Working Papers on Capital as Power, No. 2017/04, August 2017

Arms and Oil in the Middle East

A Biography of Research

Shimshon Bichler and Jonathan Nitzan [1]

Jerusalem and Montreal, August 2017

bnarchives.net / Creative Commons

![]()

1. The Weapondollar-Petrodollar Coalition

During the late 1980s, we printed a series of working papers, offering a new approach to the political economy of Israel and wars in the Middle East. [2] Our approach in these papers rested on three new concepts. It started by identifying the Weapondollar-Petrodollar Coalition – an alliance of armament firms, oil companies and financial institutions based mostly in the United States – whose interests, we posited, converged in the Middle East. [3] It continued by arguing that the interests of this coalition were best measured by its differential accumulation – i.e., by its performance relative to other large firms. And it concluded by showing that variations in differential accumulation predicted subsequent Middle East energy conflicts (our term).

At the time, the papers seemed unpublishable. They were politically unaligned (neither neoclassical nor Marxist). They were non-disciplinary (belonging to neither economics nor politics – or any other social science, for that matter). And they were written in non-academic language (i.e., simply, clearly and to the point). But they made a scientific prediction: the Middle East, they argued, was ripe for another round of military hostilities and oil crisis (Bichler, Rowley, and Nitzan 1989: Section 2.3). And when the 1990-91 Gulf War broke out, their theoretical framework suddenly sounded very relevant.

Now, prediction alone does not guarantee publication, certainly in the mainstream social sciences. But these were no ordinary times. With the fall of the Soviet Union, the end of the Cold War and the global victory of neoliberalism, the world of academic publishing began to change: talk of ‘capitalism’ and ‘accumulation’ was no longer politically incorrect; journals of critical political economy started sprouting everywhere; and enterprising editors, energized by the rekindled spirit of competition, hunted for new and different takes on a rapidly changing world.

One of these new journals was the Review of International Political Economy (RIPE). The referees who vetted our piece were clearly schizophrenic, finding it hard to decide whether it was innovative and path-breaking or faulty and unsubstantiated. But the RIPE editors decided to gamble, publishing our 124-page submission, as is, in a two-part paper series (Nitzan and Bichler 1995; Bichler and Nitzan 1996b). Moreover, despite the exceedingly long page count they agreed to include a data appendix with the articles’ raw financial time series.

2. The Unknown Facts

This last point merits elaboration. Good science depends on empirical evidence, and empirical evidence means more than findings and conclusions: it also requires authors to provide their raw data, discuss them and show that they indeed measure what they claim to. As students, though, we quickly realized that, in economics (and in the social sciences more generally), this requirement is rarely met. In practice, most economists do not engage in empirical analysis at all. The few who do empirical work seldom provide their data. And surprising as it may sound, many of the basic data they use – from ‘real GDP’, to ‘productivity’, to the ‘capital stock’ – bear little or no connection to their declared conceptual underpinnings (Leontief 1982, 1983; Nitzan 1989; Nitzan and Bichler 2009: Chs. 5-8).

Our reason for engaging with the data, though, went beyond mere formalities. When the subject at hand is hamstrung by rigid disciplinary boundaries, exploring new data can be highly generative. It exposes contradictions, casts doubt and calls for new categories, original ways of thinking and novel theories. In short, it is an act of creation.

To illustrate, take the study of oil. As it stands, the subject is crisscrossed with disciplinary barriers and boundaries: energy policies, the machinations of politicians and the activities of state officials are normally dealt with by international relations pundits; the causes and consequences of oil production, prices and trade are monopolized by macroeconomists; individual companies and sectors are handled by applied microeconomists and finance specialists; the interaction between oil, religion and ethnicity is dominated by experts of culture; etc. Every aspect of this subject seems tucked within its own protected niche, mediated by its own concepts and methods and dominated by its gatekeeping experts.

And the same holds true for the study of military spending and the arms trade. Here, too, the boundaries are clear: the interaction between armament, interstate conflict and the balance of power belongs to international relations specialists; the effect of armaments on overall trade, the balance of payments, employment and growth rates is the domain of economists; and the impact of armament on domestic bellicosity is the purview of political scientists and culturalists.

These boundaries can be very stifling, serving to safeguard the consensus, ward off challenges and prevent novelty – and it is precisely in such a context that new data can prove subversive. As we shall see in the next section, our own work uncovered a new, long-term correlation between the differential profitability of the Weapondollar-Petrodollar Coalition and the periodic eruption of Middle East energy conflicts. The data showed that, although every regional conflict has its own features, and although these features relate to various aspects of society and therefore to different social sciences, we can go beyond these particularities. Specifically, we can identify a general process than encompasses, molds and gradually shapes these otherwise unique conflicts, and we can show that this process belongs not to this or that narrow domain of society, but to the universalizing power logic of capitalism at large.

By predicting the historical ebb and flow of Middle East energy conflicts, differential profitability allows us to overstep the fractures separating international relations, economics, domestic politics and culture. And as these fractures become less relevant, so do the categories they enforce and the theories they impose.

Take the foundational concept of ‘scarcity’. Economists use it to explain, rationalize and justify the ways in which commodities are produced and priced. The larger the gap between our unlimited wants (demand) and limited means (supply), they argue, the greater the scarcity. The greater the scarcity, they continue, the higher the price on the one hand and the stronger the incentive to produce on the other. And since oil is a commodity like any other, they conclude, it follows that its production and pricing – just like the production and pricing of every other commodity – is driven by scarcity mediated by supply and demand.

Our own work, though, showed that this foundational concept is dubious, to put it politely. We demonstrated not only that the very notion of scarcity is circular and non-scientific, but also that, even if valid, its conventional measure bears no systematic relation to the production and pricing of oil (Nitzan and Bichler 1995: Figure 6, p. 489; Bichler and Nitzan 2015: Figure 1, p. 52). In addition, we showed that OPEC governments – which mainstream economic theory loves to blame for ‘intervening in’, ‘shocking’ and ‘distorting’ the otherwise ‘free market’ for oil – share the same pecuniary interests as the very oil companies they supposedly seek to undermine (Nitzan and Bichler 1995: Figure 5, p. 485; Bichler and Nitzan 2015: Figure 2, p. 58).

