Working Papers on Capital as Power, No. 2020/06, December 2020

The Limits of Capitalized Power: A 2020 U.S. Update

Shimshon Bichler and Jonathan Nitzan [1]

Jerusalem and Montreal, December 2020

bnarchives.net / Creative Commons (CC BY-NC-ND 4.0)

1. The Two Sides of Power

Until the late 2000s, our work focused primarily on why capitalism should be understood as a mode of power. We argued that capital itself is a form of organized power and researched how capitalists sustain, defend and augment their capitalized power. We called our approach ‘capital as power’ – or CasP, for short. [2]

But that’s only one side of the picture. Power is never unbounded. It is always resisted, opposed and constrained by those on whom it is imposed. And so, in the early 2010s, we started to examine more closely the limits of capitalized power and of the capitalist mode of power more generally. We called this research ‘the asymptotes of power’. In this paper, we revisit and update some of our work on these asymptotes in the United States and think about what they might mean for the future. [3]

2. Capital as Power

For those unfamiliar with ‘capital as power’ or in need of a refresher, this section outlines the CasP basics. From the viewpoint of capital, accumulation is all about power. According to CasP, capitalist power, exerted against opposition, is both a means and an end. It is a lever that capitalists use to creorder – or create the order of – their world, and it is the end goal that their creordering seeks to achieve.

Accumulation, we argue, has nothing to do with what economists call ‘real capital’. It has no direct relationship to the amalgam of machines, structures and technical knowhow, nor is it related to their presumed ‘productivity’. [4] According to CasP, capital is finance and only finance. It exists not as backward-looking stuff, but as forward-looking capitalization – the discounted present value of expected, risk-adjusted future earnings. And that’s it. Accumulation is the increase of this forward-looking magnitude.

Let’s unzip this seemingly complicated definition. As we see it, capitalization comprises four basic determinants, or ‘elementary particles’: (1) the future earnings that owners will actually receive; (2) the owners’ current hype about those future earnings (i.e., the excessive optimism/pessimism of their earning expectations); (3) the owners’ perceived risk (the way in which they quantify their uncertainty about the pattern of future earnings); and (4) the normal rate of return (the rate that owners expect to earn on ‘riskless’ investment). For the symbolically inclined, we can express this determination as

where ![]() is capitalization (measured

in money terms),

is capitalization (measured

in money terms), ![]() is a perpetually even

flow of future hearings (also in money terms),

is a perpetually even

flow of future hearings (also in money terms), ![]() is hype (decimal),

is hype (decimal), ![]() is risk (decimal) and

is risk (decimal) and ![]() is the normal rate of

return (decimal). [5]

is the normal rate of

return (decimal). [5]

Each of these elementary particles,

we argue – be it ![]() ,

, ![]() ,

, ![]() , or

, or ![]() – represents

power and only power. And since the elementary particles are all about power,

so is the capitalization

– represents

power and only power. And since the elementary particles are all about power,

so is the capitalization ![]() to

which they give rise. In other words, when we look at capitalization, we look

at distilled capitalized power.

to

which they give rise. In other words, when we look at capitalization, we look

at distilled capitalized power.

But that’s just the first step. The mere knowledge that Alphabet is capitalized at $1.2 trillion or that Jeff Bezos is ‘worth’ $190 billion tells us nothing about their capitalized power. To assess this power, we need to measure it not absolutely, but relatively.

And that should not surprise us. Following Johannes Kepler, physicists see force as a quantitative relationship. [6] And in our view, the same applies to the capitalized power of Alphabet and Jeff Bezos – or any other capitalist person or organization, for that matter.

Capitalized power is not a standalone entity like thunder, god, king or government. Instead, it is a relationship between and among social entities – namely, individuals, groups and organizations. Furthermore, capitalized power is not a mere assemblage of qualitatively different relations of power. Instead, it is the reduction of all these qualitatively different relationships to one universal quantity.

According to CasP – and here is the crucial point – capitalized power, understood as a quantitative relationship, is always differential. It is meaningful only relative to some benchmark. And that is exactly how modern-day capitalists see it.

Economists tell us that capitalists seek to ‘maximize’ their profit and net worth. Yet actual capitalists – be they individuals like Jeff Bezos or organizations like Alphabet – do no such thing. Their goal is not to get as much income and assets as they can, but to get more than others do. They attempt not to maximize, but to outperform. They try to climb up the list of the richest and biggest, to have their profits and assets rise faster than the average, to gain more than their rivals. Their obsession isn’t absolute accumulation, but differential accumulation.

From this viewpoint, the key ritual

of capitalism is the constant attempt by capitalists and capitalist

organizations to augment their differential

capitalization ![]() – i.e., to increase

the ratio between their own capitalization and the capitalization of the

‘benchmark’ they seek to beat. In practice, there are numerous possible

benchmarks – the capitalization of other capitalists, of other corporations, of

other groups of capitalists or corporations, etc. – but regardless of the

specific choice, in the capitalist mode of power there is always a referential

yardstick that capitalists feel compelled to outperform.

– i.e., to increase

the ratio between their own capitalization and the capitalization of the

‘benchmark’ they seek to beat. In practice, there are numerous possible

benchmarks – the capitalization of other capitalists, of other corporations, of

other groups of capitalists or corporations, etc. – but regardless of the

specific choice, in the capitalist mode of power there is always a referential

yardstick that capitalists feel compelled to outperform.

