Research Note

Still in the Danger Zone

Shimshon Bichler and Jonathan Nitzan

Jerusalem and Montreal, January 2020

![]() bnarchives.net / Creative

Commons (CC BY-NC-ND 4.0)

bnarchives.net / Creative

Commons (CC BY-NC-ND 4.0)

In December 2017, we posted a RWERB entry, titled ‘Profit warning: there will be blood’. We warned that, although the Weapondollar-Petrodollar Coalition might no longer be in the Middle East driver’s seat, the oil and armament companies, the region’s oil-exporting autocracies and various non-state groups were all keen on seeing their oil incomes rise from record lows. And we observed that, in this context, ‘the prospects of a new energy conflict, whether premeditated or coincidental, seem extremely high’.

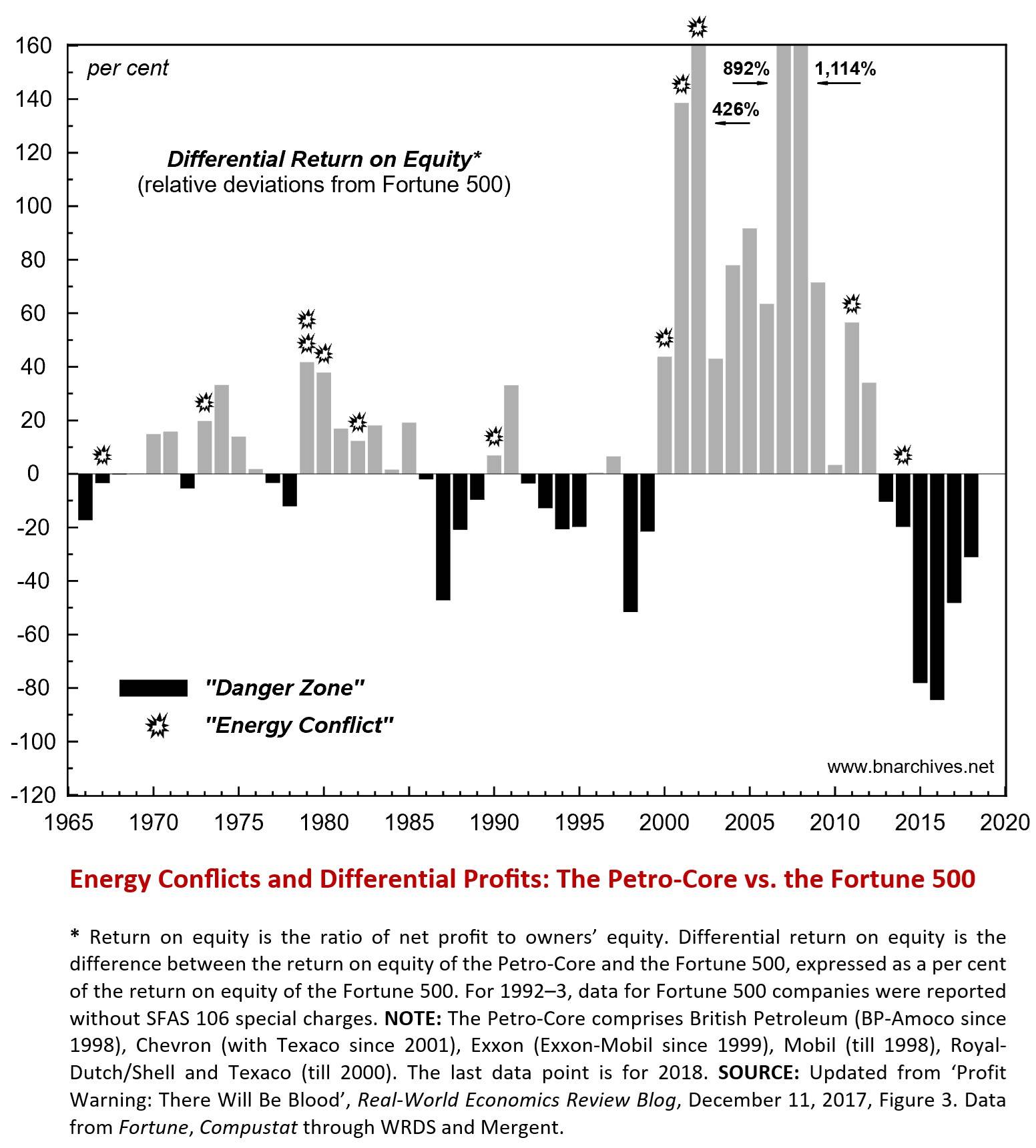

The above chart, which is updated from Figure 3 in our original 2017 article, shows the differential return on equity of the Petro-Core (the leading publicly-traded oil companies) relative to the Fortune 500: when the bars are grey, the Petro-Core beats the average (having a higher return on equity than the Fortune 500); when the bars are black, it trails the average (showing lower returns than the Fortune 500). These latter periods denote ‘danger zones’, indicating that the region is ripe for a new energy conflict. The actual eruption of such conflicts is marked by an explosion sign. The figure demonstrates three important regularities:

1. Every energy conflict save one was preceded by the Petro-Core trailing the average. In other words, for a Middle East energy conflict to erupt, the large oil companies first have to differentially decumulate (trail the average). The sole exception to this rule was the 2011 burst of the Arab Spring and the subsequent blooming of ‘outsourced wars’.

2. Until 2014, every energy conflict was followed by the oil companies beating the average. The reason is that differential oil profits are intimately correlated with the relative price of oil (compared to the overall price level); the relative price of oil in turn is highly responsive to Middle East risk perceptions, real or imaginary; these risk perceptions tend to jump in preparation for and during armed conflict; and as risks mount, they raise the relative price of oil and boost the differential returns of the oil companies.

3. With one exception, in 1996-97, the Petro-Core never managed to beat the average without a regional energy conflict. In other words, the differential performance of the oil companies depended not on production, but on the most extreme form of sabotage: war.

Given these regularities, we observed that the experience since 2015 was exceptional:

In line with the first regularity, the danger zone that opened up in 2013 was dully followed by the 2014 onset of the so-called third Gulf War. But then, for the first time in half a century, the first regularity was not followed by the second. Despite the ongoing hostilities – in Syria, Iraq and Yemen, among other places – and notwithstanding mounting regional instabilities hastened by dwindling petroleum export revenues, oil prices have plummeted, and the oil companies continue to trail the average. Moreover – and ominously – the magnitudes of the price drops and differential losses are unprecedented.

We can only hope that the current round of Middle East hostilities won’t be proportional to the size of its current danger zone.

***

The original 2017 RWERB entry: https://rwer.wordpress.com/2017/12/11/profit-warning-there-will-be-blood/