Now, conventional disciplinary experts can neither accept nor reject these claims, even tentatively. To accept them implies abandoning the framework of economics and indeed the very fracturing of society into separate disciplines. To refute them is even worse, since doing so opens a Pandora’s Box that might never close. The safest path, then, is to simply ignore the whole thing, hope it draws no attention and wait till it fizzles out and sinks into academic oblivion.

With so much going against it, it is no wonder that research like ours had never been done before. Very few researchers have ever bothered to trace and examine the historical profits, contracts and sales of the leading oil and armament firms over the past century, let alone relate them to the political economy of the Middle East. And since nobody had investigated this subject, when we started our research in the late 1980s these long-term time series simply did not exist. They had to be conceived, collated, analyzed, unified and standardized, pretty much from scratch.

And that wasn’t easy. First, there were theoretical issues. For example, what constitutes a ‘leading armament firm’ or a ‘dominant oil company’? How should they be ranked? How do we reconcile their various accounting methods, different reporting periods and numerous retroactive revisions? What is the meaning of ‘real’ military spending and arms exports (as opposed to their nominal dollar values)?

And then there were practical hurdles. Recall that these were the 1980s, before the internet, the World Wide Web and readily accessible databases. The ‘data points’ were scattered across different libraries around the world, buried in various print publications. They had to be located and requested via snail mail. When found, they were snail-mailed back via inter-library loans – sometimes in print, at others as photocopies or on microfiche. And when they arrived, they had to be collated, organized and inputted, one datum at a time, into user-unfriendly computer programs.

Given these difficulties and the amount of work needed to overcome them, we thought it was important to make our raw data freely available. We hoped that these data would enable other scientists to critically engage with and extend our work and were therefore delighted that RIPE shared this vision of open science and was willing to put in the extra pages.

3. Energy Conflicts and Differential Profit

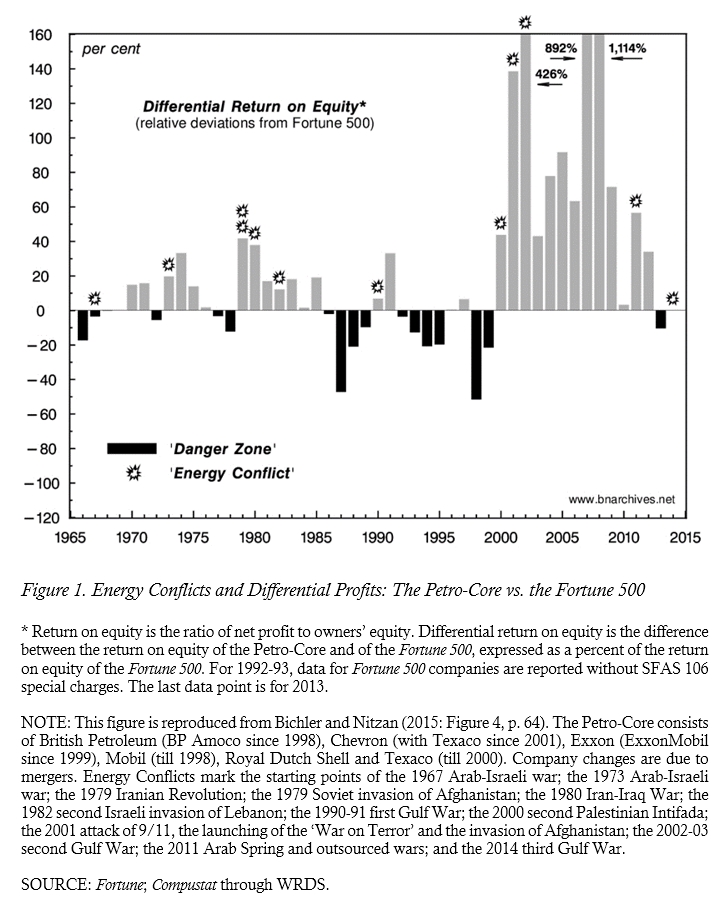

The historical link between energy conflicts and differential profits is demonstrated in Figure 1. [4] The chart shows the differential return on equity of the Petro-Core. This measure is computed in two steps: first, by subtracting the return on equity of the Fortune 500 group of companies from the return on equity of the Petro-Core; and second, by expressing the resulting difference as a percent of the Fortune 500’s return on equity. Positive readings (grey bars) indicate differential accumulation: they measure the extent to which the Petro-Core beats the Fortune 500 average. Negative readings (black bars) show differential decumulation: they tell us by how much the Petro-Core trails this average.

A stretch of differential decumulation constitutes a ‘danger zone’ – i.e., a period during which an energy conflict is likely to erupt in the Middle East. The actual breakout of a conflict is marked by an explosion sign. The individual conflicts are listed in the note underneath the chart (for a similar analysis that uses different data to show the same results, see Bichler and Nitzan 2015: 65-67).

The figure shows three stylized patterns that have remained practically unchanged for the past half century:

• First, and most importantly, every energy conflict save one was preceded by the Petro-Core trailing the average. In other words, for a Middle East energy conflict to erupt, the leading oil companies first have to differentially decumulate. [5] The only exception to this rule is the 2011 burst of the Arab Spring and the subsequent blooming of ‘outsourced wars’ (our term for the ongoing fighting in Lebanon, Syria and Iraq, which is financed and supported by a multitude of governments and organizations in and outside the region). This round erupted without prior differential decumulation – although the Petro-Core was very close to falling below the average. In 2010, its differential return on equity dropped to a mere 3.3 percent, down from 71.5 percent in 2009 and a whopping 1,114 percent in 2008.

• Second, every energy conflict was followed by the oil companies beating the average. In other words, war and conflict in the region – processes that are customarily blamed for rattling, distorting and undermining the aggregate economy – have served the differential interests of the large oil companies at the expense of leading non-oil firms. [6] This finding, although striking, should not surprise our reader: differential oil profits are intimately correlated with the relative price of oil (Bichler and Nitzan 2015: Figure 3, p. 60); the relative price of oil in turn is highly responsive to Middle East ‘risk’ perceptions, real or imaginary; these risk perceptions tend to jump in preparation for and during armed conflict; and as the risks mount, they raise the relative price of oil and therefore the differential accumulation of the oil companies.