Equation 2 describes

this key ritual by showing, on the left-hand side, the differential

capitalization ![]() of a given

capitalized entity measured relative to a particular benchmark, and connecting

this differential capitalization to its differential determinants on the

right-hand side – namely, to the entity’s differential future earnings

of a given

capitalized entity measured relative to a particular benchmark, and connecting

this differential capitalization to its differential determinants on the

right-hand side – namely, to the entity’s differential future earnings ![]() ,

differential hype

,

differential hype ![]() and

differential risk

and

differential risk ![]() (all of

which are pure numbers expressing the entity’s own value relative to the

corresponding value of the benchmark). Note that as long as the normal rate of

return

(all of

which are pure numbers expressing the entity’s own value relative to the

corresponding value of the benchmark). Note that as long as the normal rate of

return ![]() is the

same for the capitalized entity and its benchmark, the differential normal rate

of return is equal to 1 and drops out:

is the

same for the capitalized entity and its benchmark, the differential normal rate

of return is equal to 1 and drops out:

In other words, capitalists see accumulation as a process of distribution and redistribution – and nothing else. And not that they have much leeway in this matter. Capitalists who forgo differentials for absolutes quickly find themselves absorbed by other capitalists or left behind on the capitalist side-lines. The capitalist mode of power forces them to accumulate differentially or perish capitalistically.

3. Strategic Sabotage

The crucial difference between absolute and differential returns is that the former can be augmented only by increasing one’s own return, while the latter can also be attained by reducing or limiting the returns of others. And this is where the exercise of power comes in.

The differential accumulation of capitalized power is achieved by imposing – or threatening to impose – various restrictions, barriers and sanctions. American social thinker Thorstein Veblen called these impositions ‘strategic sabotage’. [7] Sabotage must be strategic because the relationship between sabotage and power is almost always nonlinear: too little sabotage is ineffective – but so is too much. In fact, too much sabotage can seriously harm capitalists – particularly when its elicits excessive resistance and doubly so when it sprawls out of control. [8] Bottom line: in order to maintain and increase their distributional power, capitalists must constantly calibrate their sabotage. They have to be strategic about it, to keep it in a Goldilocks range, neither too cold nor too warm.

