Research Note

Can Capitalists Afford Recovery? A 2018 Update

Shimshon Bichler and Jonathan Nitzan [1]

Jerusalem and Montreal, October 2018

![]() bnarchives.net / Creative

Commons (CC BY-NC-ND 4.0)

bnarchives.net / Creative

Commons (CC BY-NC-ND 4.0)

In our work, we’ve argued that, contrary to the conventional creed, capitalists dislike recovery. Their main driving force, we’ve claimed, is not the absolute level of their income, but its distributive share, and this later emphasis has far-reaching implication. Whereas the absolute level of capitalist income correlates with the absolute level of economic activity, the distributive share of that income depends on capitalist power. And in the United States – and this is the key point here – the power of capitalists relative to the underlying population depends crucially on the sabotage inflicted by unemployment. Since unemployment is inversly related to growth, it follows that capitalists cannot really afford recovery, particularly a prolonged one.

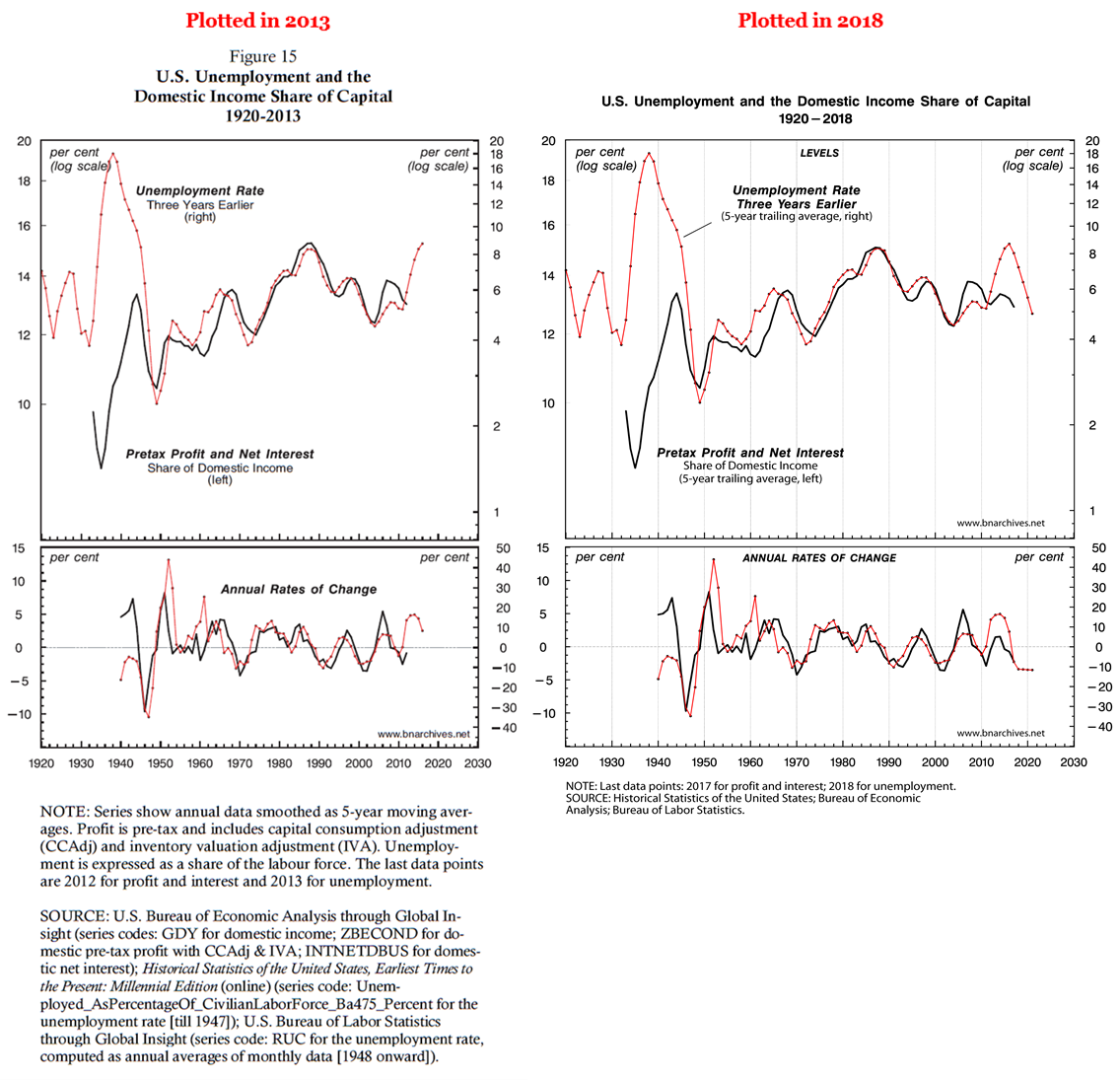

This claim is illustrated by the left figure, taken from our paper ‘Can Capitalists Afford Recovery’ (Bichler and Nitzan 2013; Nitzan and Bichler 2014a). The chart shows the overall share of capital in domestic income along with the rate of unemployment. The top panel displays the levels of the two variables, both smoothed as 5-year moving averages. The solid line, plotted against the left log scale, shows pretax profit and net interest as a percent of domestic income. The dotted line, plotted against the right log scale, shows the rate of unemployment three years earlier. The bottom panel shows the annual rates of change of the two top variables since 1940.

A Leading Indicator

The data show unemployment to be a highly reliable leading indicator for the capitalist share of domestic income, for both levels and rates of change. In general, the higher the level (or rate of change) of unemployment, the greater the share of capital in domestic income (or its rate of change), and vice versa.

Based on this long-term relationship, we wrote in 2014 that, ‘Looking forward, capitalists have reason to remain crisis-happy: with the rate of unemployment again approaching post-war highs, their income share has more room to rise in the years ahead’ (Nitzan and Bichler 2014b).

And that is indeed what happened. According to the up-to-date figure on the right, in 2013, the share of capital in domestic income started to rise (top panel) while its growth rate accelerated (bottom panel). But the ascent didn’t last long. Unemployment had peaked, and as it started its prolonged decline, the capitalist income share as well as its rate of change headed south.

The Coming CasP Crisis

Looking forward, the prognosis for capitalists seems negative. Over the last few years, unemployment has fallen sharply, and if the predictive power of our chart remains intact, the capitalist income-share-read-power is bound to contract further, raising the ante for a prolonged accumulation crisis. Eventually, though, capitalists are likely the resolve their CasP crisis, as they have done repeatedly for nearly a century, by offloading it onto the underlying population in the form of rising unemployment.

Endnotes

[1] Shimshon Bichler teaches political economy at colleges and universities in Israel. Jonathan Nitzan teaches political economy at York University in Canada. All of their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net). Research for this paper was partly supported by the SSHRC. The article is licenced under Creative Commons (Attribution-NonCommercial-NoDerivs 4.0 International).

References

Bichler, Shimshon, and Jonathan Nitzan. 2013. Can Capitalists Afford Recovery? Economic Policy When Capital is Power. Working Papers on Capital as Power (2013/01, October): 1-36.

Nitzan, Jonathan, and Shimshon Bichler. 2014a. Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis. Review of Capital as Power 1 (1): 110-155.

Nitzan, Jonathan, and Shimshon Bichler. 2014b. Profit from Crisis: Why Capitalists Do Not Want Recovery, and What That Means for America. Real-World Economics Review Blog, April 30.