• Third and finally, with one exception, in 1996-97, the Petro-Core never managed to beat the average without there first being an energy conflict in the region. [7] In other words, the differential performance of the oil companies depended not on production, but on the most extreme form of sabotage: war. [8]

As far as we know, this analysis is unique. No one has ever examined the relationships we portray here, let alone uncovered the patterns they reveal. And the reason is that, to the best of our knowledge, no one has ever raised the questions that led us to this analysis in the first place.

4. Politics and Economics

These questions first emerged in the early 1980s, when we were still university students. Israel was mired in a deep crisis, which started in the early 1970s and intensified after the 1977 political rise of the radical right. The crisis was marked by two seemingly unrelated phenomena: stagflation and militarization.

The stagflationary process combined decelerating growth and rising unemployment on the one hand with soaring inflation and a booming stock market on the other. In 1983, at the peak of this process, Israel’s one-year-old invasion of Lebanon appeared headed for a humiliating defeat, the economy stagnated and inflation hit 200 percent. The stock market, though, rigged by the large conglomerates, the finance ministry and the central bank (yes, by all three, in daily collusion) reached an all-time high. [9]

In this context, we found it striking to see Israeli academics insisting that politics and economics must be studied separately and independently. On the ‘political’ side, the country was becoming increasingly militarized and racialized. Labor governments have long maintained that Israel’s was an interstate conflict with its Arab neighbors. Menachem Begin’s new rightwing government, though, abandoned this façade. By embarking on an open policy of Jewish settlements and permanent military rule in the occupied Palestinian territories, by invading Lebanon with the stated intention of ‘cleansing’ it of ‘Palestinian terrorist organizations’ and by cementing the bond between the Rabbinate church, Israeli nationalism and Jewish racism, it exposed the true roots of the conflict: a foundational clash between the Zionist project and the indigenous Palestinian population.

The ‘economy’, though, continued to function as if none of this mattered – or so it seemed. For Israeli social scientists, the economic categories of supply, demand, equilibrium, productivity, the capital stock, output and prices – and therefore the actual economy they defined – remained self-contained. Politics, militarization, religion and racism of course counted, but only as ‘external shocks’ and ‘distortions’. Moreover, these shocks and distortions were remnants of an old statist legacy, and the good news was that, courtesy of the new ‘liberal’ government, they were finally on their way out.

The insistence on separating economics from politics produced strange bedfellows – for example, free-market economists leading Peace Now demonstrations. During the day, these economists worked in the service of capital, advising governments, consulting corporations and preaching the wonders of perfect competition and the evils of government intervention. At night, though, they marched the streets and gave speeches, calling on their government to end the occupation and give the Palestinians their own state. And for most observers, this marriage looked natural. In their minds, Israel’s occupation of the Palestinian territories and its statist economy were offspring of the same original sin: Socialist Zionism. Relieving Zionism from socialism, they argued, would liberate both the Palestinians and the market in one fell swoop.

This context helped keep the country’s social sciences, founded during the Cold War, highly conservative. They dismissed Marxism as irrelevant to the Israeli case, discouraged broad criticisms and penalized innovative dissent. Most of their academics were mainstream, and even those who saw themselves as radical and socialist rarely allowed their ‘political beliefs’ to affect their ‘professional research’. Between the late 1970s and the late 1980s – the dark years of the Begin-Peres-Shamir regime – you could not find a single paper written by an Israeli academic in a heterodox international journal (let alone a paper that used radical methods and theories).

5. Military Spending and Inflation

So, when we started to study Israel’s political economy, our theoretical framework had to come from elsewhere. Now, as noted, our focus was the twin processes of militarization and stagflation, and at the time this focus seemed congruent with ‘macro-Marxist’ theories that emerged in the United States during the 1960s Vietnam War and gained traction during the 1970s stagflation crisis. The most relevant of these theories, we thought, was the Monopoly Capital thesis, broadly associated with the works of Kalecki (1971, 1972), Huberman (1936), Tsuru (1956), Steindl (1945, 1952, 1979), Baran and Sweezy (1966), Magdoff (1969, 1972), Braverman (1974) and Magdoff and Sweezy (1983), among others.

The thesis posited that that the monopoly stage of capitalism is characterized by a growing divergence between falling costs and rising prices. This divergence, it continued, generates a tendency for the surplus to rise, on the one hand, while limiting the system’s inherent ability to ‘offset’ or ‘absorb’ this surplus, on the other. And these conflicting processes, it concluded, serve to alter the nature of the state.

During the competitive capitalism of Marx’s time, argued the theory’s advocates, growth was led by private investment; and since taxation was imposed mostly on profit and therefore reduced the amount available for investment, the state was expected to stick to a laissez faire policy of limited intervention and a minimal tax footprint. The monopoly phase, though, shifted the emphasis. The growth of large firms made capitalism hyper productive, which meant that the key challenge now was not how to produce more surplus (supply), but how to realize it (demand). And this is where ‘state intervention’ became crucial.

In principle, the state can expand the economy’s aggregate demand in a variety of ways: it can spend on civilian items such as low-cost housing, education, R&D, health and infrastructure (welfare); it can increase its military budget (warfare); or it can engage in some combination of the two. In practice, though, its options are more limited. Big business and the leading capitalists loathe facing government competition in civilian markets. They also dread losing their commanding heights – and therefore the ideological supremacy of private investment – to public management of the economy. And given these objections, the only way left for a capitalist government to avoid stagnation is through what David Gold (1977) called ‘military Keynesianism’ – a bellicose form of demand management led by a ‘Keynesian Coalition’ of big business and large unions that shun peaceful civilian spending in favor of armaments and an aggressive foreign policy.