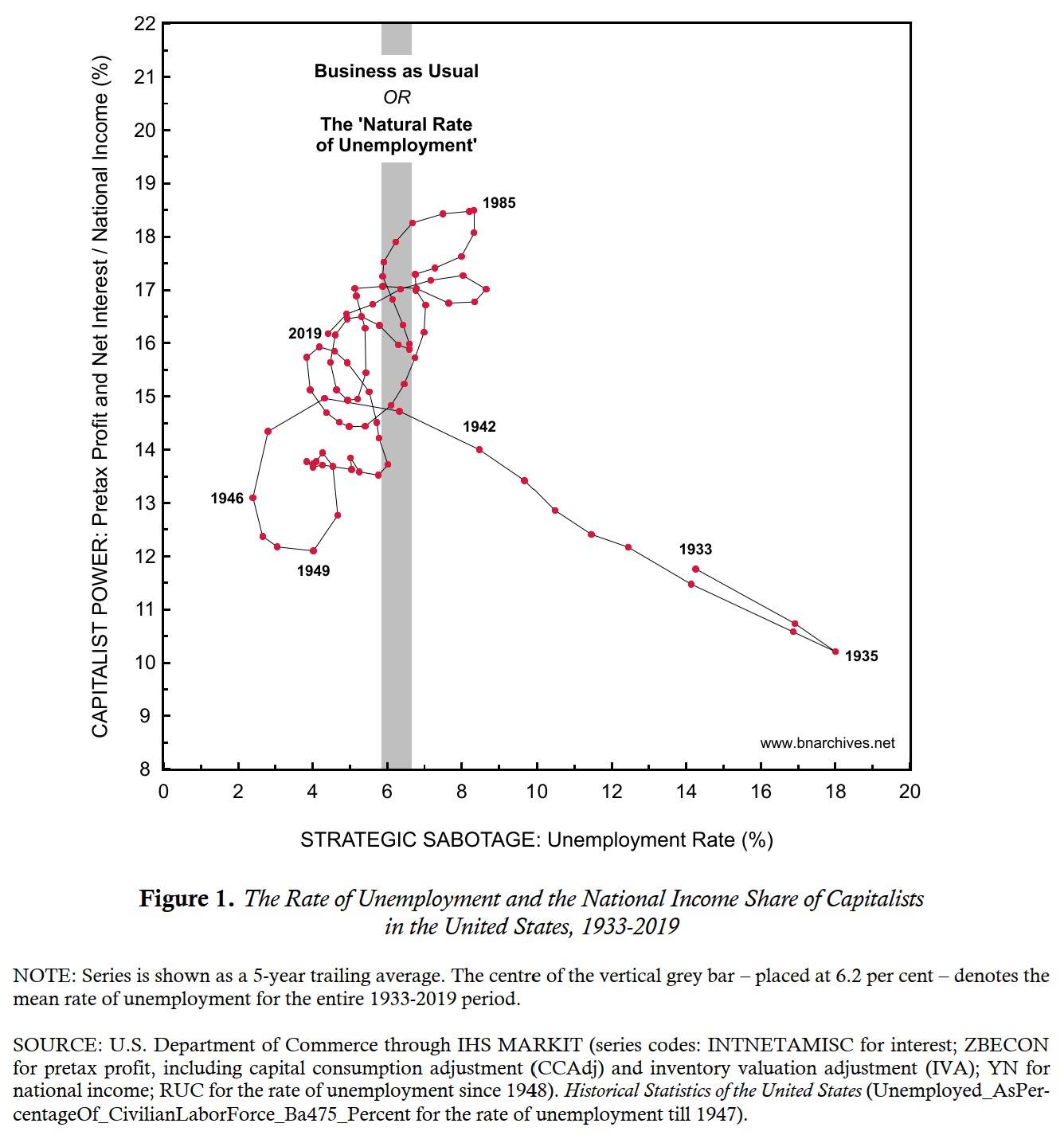

And that is what we see in Figure 1. [9] The chart portrays a key aspect of the relationship between capitalist power and strategic sabotage in the United States. The vertical axis indicates the extent of capitalist power, proxied here by the national income share of capitalists (pretax profit and net interest). The horizontal axis shows the extent of sabotage imposed on the underlying population via unemployment. The data are smoothed as 5-year trailing averages, so when we project a specific annual observation onto the vertical and horizontal axes, we get the mean value of each variable over the previous five years.

The first feature jumping out the page is nonlinearity. To see it, start from the Great Depression at the bottom righthand side of the graph and move forward in time. During the early 1930s, unemployment was very high and the capitalist share of national income very low. In other words, sabotage proved excessive not only for the underlying population, but also for capitalists. Eventually, though, the depression receded, and as sabotage declined and unemployment dropped (moving leftward on the chart), the power-read-national-income share of capitalists began to rise (moving up on the chart). So during this period, the relationship between sabotage and capitalist power was negative: the higher/lower the sabotage, the lower/higher the power of capitalists.

But shortly after the United States joined the Second World War, the relationship inverted. With the country mobilized to the teeth – almost half the GDP went to the military, and practically anyone who wanted a job could get one – the rate of unemployment continued to drop, falling to historical lows (further movement to the left of the chart). Yet, this time, the capitalist share of national income, instead of rising with less sabotage, actually declined, reaching a depression-like low in 1949. In other words, unlike before, capitalist power and strategic sabotage were now positively correlated: the higher/lower the sabotage, the greater/lesser the power of capitalists. And that is how the relationship has stayed ever since.

Now, most economists, heterodox included, focus on absolutes rather than differentials and are therefore unaware of or simply ignore this inversion. Take the brilliant neo-Marxist economist Michal Kalecki. During the Second World War, Kalecki predicted that although liberal governments had learnt how to achieve full employment, they would never agree to actually sustaining it. [10] And why not? Because if the government can ensure that everyone who wants to work can do so – and can do so indefinitely – who needs the capitalists? In this sense, ongoing full employment, although good for the absolute levels of wages and profits, undermines the societal primacy of capitalists. And since this primacy is something that no liberal government will ever dare to endanger, ongoing full employment, although spelling higher profits for capitalists, is out of the question. [11]

Now, it is true that Kalecki expressed this opinion before the inversion in Figure 1 became apparent. But in our view, his very logic here is misguided. And it is misguided because, like most economists, he misjudges the principal driving force of capitalists. Unlike workers, capitalists seek not wellbeing, but power. [12] This quest for power explains why they are interested not in absolute but relative earnings. And as policymakers shift their focus from absolute capitalist income to its distributive share of the total, their policy dilemma disappears.

In this differential context, policymakers no longer have to choose between promoting the ideological legitimacy of capitalists and increasing their down-to-earth earnings. Instead, they can achieve both goals – and in one fell swoop. All they need to do is keep unemployment in the neither-too-high-nor-too-low Goldilocks range. Doing so will bolster the belief that society needs capitalists because they ‘provide jobs’, as well as ensure that their share of national income remains high.

4. Business as Usual and the ‘Natural Rate of Unemployment’

And this view seems consistent with Figure 1. After the war, large U.S. firms accelerated their own corporate amalgamation and integrated more closely with government organs and policymakers. Emboldened by the efficacy of Keynesian policy and the tacit collaboration of the large labour unions, they managed, or so it seems, to calibrate the country’s welfare-warfare policies so that the unemployment rate oscillated between 4 and 9 per cent, keeping the capitalist share of national income between 13 and 19 per cent. Strategic sabotage and capitalist power seemed to go hand in hand.

This regularity gave rise to a new eco-lingo. In 1968, Milton Friedman informed his colleagues that there exists a ‘natural rate of unemployment’ – a rate, he said, that reflects the various distortions and imperfections buried underneath a country’s Walrasian general equilibrium. [13] Of course, nobody – not even Friedman – has ever managed to objectively identify this general equilibrium, and therefore no one, Friedman included, has been able to pin down its associated natural rate of unemployment.

