments:

The large oil companies and the leading arms makers both gained from Middle East ‘energy conflicts’ – the first through higher conflict premiums and the latter via larger military orders. But beyond this common interest the position of these groups differed in certain important respects…. Overall, ‘energy conflicts’ tended to boost arms exports both in the short‑run and long-run, and given that the weapon makers have had an open‑ended interest in such sales … their support for these conflicts should have been more or less unqualified. For the Petro‑Core, however, the calculations are probably more subtle…. [T]he effects on their profits of higher war‑premiums would be positive only up to a certain point. Furthermore, the outcome of regional conflicts is not entirely predictable and carries the inherent danger of undermining their intricate relations with host governments. For these reasons, we should expect the large oil companies to have a more qualified view on the desirability of open Middle‑East hostilities. Specifically, as long as their financial performance is deemed satisfactory, the Petro‑Core members would prefer the status quo of tension‑without-war. When their profits wither, however, the companies’ outlook is bound to become more hawkish, seeking to boost income via a conflict‑driven ‘energy crisis.’7

Unfortunately for most subjects of the Middle East – and for the vast majority of the world population – the empirical regularities of energy conflicts and differential profits we have teased out of this hypothesis remain as true today as they were in the early 1970s.

QED

Looking backward, these regularities helped us explain the history of the process till the late 1980s. Looking forward, they allowed us to predict, in writing and before the event, the 1990‑91 first Gulf War as well as the 2001 invasion of Afghanistan and the 2002 onset of the second Gulf War. 8

We have not predicted the recent spate of energy conflicts – but only because our research over the past decade has carried us away from the Middle East. The logic of our argument, though, remains intact. As Figure 1 shows, any researcher who would have updated our data could have predicted, ahead of time, the 2011 Arab Spring and its associated outsourced wars, as well as the 2014 third Gulf War against ISIS.

Of course, our Middle East story here is largely a fable, a way of making a bigger point. The region’s dramas – its conflicts and wars, its oil crises and inflicted scarcities, OPEC’s machinations and outside interventions, terrorism and nationalism, religion and culture – all have their own specific logic, or ‘narrative’. But the world we live in is dominated by capital, and the very essence capital is to harness, internalize and subjugate each and every power process, so that they all end up marching to its own universal drum beat: the differential accumulation of dominant capital.

Q E D.

- The figure appeared in Nitzan and Bichler (1995: 499). [↩]

- In the late 1970s and early 1980s, and again during the 2000s, differential decumulation was sometimes followed by a string of conflicts stretching over several years. In these instances, the result was a longer time lag between the initial spell of differential decumulation and some of the subsequent conflicts. [↩]

- It is important to note here that the energy conflicts have led not to higher oil profits as such, but to higher differential oil profits. For example, in 1969-70, 1975, 1980-82, 1985, 1991, 2001‑2, 2006-7, 2009 and 2012, the rate of return on equity of the Petro‑Core actually fell; but in all cases the fall was either slower than that of the Fortune 500 or too small to close the positive gap between them, so despite the decline, the Petro‑Core continued to beat the average. [↩]

- Although there was no official conflict in 1996-97, there was plenty of violence, including an Iraqi invasion of Kurdish areas and U.S. cruise missile attacks (‘Operation Desert Strike’). [↩]

- For the details underlying the individual energy conflicts, as well as a broader discussion of the entire process, see Bichler and Nitzan (1996), Nitzan and Bichler (2002: Ch. 5), Bichler and Nitzan (2004) and Nitzan and Bichler (2006). [↩]

- Nitzan, Jonathan, and Shimshon Bichler. 2007. War Profits, Peace Dividends. Hebrew. 2nd Expanded and Revised ed. Haifa: Pardes. [↩]

- Nitzan, Jonathan, and Shimshon Bichler. 1995. Bringing Capital Accumulation Back In: The Weapondollar-Petrodollar Coalition — Military Contractors, Oil Companies and Middle-East “Energy Conflicts“. Review of International Political Economy 2 (3): 446-515. [↩]

- See Bichler, Rowley and Nitzan (1989: Section 2.3) for a prediction of the first conflict and Bichler and Nitzan (1996: Section 8) for a prediction of the second. [↩]

0 0 4