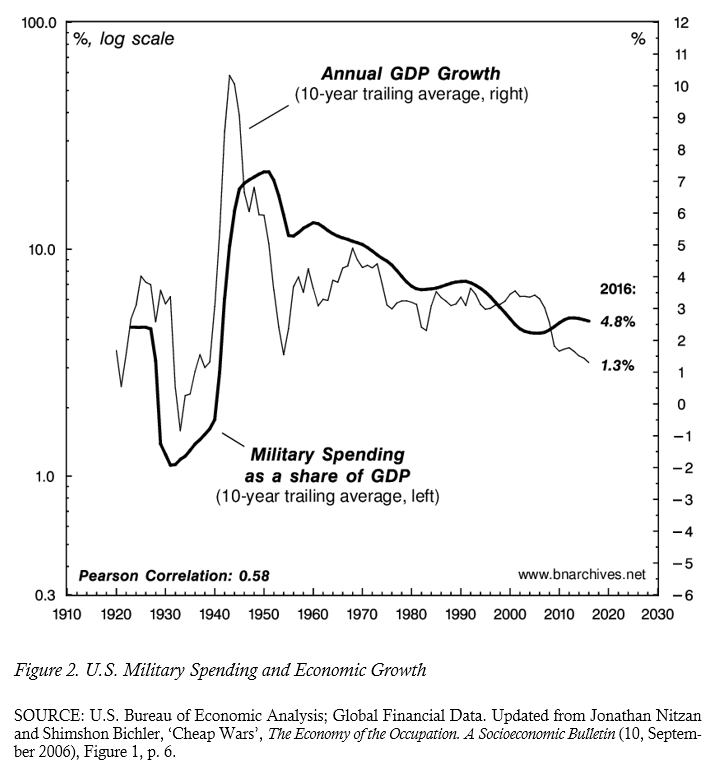

Figure 2 contextualizes this new order of monopoly capitalism. The graph shows the century-long relationship between U.S. economic growth and the country’s military spending. The thin line plots the annual rate of economic growth against the right scale. The thick line shows the level of military spending, expressed as a share of GDP, against the left logarithmic scale. Both series are smoothed as a 10-year trailing average to emphasize their long-term tendencies.

The data show the close co-movement of the two series (Pearson correlation coefficient of +0.58). After the First World War, disarmament went hand in hand with falling growth – but this situation proved temporary. In the 1930s, the tide inverted: military spending soared in preparation for the Second World War and the economy boomed. After the war, when demobilization coincided with a sharp drop in growth, the U.S. National Security Council suggested that, looking forward, the government consider keeping military expenditures permanently high as a way of avoiding another depression (United States 1950). The subsequent adoption of Military Keynesianism, along with the wars in Korea and Vietnam, helped achieve that goal. During the 1960s, 1970s and 1980s, military expenditures remained over 10 percent of GDP and economic growth above 4 percent – lower than during the Second World War, but rapid enough to sustain the buoyancy of American capitalism and the confidence of its capitalists. By the early 1990s, though, the Cold War had ended, and with neoliberal ‘peace dividends’ undermining military budgets, economic growth decelerated sharply: in the decade ending in 2016, growth fell to a mere 1.3 percent, a level last seen in the 1930s.

On the face of it, the logic behind this correlation was highly pertinent to Israel of the 1980s, where rapid business concentration and soaring inflation, on the one hand, appeared to have been ‘offset’ by rising military budgets, massive spending on settlements and bloating religious institutions and organizations, on the other. The only thing left to do was to test this relationship empirically – only that this testing proved easier said than done.

6. Mapping Israel’s Dominant Capital

The main problem was that Israeli scholars – including those on the left – had never bothered to map their country’s unfolding capitalist structures, class relations and power dynamics. The most neglected subject was the corporate core – i.e., the largest holding groups and their intricate relations with the state. In our view, any investigation of a modern capitalist policy must begin with this core – yet in Israel of the early 1980s, nobody knew the basic historical facts about it. Even the most rudimentary financial time series – the core’s total assets, net profit, sales and owners’ equity – were unavailable.

In fact, even the raw data – i.e., the companies’ annual financial reports – could not be found in any one location. The most obvious depositories – the Central Bureau of Statistics, the Bank of Israel, the Ministry of Finance and the Office of the Tax Comptroller – had only disorganized fragments. The National Library – which according to Israeli law must be given two copies of every print publication – had no more than a limited sample. And when we checked with the companies themselves, we learned that they too had only a few specimens – and these were their own financial reports!

So, all in all, nobody cared – not the forward-looking companies for whom the past was irrelevant; not the statisticians whose job was to assemble the historical facts; and not the researchers and theorists who were supposed to analyze them. The net result was that the financial history of these firms – and, by extension, their political-economic significance – was largely unknown. For lay persons, these firms seemed everywhere; for the pundits, they were nowhere.

And so we decided to fill the void. We labored for months, excavating, deciphering and organizing the obscure facts. And since these were the mid-1980s, before the internet and readily accessible computerized data, everything had to be done manually. We had to go from office to office, from library to library, from archive to archive. We had to collate, photocopy and, when necessary, hand-copy the individual printed reports wherever we found them. And we had to read the numerous footnotes and extensive small print to reconcile endless inconsistencies and numerous revisions (particularly those associated with hyperinflation ‘adjustments’ and retroactive ‘restatements’). Eventually, we managed to assemble a rudimentary, albeit historically complete, statistical picture of what we subsequently called Israel’s dominant capital (Bichler 1986; Nitzan 1986; Rowley, Bichler, and Nitzan 1988; Bichler 1991). And it was only then, when we started analyzing this entity, that we finally realized why everyone was trying to keep it safely in the statistical shadows.

7. From Breadth to Depth: Accumulating Through Crisis

Our analysis indicated that, until the mid-1960s, the structure of the Israeli market had been rather dispersed, at least by subsequent standards (Nitzan and Bichler 2002: Ch. 3). This structure, formed during the British Mandate era, consisted of three distinct sectors. The dividing lines were primarily ‘political’: the largest and most important sector was the government’s; the second largest was the Histadrut’s (confederation of labor unions); and the third was private. Since greenfield investment was almost entirely financed by unilateral capital inflows, and since these inflows were allocated almost exclusively by the government, the economy was considered ‘statist’.

The leading corporations and economic organizations, often in collaboration with politically connected families and foreign investors, acted as de-facto agents of the state, abiding by its macro and micro priorities. In return, they were invited to invest in and trade with government-sanctioned projects, were awarded state subsidies and exclusive licenses, enjoyed multiple protections against foreign and domestic competition and participated in looting the properties abandoned by and confiscated from the 1948 Palestinians refugees.