But this inability has never been a problem. In general, economists seem perfectly happy with unobservable concepts, including utility, factor productivity, ‘real’ consumption and production, supply, demand and equilibrium. In fact, their entire so-called science is built on such intractable constructs. In this context, adding the natural rate of unemployment to their already large battery of unobservable tools was business as usual – particularly since most economists seem convinced that this invisible rate indeed exists. [14]

So, for argument’s sake, let’s join the laity and equate the U.S.’s natural rate of unemployment with its long-term average – which, during the period of 1933-2019, stood at 6.2 per cent. This average-read-natural rate, marked by vertical grey bar in the chart, is a very useful business-as-usual benchmark. For capitalists, it marks the anchor of their Goldilocks range of strategic sabotage – not too warm, not too cold. It is the rate that keeps their national income share high enough without stirring anti-capitalist resistance and creating undue systemic risk.

Based on this analysis, though, U.S. capitalists seem to have experienced some setbacks of late. As Figure 1 shows, their best period was the early 1980s. In the five years ending in 1985, the rate of unemployment averaged 8.3 per cent, while the capitalist income share associated with this strategic sabotage averaged 18.5 per cent – an all-time high. But that was the peak. Since then, the trajectory has pointed down.

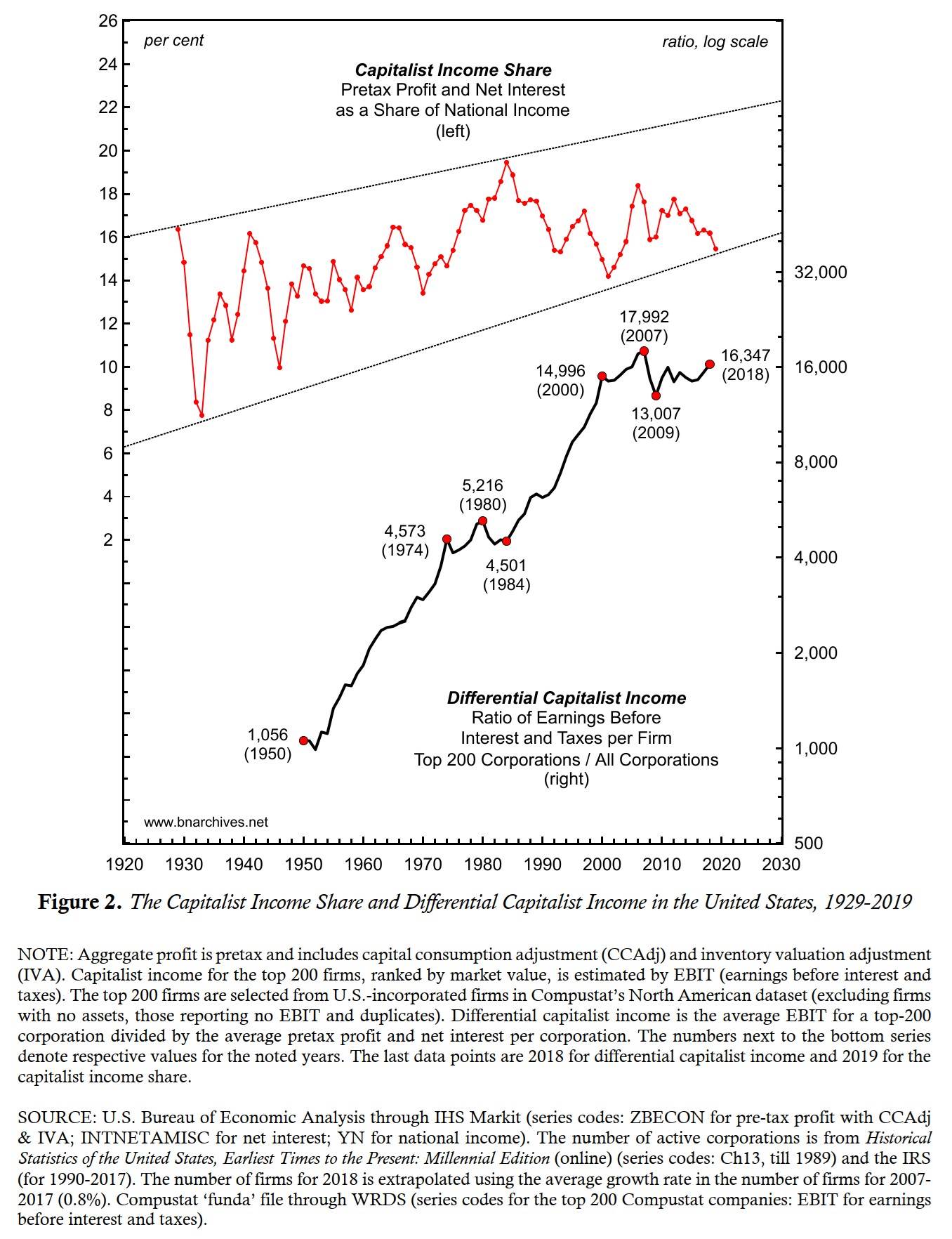

The purely temporal picture is shown more clearly in Figure 2. The top series, plotted against the left scale, depicts the national income share of capitalists – pretax profit and net interest – as it has evolved since 1929 (note that, unlike in Figure 1, here the data are unsmoothed). The overall trend is unmistakably positive, as is the narrowing range of variations. But within this overall pattern, we can see that, since the mid 1980s, capitalist power, measured by the national income share of capitalists, has receded.