In retrospect, we can say that the state during those years acted as a sheltering ‘cocoon’, incubating the future business organizations and institutions that would eventually become the core of Israel’s political economy. The 1966-67 recession helped shed this cocoon. Following a massive wave of mergers and privatization, the old ‘political’ sectors disintegrated, replaced by dominant capital: a small cluster of giant holding groups surrounded by big monopolies and large investors that gradually took over the commanding heights of Israeli society and eventually transformed it into a full-fledged capitalist mode of power.

As part of this transformation, the government – particularly after the 1977 rise of the radical right – altered its domestic and foreign stance. Domestically, it adopted a laissez faire rhetoric of deregulation and privatization, gradually withdrawing from its former role of directing and determining greenfield investment. In terms of foreign policy, though, it pursued a proactive, bellicose line, menacing neighboring countries and primarily the Palestinians. This double movement helped alter the focus of accumulation: instead of the rapid employment and GDP growth that had marked the previous regime (‘external breadth’ in our terminology), the emphasis shifted to income redistribution via rising military spending and stagflation (‘external depth’).

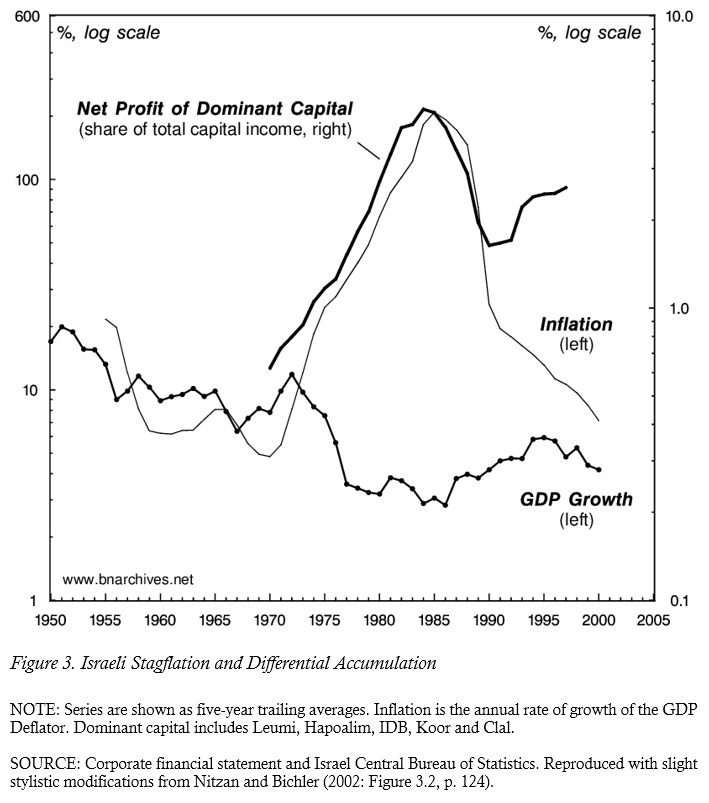

And so began the gilded age of Israel’s militarized capitalism (Nitzan and Bichler 2002: Ch. 4). The gist of this period is illustrated in Figure 3. The chart shows two sets of series, both smoothed as five-year trailing averages. The left log scale denotes the rates of GDP growth and inflation, while the right log scale indicates the differential profits of the top five holding groups (computed by the share of their net earnings in total capital income).

As we can see, until the mid-1960s, when the Israeli market was still relatively dispersed, growth was very high (~ 10 percent) and inflation relatively low by subsequent standards (~ 8 percent). By the late 1960s, though, the rise of dominant capital had triggered a radical change. GDP growth plummeted, reaching less than 3 percent in the mid-1980s, while inflation, instead of falling as mainstream economics would have predicted, soared to over 200 percent. This stagflation was a boon for dominant capital. As the figure shows, its differential earnings benefited massively and disproportionately relative to the rest of the business sector, soaring eightfold to 5 percent in the mid-1980s, up from 0.6 percent in 1970. This bonanza, though, ended in the late 1980s, when the global rise of neoliberalism introduced a totally new regime of accumulation, forcing small bellicose countries such as Israel and South Africa to radically transform their mode of power, open up to foreign takeovers and scale back their militarized structures (Nitzan and Bichler 2001; Bichler and Nitzan 2007).

8. The Gatekeepers

Nowadays, these observations may seem less controversial. But when they were first made in our Master’s and Doctoral theses, they elicited stiff academic opposition. Nitzan’s MA thesis, submitted to the Department of Economics at McGill University, was failed by its external referee. Titled Holding Groups and the Israeli Economy (Nitzan 1986), the thesis demonstrated the close connection between various macroeconomic phenomena such as inflation, stagnation, military spending and the public debt on the one hand, and the differential consolidation of Israel’s dominant capital on the other. The external referee – an orthodox agricultural economist and a devout Zionist – found the application of ‘Marxist’ theories to Israel both redundant and appalling: redundant because whatever needed explaining was already properly explained by mainstream economics, and appalling because Israel was a special case of a nation under siege and therefore exempt from such application to start with. [10] It cost Nitzan two years of legal wrangling, grievances, appeals and lost reputation to have her report jettisoned and the thesis accepted. The research itself later got published in Science & Society (Nitzan and Bichler 2000).

Similarly with Bichler’s work. His PhD dissertation, titled The Political Economy of Military Spending in Israel (Bichler 1991), was submitted to the Department of Political Science at the Hebrew University. The thesis examined the connection between military spending and the rise of Israel’s dominant capital. The research, based partly on Kalecki’s framework, bifurcated the business sector into two segments – dominant capital and ‘the rest’ – showing, among other things, that military expenditures operated to redistribute income in favor of the former group, while civilian spending worked in favor of the latter.

The thesis’ committee members had never heard of Kalecki and were therefore indifferent to his radical model being applied to Israel. They were flabbergasted, though, by Bichler’s unpatriotic econometrics. His empirics demonstrated that Israel’s wars might have served and even depended on the profits of its large corporate groups, and this possibility was impossible for them to contemplate.

The dissertation was sent to an external referee with an explicit instruction to fail it – only that here, unlike in Nitzan’s case, the referee refused to cooperate and informed Bichler of the plot. The committee, though, was unfazed and approved the thesis only after Bichler deleted the offensive econometric chapter. Our attempts to publish this research in mainstream journals were repeatedly rejected on equally embarrassing pretexts. The only journal that seriously considered and eventually published it was the Review of Radical Political Economics (Bichler and Nitzan 1996a).