5. Dominant Capital

This recent lull in capitalist power

is mirrored by the bottom series in Figure

2. Recall that, according to CasP, capitalists are driven to

accumulate differentially – that is, to increase their capitalized assets relative to the assets of others (![]() in Equation 2). Now, as it turns out,

over the longer haul, the most important driver of differential accumulation is

differential earnings

in Equation 2). Now, as it turns out,

over the longer haul, the most important driver of differential accumulation is

differential earnings ![]() , which is

what we emphasize in Figure 2. [15]

, which is

what we emphasize in Figure 2. [15]

The top series in the chart examines differential earnings with respect to capital in the aggregate. It shows the ability of all capitalists, taken as a group, to increase their earnings relative to society at large. The bottom series does a similar thing with respect to the leading corporations in society, or what we call dominant capital. In this series, we define dominant capital as the top 200 U.S.-incorporated firms in the North American Compustat dataset, ranked annually by market value, and compare their average earnings to the average earnings of a U.S. corporation.

The two series are similar in that both focus on the same capitalist flow – namely, pretax profit and net interest. But they differ in two important respects. First, whereas the top series looks at capitalists as persons, the bottom one examines the corporate organizations they own. Second, while the top series measures the distribution between entire groups – in this case, capitalists versus the whole of society – the bottom one shows the ratio between typical units – in this case, between the average dominant capital corporation and the average corporation in society.

Empirically, these differences yield radically different orders of magnitude. The overall income share of capitalists in society ranges between 7 per cent in 1933 and 19 per cent in 1984. By contrast, the income size of a typical dominant capital corporation relative to the average corporation ranges from less than 1,000 in 1952 to nearly 18,000 in 2007 (to facilitate visual analysis, we plot this series against a log scale).

Our bottom measure of differential capitalist earnings has grown exponentially. From 1950 to 2018, it rose at a compounded average annual rate of 4.1 per cent. But this average increase has been interrupted, twice – first in 1974-1984, and then in 2000-2018. In both periods, the differential index, instead of growing, moved sideways. And the question is why.

6. Stagflation and Corporate Amalgamation

As we have seen in Figure 1, the overall national income share of U.S. capitalists is determined, at least in part, by the sabotage of unemployment. We should note, though, that this income share is also affected by inflation, which since the 1950s has tended to redistribute income from employees to capitalists. [16] Adherents of mainstream economics might find this latter claim surprising – primarily because, according to their theory, and in the absence of ‘supply shocks’, inflation is supposed to go together not with unemployment, but with growth. The actual data, though, tell a very different story. They show that, in most countries – and certainly in the United States – the relationship between growth and inflation is not positive, but negative. In other words, inflation tends to come not with growth, but with stagnation and unemployment. It appears not as ‘growthflation’, but as ‘stagflation’. [17] And in most cases, it is this very combination that helps redistribute income from employees to capitalists: stagnation weakens workers’ bargaining power versus capitalists and therefore restrains their wage demands, while higher inflation helps channel their foregone income to capitalists.

Interestingly, stagflation also helps redistribute income from small to large firms – although here its impact is usually secondary. In our research we found that the distribution of income among firms is affected by two key factors. [18] The first is stagflation, which, in the United States, tends to redistribute profit not only from employees to capitalists, but also from small to large firms. [19] But, as noted, this impact is mostly cyclical and short-term in nature and tends to recede when stagflation eases.

The second and more important factor, particularly in the longer term, is corporate amalgamation through mergers and acquisitions. And the reason is twofold. (1) Corporate amalgamation creates larger and larger firms that percolate up to the very top of the size distribution of corporations, while having little or no effect on most other firms. Also, newly created corporations are almost always small, so their rapid birth rate helps keeps the average corporation small (according to the IRS, the number of U.S. corporations has risen from 350,000 in the early twentieth century to nearly 6.5 million today). (2) Unlike the cyclical and largely ephemeral effect of stagflation, the distributive impact of mergers and acquisitions is cumulative. Corporate amalgams created by mergers and takeovers rarely unbundle – and even when they do, the spinoffs are usually swallowed by other large companies.

Taken together, these two reasons mean that the bottom series of differential corporate income in Figure 2 should grow and abate with the ups and downs of mergers and acquisitions. And it does. The two main lulls in this series – in 1974-1984 and 2000-2018 – coincide with two significant drops that punctured the merger and acquisition uptrend since 1950. [20]

7. The Asymptotes

As we have seen, U.S. capital seems to be facing a differential setback, or at least a long pause. Taken as a group, U.S. capitalists have watched their distributive share of national income trend downward since the mid-1980s, while the country’s top 200 dominant capital groups have been unable to beat the capitalist income growth of the average firm for nearly a generation.

Is this setback a mere historical breather? Should we expect U.S. capitalists to intensify their strategic sabotage once again in their quest for a higher national income share? Are large firms ready to resume their merger and acquisition binge so that they can again beat the average as they did during much of the second half of the twentieth century?

In our view, the answer is yes. According to CasP, the quest for capitalized power – and for more of it – is the principal driving force of capitalism, so as long as the capitalist mode of power prevails, this driver is here to stay. However, as we shall argue below, the impact of this quest on both the distributive share of capitalists and the differential earnings of dominant capital is likely to become more limited in the years ahead.

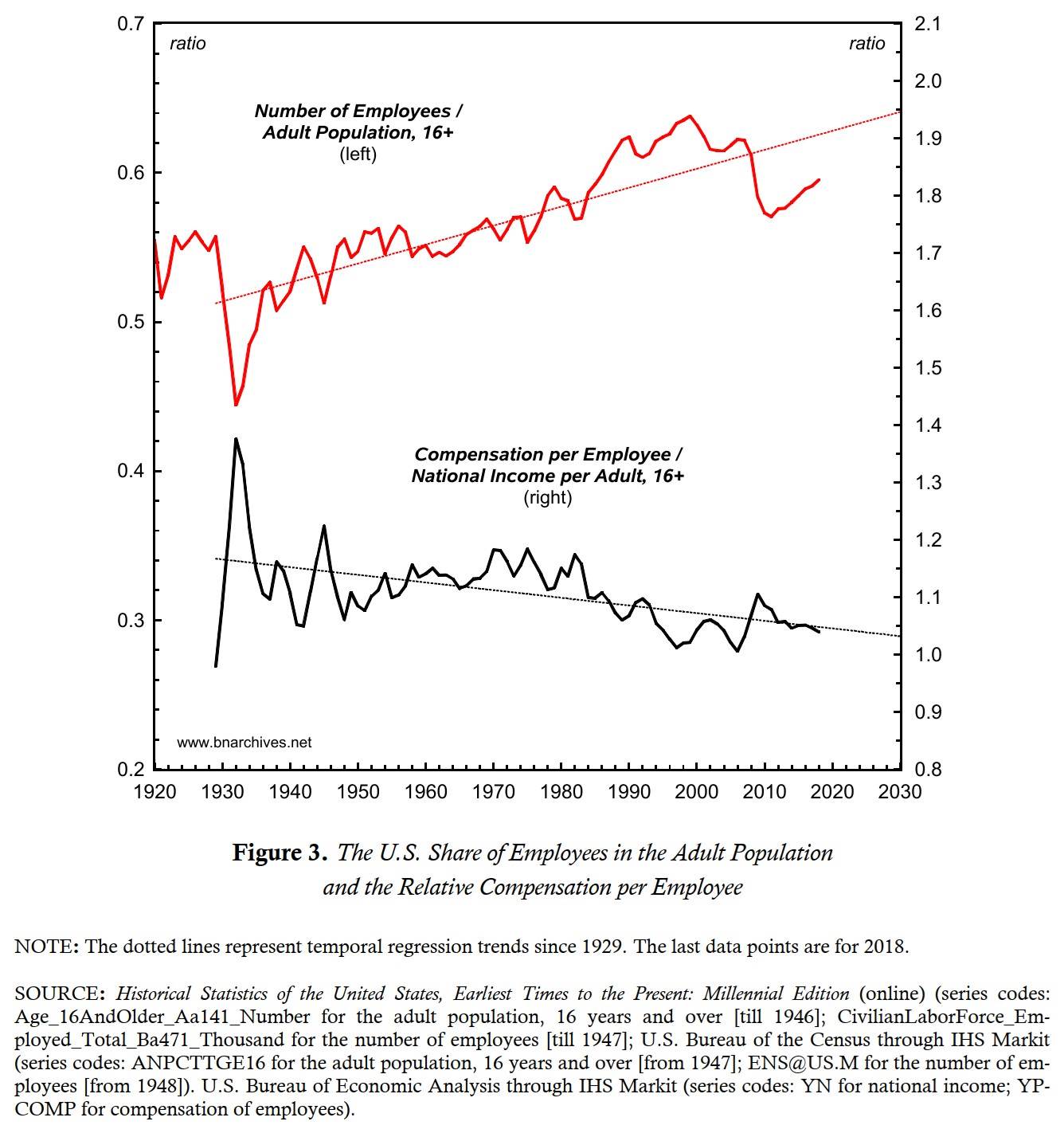

Begin with the overall national income share of capitalists. The main way to raise this share is to squeeze the comparable share of employees. And as Figure 3 suggests, this squeezing is likely to become increasingly difficult to achieve. [21] Mathematically, the national income share of employees is the product of two distinct ratios: (1) the share of employees in the overall adult population, shown by the top series against the left scale; and (2) the ratio between compensation per employee and the national income per adult, displayed by the bottom series against the right scale.

Over the past century, the first ratio has trended upward, and for the simplest of reasons: capitalism forces more and more people to become wage earners – and it does so relentlessly, even in the land of unlimited opportunities. The second ratio has trended in the opposite direction. Although U.S. workers are encouraged to believe that they will be rich someday, in reality their wage income has tended to fall relative to the country’s average income per adult. [22]

Now, since the capitalist reality forces the first ratio upward, the only way for capitalists to squeeze employees further is to reduce the second ratio – i.e., to lower employee compensation relative to the average income per adult – and to do so faster than the rate at which the first ratio trends upward.

And here lies the problem. Given that the ratio of employee compensation relative to the national income per adult has trended downward for nearly a century, pushing it down even further is bound to become harder and harder. Of course, this additional squeeze can be achieved, but only with larger and larger doses of sabotage, fear and violence. And as the recent rise in populist politics and strife in the U.S. demonstrates, this additional pressure might be pushing capitalist power against its asymptote, with a growing risk of a violent backlash.