9. The CasP Triangle: Capitalized Power, Dominant Capital and Differential Accumulation

As noted, our early research was heavily influenced by Marxism, particularly the neo-Marxist version of Monopoly Capital. [11] Yet, from the very beginning, we sensed that something in this framework was seriously lacking. Our initial plan was simply to ‘follow the surplus’. We naively thought that, by tracing the various realizations of this surplus – from military spending and the settlements to religious institutions and financial intermediation – we would be able to narrate the development of Israeli capitalism and model its gyrations. But as we delved into the actual research, we realized that the basic categories (surplus, capital accumulation, rate of profit, etc.) and the dualities in which they were embedded (economics-politics, real-financial, productive-speculative, actual-fictitious) were difficult if not impossible to concretize and measure. Seeking solutions, we delved into Marxist debates on these subjects, but they discouraged us even further.

The problem, we concluded, was that the neo-Marxist revisions of Marx’s value theory did not go far enough. Instead of placing power at the center of analysis, they treated it as an addendum, a separate sphere that merely complements the key ‘economic’ entities of capitalism. And that path, we thought, was leading to a dead end (for a concise summary of these difficulties, see Bichler and Nitzan 2012).

To analyze contemporary capitalism, we argued, requires a fundamental rethinking of capital itself. First, we posited that accumulation is neither a utilitarian process distorted by power (the neoclassical version) nor a productive process assisted by power (the Marxist view), but rather a power process quantified as capitalization.

Second, we argued that, with power at the center of analysis, the macro-Marxist notion of ‘capital in general’ becomes insufficient and potentially misleading. Instead, we need to differentiate various forms of capital, and we need to do so based on relative power. This requirement led us to the notion of dominant capital – the idea that the capitalist mode of power is dominated by a core of leading corporate groups and state institutions, and that it is the inner and outer alliances and conflicts of this core that stir the historical development of capitalism as a whole.

And third, we claimed that the shifts from utility and labor to power, on the one hand, and from general capital to dominant capital, on the other, called for a new building bloc. The conventional view of capital is economic and therefore absolute. Wedded to production and consumption, capital in this view is counted in stand-alone units, be they neoclassical ‘utils’ or Marxist ‘SNALT’ (socially necessary abstract labor time). But if we think of capital in terms of power, we must also change our elementary particle: we need to think not of absolute accumulation, but of differential accumulation.

10. From Israel to the Middle East

And as we came to realize, the significance of this CasP triangle – i.e., capitalized power, dominant capital and differential accumulation – goes beyond Israel. Many Middle East analysts, both mainstream and radical, continue to see the region’s conflicts as imperial in nature, related, first and foremost, to securing Western access to cheap oil. But as Figure 1 in Section 3 shows, using the CasP triangle, the underlying logic of these conflicts can be explained very differently.

The chart analyzes the history of these conflicts not in relation to the level of oil production or the rate of Western economic growth, but to the differential profit of the dominant oil companies. As noted earlier in the paper, over the past half-century, the differential profit of these firms as well as the relative earnings of oil-producing countries (OPEC and non-OPEC) have come to depend not on the volume of oil being produced and sold, but on its relative price; and this relative price hinges not on the ‘scarcity’ of oil, but on the mayhem and fear created by Middle East energy conflicts.

The predictive power of this framework has been remarkably robust, at least until recently. To reiterate, according Figure 1, every energy conflict save one was preceded by the leading oil companies trailing the average (differentially decumulating); every energy conflict was followed by the oil companies beating the average (differentially accumulating); and with one exception, these companies never managed to beat the average in the absence of a prior or concurrent energy conflict. Clearly, accumulation here represents and manifests not productivity and utility, but power and violence.

11. Still About Oil?

Is this framework still valid today? Technically, the answer is yes and no. On the one hand, the differential profits of the oil companies and the revenues of the oil-producing countries remain tightly correlated with the relative price of oil: over the past decade or so, both have plummeted in tandem. So this side of the theory still works. On the other hand, the synchronized decline of prices and earnings has occurred despite ongoing regional conflict and plenty of violence. On this count, the theory seems inconsistent with recent events.

Is this partial breakdown a sign of things to come? Will the differential profits of the Weapondollar-Petrodollar Coalition continue to stir Blood and Oil in the Orient, as Essad Bey (1932) poetically called it – or are we witnessing the end of an era?

In our view, the answer to this question will depend crucially on the conflict within the global ruling class. The potential significance of such intra-class conflicts was illustrated during the 1960s by Michael Kalecki. In his articles ‘The Fascism of Our Times’ (Kalecki 1964) and ‘Vietnam and U.S. Big Business’ (Kalecki 1967), Kalecki forecast that continued U.S. involvement in Vietnam would increase the dichotomy between the ‘old’, largely civilian business groups located mainly on the East Coast, and the ‘new’ militarized business groups, primarily the arms contractors of the West Coast. The rise in military budgets, he anticipated, would force a redistribution of income from the old to the new groups. The ‘angry elements’ within the U.S. ruling class would then be significantly strengthened, pushing for a more aggressive foreign policy and further propagating what Melman would later call the ‘permanent war economy’ (Melman 1974).