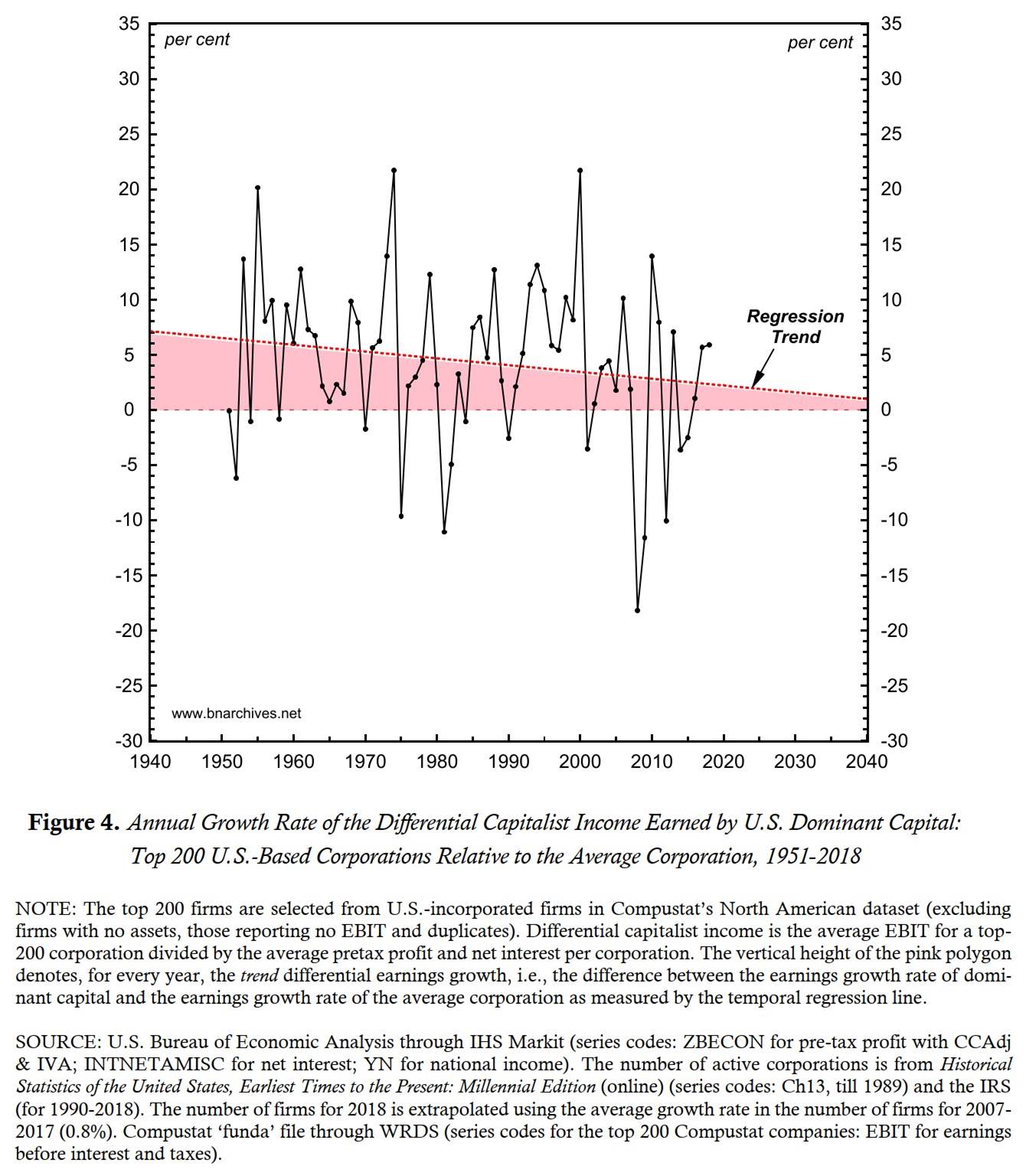

The second limitation has to do with the differential earnings of dominant capital. As we saw in Figure 2, beginning in 1950, the largest 200 U.S.-based firms have managed to make their pretax profit and interest payments grow exponentially relative to those of the average corporation. However, we also saw that there were at least two significant pauses in this process. Moreover, Figure 4 indicates that the average growth rate of differential earnings, although still positive, has decelerated significantly.

This long-term deceleration is crucial. The red dotted line in the figure, marking the temporal regression trend, shows that the two lulls of the bottom series in Figure 2 are part of a broader historical downtrend. The fact that this downtrend lies above the zero line indicates that U.S. dominant capital continues to increase its earning power relative to smaller corporations; in other words, that it continues to ‘beat the average’. But as the narrowing pink polygon underneath the trend indicates, it does so at a slower and slower pace. If during the early 1950s the average annual growth of this differential was 6 or 7 per cent, by the late 2010s it had fallen to a mere 2 per cent.

Should this downtrend surprise us? Not really. Remember that the differential earnings of the top 200 corporations represent the organized power of U.S. dominant capital, and although this might seem counterintuitive at first, from a certain point onward, the greater this power, the more difficult it is to increase it even further.

To convince yourself, consider the following comparison. In the early 1950s, the earnings of a typical U.S. dominant capital firm were ‘only’ 1,000 times greater than those of the average corporation. At that time, doubling this differential to 2,000 was relatively easy. But nowadays the earnings of dominant capital firms are nearly 17,000 times greater than the average, so doubling them to 34,000 times the average is likely to be much more difficult. Of course, this increase might be possible – but achieving it will probably require a radical transformation to a far more authoritarian society.