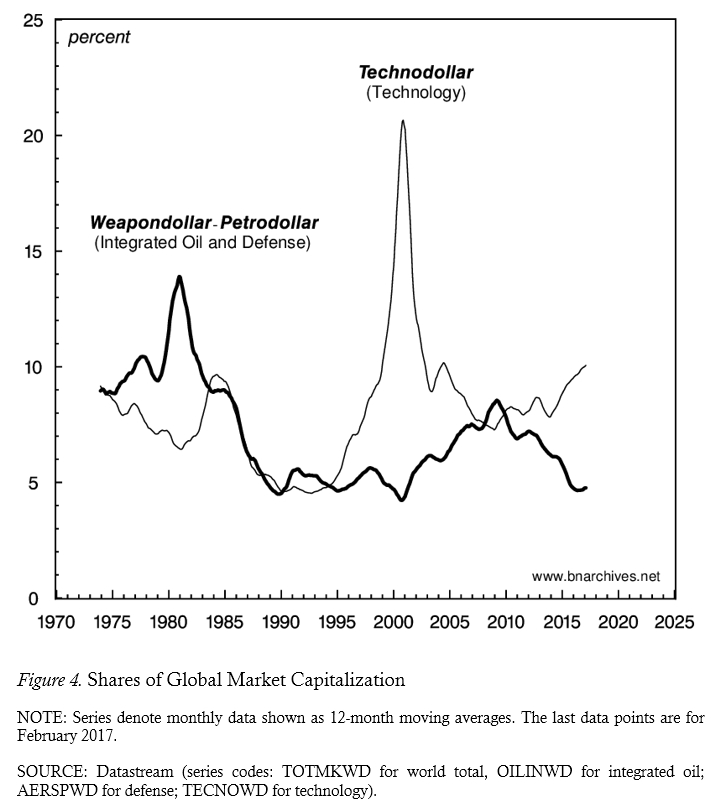

Is there a similar intra-class conflict affecting the ebb and flow of Middle East wars? To contextualize this question, consider Figure 4, which juxtaposes two global coalitions: the Weapondollar-Petrodollar cluster, made up of listed integrated oil and defense corporations, and the Technodollar Coalition, comprising listed technology firms, both hardware and software. Each series measures the market capitalization of the relevant coalition, expressed as a percent share of the global market capitalization of all listed firms. [12]

The figure shows a clear inverse relationship: since the mid-1970s, the global market capitalization shares of two coalitions have moved in opposite directions (with only a brief exception in 1985-90). Now, since relative capitalization hinges on differential profit expectations and risk assessments, and since these expectations reflect the broader trajectories of the global political economy, we can say that there is an inherent conflict between these two coalitions: conditions that favour one coalition undermine the other, and vice versa.

The significance of this structural conflict is best assessed in historical retrospect. The classical imperialism of the early twentieth century was spearheaded by the leading oil companies, whose activities dominated and often dictated the foreign policies of the old powers. After the First World War, these companies helped draft various regional agreements – from Sykes-Picot (1916), San Remo (1920) and Cairo (1921) to Red Line (1928) and Achnacarry (1928) – carving and shaping the Middle East in line with their own interests. During that period, their main concern was the ‘free flow’ of oil – i.e., political stability, open access to oil at low prices and minimal royalties to the region’s rulers.

This free-flow era ended in the late 1960s and early 1970s. The demise of colonialism undermined the oil companies’ former autonomy. Instead of calling the shots, they now had to negotiate and align with oil-producing oligarchies, elements in their own parent governments and armed forces, and other corporate coalitions, particularly in armament and finance. The centre of this complex network was the Weapondollar-Petrodollar Coalition. Unlike during the free-flow era, their interest now lay in limiting the flow of oil. The main purpose was to raise the price of oil so as to boost oil incomes and augment military spending and arms exports into the region. And that goal was best served by a divide-and-conquer strategy that kept the Middle East embroiled in a never-ending string of managed energy conflicts, stoked the Cold War and the arms race and pushed the world into reoccurring stagflation crises.

In the 1990s, the capitalist mode of power was again transformed. First, the end of the Cold War accentuated the gradual decline of the United States and the former Soviet Union relative the former periphery, particularly in Asia. Second, the ongoing global wave of corporate mergers and acquisitions gave rise to a new and highly complex power hierarchy of giant transnational corporations whose activities, although deeply embedded in state structures, gradually work to undermine the very notion of ‘state sovereignty’. Third, the pivotal political-economic role of oil has been challenged by the threats of peak oil and climate change, the development of renewable alternatives and, most importantly, the emergence of new power hierarchies built not on raw materials, but information – hence the Technodollar Coalition.

The rise of this new, information-based power is illustrated in Figure 4. Between 1990 and 2000, the global market capitalization of the Weapondollar-Petrodollar Coalition continued its long-term slide, hitting a record low of 4 percent of the total in 2000, down from 14 percent in 1980. By contrast, the market capitalization of the Technodollar Coalition more than quadrupled – rising to 21 percent of the total in 2000, up from a mere 5 percent in 1990.

In the early 2000s, the Weapondollar-Petrodollar Coalition embarked on a last-ditch attempt to resurrect its capitalized power, pushing the U.S. White House toward yet another Gulf War. And for a while, the effort succeeded: the Technodollar Coalition’s market capitalization dropped to a mere 7 percent of the total – the experts called it a ‘burst bubble’ – while the Weapondollar-Petrodollar Coalition’s share doubled to 8 percent.

This comeback, though, was partial and short-lived. In 2010, with the Middle East still in flames and the analysts predicting the imminent arrival of peak oil, the price of oil started to plummet. And as the plunge continued, the market capitalization of the Weapondollar-Petrodollar Coalition again fell below 5 percent of the total, while that of the Technodollar Coalition resumed its uptrend.

The new Trump administration, populated by key oil, armament and finance representatives and seemingly hostile to the high-technology sector, may try to revive the fading fortunes of the Weapondollar-Petrodollar Coalition once again. But over the longer haul, this fight might prove difficult to win. Unlike in the 1970s and 1980s, U.S. governments can no longer easily instigate, let alone manage, Middle East energy conflicts, particularly against opposition from the ascending Technodollar Coalition. And if this prognosis turns out to be correct, the Middle East might witness yet another significant transformation.

The Israeli occupation of the Palestinian territories, the oppression of Arab populations by military and religious theocracies and the global spread of Saudi Wahhabism and terrorism haven’t happened in a vacuum. Over the past half-century, these activities aligned with and were in turn supported by the Weapondollar-Petrodollar Coalition. And if the power of this coalition continues to slide, that slide might spell the demise of Israel’s occupation of Palestine and a major shakeup of many of the region’s oligarchies.

Endnotes

[1] Shimshon Bichler teaches political economy at colleges and universities in Israel. Jonathan Nitzan teaches political economy at York University in Canada. All of their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net). Research for this paper was partly supported by the SSHRC. The article is licenced under Creative Commons (Attribution-NonCommercial-NoDerivs 4.0 International).

[2] Rowley, Bichler and Nitzan (1988); Bichler, Nitzan and Rowley (1989); Nitzan, Rowley and Bichler (1989); Rowley, Bichler and Nitzan (1989); Bichler, Rowley, Nitzan (1989).

[3] Our original term was the Armadollar-Petrodollar Coalition. A journal referee, though, later opined that the term ‘armadollar’ sounded too much like armadillo, so we reluctantly replaced it with the duller-yet-safer ‘weapondollar’.

[4] The figure was first published in Nitzan and Bichler (1995: Figure 10b, p. 499) and most recently updated in Bichler and Nitzan (2015: Figure 4, p. 64). An earlier, non-differential precursor of this chart is given in Rowley, Bichler and Nitzan (1989: 26, Figure 8).

[5] In the late 1970s and early 1980s, and again during the 2000s, differential decumulation was sometimes followed by a string of conflicts stretching over several years. In these instances, the result was a longer time lag between the initial spell of differential decumulation and some of the subsequent conflicts.

[6] It is important to note here that the energy conflicts have led not to higher oil profits as such, but to higher differential oil profits. For example, in 1969-70, 1975, 1980-82, 1985, 1991, 2001‑02, 2006-07, 2009 and 2012, the rate of return on equity of the Petro‑Core actually fell; but in all cases the fall was either slower than that of the Fortune 500 or too small to close the positive gap between them, so despite the decline, the Petro‑Core continued to beat the average.

[7] Although there was no official conflict in 1996-97, there was plenty of violence, including an Iraqi invasion of Kurdish areas and U.S. cruise missile attacks (‘Operation Desert Strike’).

[8] For the details underlying the individual energy conflicts, as well as a broader discussion of the entire process, see Bichler and Nitzan (1996b), Nitzan and Bichler (2002: Ch. 5), Bichler and Nitzan (2004) and Nitzan and Bichler (2006).

[9] The rigging of the stock market was reluctantly and only partially investigated by the Bejsky Commission (Bejsky et al. 1986). See also Nitzan and Bichler (2002: 119).

[10] She was also enraged by many of the unpleasant facts cited in the thesis. For example, she didn’t like Nitzan’s reference to the 700,000 Palestinian refugees produced by the 1948 War, a number she believed to be grossly inflated. She also disliked some of Nitzan’s sources – for example, Israel’s most important investigative weekly, Ha’olam Hazhe, which, in her view, was a yellow newspaper.

[11] Since the 1980s, ‘neo-Marxism’ has been broadened to include various cultural theories associated with writers such as Gramsci, Foucault, Leotard and Jameson. In this paper, we use neo-Marxism much more narrowly to denote scientific attempts to revise and adapt Marx’s value analysis to the new age of monopoly capitalism.

[12] A similar chart, focusing only on the United States, is given in Nitzan and Bichler (2002: Figure 5.9, p. 272).

References

Bichler, Shimshon, and Jonathan Nitzan. 1996a. Military Spending and Differential Accumulation: A New Approach to the Political Economy of Armament -- The Case of Israel. Review of Radical Political Economics 28 (1): 51-95.

Bichler, Shimshon, and Jonathan Nitzan. 1996b. Putting the State In Its Place: US Foreign Policy and Differential Accumulation in Middle-East "Energy Conflicts". Review of International Political Economy 3 (4): 608-661.

Bichler, Shimshon, and Jonathan Nitzan. 2004. Dominant Capital and the New Wars. Journal of World-Systems Research 10 (2, August): 255-327.

Bichler, Shimshon, and Jonathan Nitzan. 2007. Israel's Roaring Economy. Global Research, July 6.

Bichler, Shimshon, and Jonathan Nitzan. 2012. Capital as Power: Toward a New Cosmology of Capitalism. Real-World Economics Review (61, September): 65-84.

Bichler, Shimshon, and Jonathan Nitzan. 2015. Still About Oil? Real-World Economics Review (70, February): 49-79.

Bichler, Shimshon, Jonathan Nitzan, and Robin Rowley. 1989. The Political Economy of Armaments. Working Paper 7/89, Department of Economics, McGill University, Montreal, pp. 1-34.

Bichler, Shimshon, Robin Rowley, and Jonathan Nitzan. 1989. The Armadollar-Petrodollar Coalition: Demise or New Order? Working Paper 11/89, Department of Economics, McGill University, Montreal, pp. 1-63.

Gold, David A. 1977. The Rise and Fall of the Keynesian Coalition. Kapitalistate 6 (1): 129-161.

Leontief, Wassily. 1982. Academic Economics. Science (New Series) 217 (4555, July 9): 104, 107.

Nitzan, Jonathan. 1989. Price and Quantity Measurements: Theoretical Biases in Empirical Procedures. Working Paper 14/1989, Department of Economics, McGill University, Montreal, pp. 1-24.

Nitzan, Jonathan, and Shimshon Bichler. 1995. Bringing Capital Accumulation Back In: The Weapondollar-Petrodollar Coalition -- Military Contractors, Oil Companies and Middle-East "Energy Conflicts". Review of International Political Economy 2 (3): 446-515.

Nitzan, Jonathan, and Shimshon Bichler. 2000. Inflation and Accumulation: The Case of Israel. Science & Society 64 (3): 274-309.

Nitzan, Jonathan, and Shimshon Bichler. 2001. Going Global: Differential Accumulation and the Great U-turn in South Africa and Israel. Review of Radical Political Economics 33: 21-55.

Nitzan, Jonathan, and Shimshon Bichler. 2002. The Global Political Economy of Israel. London: Pluto Press.

Nitzan, Jonathan, and Shimshon Bichler. 2006. New Imperialism or New Capitalism? Review XXIX (1, April): 1-86.

Nitzan, Jonathan, and Shimshon Bichler. 2009. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Nitzan, Jonathan, Robin Rowley, and Shimshon Bichler. 1989. Changing Fortunes: Armaments and the U.S. Economy. Working Paper 8/89, Department of Economics, McGill University, Montreal, pp. 1-27.

Rowley, Robin, Shimshon Bichler, and Jonathan Nitzan. 1988. Some Aspects of Aggregate Concentration in the Israeli Economy, 1964-1986. Working Paper 7/88, Department of Economics, McGill University, Montreal, pp. 1-64.

Rowley, Robin, Shimshon Bichler, and Jonathan Nitzan. 1989. The Armadollar-Petrodollar Coalition and the Middle East. Working Paper 10/89, Department of Economics, McGill University, Montreal, pp. 1-54.