So here, too, the capitalist quest for more and more power faces an uphill battle. One solution has been to ‘break the national envelope’ and take over corporations outside the U.S. The consequence of this process, popularly known as ‘globalization’, has been to increase the foreign earnings of U.S. corporations from roughly 7 per cent of their total profit in the late 1940s to nearly 50 per cent presently. [23] But U.S. firms no longer reign supreme over the world at large. During the past half century, they have seen growing challenges from non-U.S. corporate rivals and governments, and this tougher environment has caused the globalization of their profit – which is already embedded in the earnings data shown in Figure 4 – to decelerate as well. [24]

8. The Future of Capitalist Power

The future, say the Aymara, lies behind us, dark and unknowable. The only thing we can actually see and know is what lies in front of us, namely the past. And if you think the Aymara got their directions mixed up, just look at the bright stars at night. [25] Inevitably, our speculations about the unknowable future always draw on what we know about and how we theorize the past – and this general rule certainly applies to capitalism.

There are three historical perspectives on capitalism and its crises. The first, liberal, approach was born with capitalism. The centre of this regime, argue the liberals, is the autonomous, utility-maximizing individual and the self-equilibrating free market. These two entities, they say, not only freed us from feudalism, but also brought prosperity, modernity, industrialization and accumulation – as well as competition, enterprise and the separation of civil society from the state. But there is no good without bad, and, regrettably, the capitalist regime also suffers from periodic crises. For liberals, though, these crises are always ‘exogenous’. They originate in ‘distortions’ – including government intervention, cultural inhibitions, monopolies, labour unions and other undue restrictions – that shock the free economy from the outside. And luckily, these shock-induced crises are inherently temporary. Eventually they get washed away by the optimizing forces of rational self-interest and slate-cleaning competition.

The second, Marxist, approach emerged as a critique of liberalism. For Marx, the centre of capitalism was not the autonomous liberal individual, but antagonistic classes. These classes, he argued, emerge from and together with the conflictual reality of production, private ownership and exploitation. In this reality, the main class struggle is between capitalists and workers. The former, who own the means of production and control the dominant ideology, extract surplus value from their productive workers. The latter, who own nothing but their labour power, resist the capitalists and occasionally aim and even try to overthrow them. In this struggle, crises are not exogenous and accidental, but internal and inherent. They emerge from the negative effect of built-in class inequality on the aggregate purchasing power of society; from the destabilizing built-in disproportionalities of production; and from the built-in tendency for relentless mechanization to depress the rate of profit. These built-in tendencies, Marxists point out, are often offset by countertendencies. But over the very long haul (whose exact duration is anyone’s guess), the former overcome the later, and capitalism, having been gradually weakened, eventually crumbles.

The third approach is CasP, which offers a critical alternative to both liberalism and Marxism. Instead of the utility-maximizing individual of the liberal cosmos and the productive labourer of Marx’s scheme, in CasP the basic building bloc is quantified power. According to CasP, capital is neither a physical artifact nor dead labour. Instead, it’s a financial symbol of organized power. This symbol amalgamates and reduces many qualitatively different relations of power to a single universal quantum that we call ‘differential capitalization’. And it is the temporal path of this quantum that drives and describes the history – and possibly the future – of capitalism.

Contrary to liberals and very much like Marx, CasP sees crisis as inherent in capitalism. But CasP understands the nature and implications of crises very differently from Marx. First, whereas for Marx crises are rooted primarily if not exclusively in the ‘economy’, in CasP they emerge from the intersection of all important power relations in society. Second, whereas in Marx’s theory capitalist crisis is synonymous with falling production, unemployment and hardship, in CasP these very processes – at least within the business-as-usual Goldilocks range – serve to support and enhance capitalized power. Third, contrary to Marxism, where labour values – and therefore capital accumulation – are unobservable and must be approximated by prices (instead of the other way around), in CasP capitalized power is measured directly as ratios of observable monetary magnitudes. Fourth and finally, whereas in Marxism crisis tendencies are considered inevitable and ultimately destructive of capitalism, in CasP they are much more open-ended.

Marxist economists, particularly ‘fundamentalist’ adherents of the the falling tendency of the rate of profit, are constantly looking for long-term pointers to the ongoing weakening of accumulation. [26] But as we have seen in this paper, the CasP approach shows that, in the United States, capitalist power – in the aggregate as well as in the hands of the top corporations of dominant capital – has trended upward for almost a century. In other words, the same reality that Marxists see as undermining capital is shown by CasP to have bolstered it.

Rising capitalized power, though, doesn’t mean that capitalism is becoming immune to crisis. Far from it. Unlike the Marxist view, which sees the collapse of capitalism as coming at the end of a long-term process of attrition, in CasP the dialectic of power – and therefore of crisis – is deeply non-linear. Capitalized power can increase, seemingly unabated, for a long time. But rising power requires rising sabotage, and from a certain critical point onward this requirement makes further increases in power much more difficult to sustain and therefore susceptible to a sharp historical inversion.

In our view, this is the critical juncture that U.S. capitalists – and dominant capital in particular – currently find themselves in. But how this difficulty gets ‘resolved’ is far from predetermined. Hopefully, the resolution will involve some form of democratic transition where capitalists are made to accept lesser power, at least for the time being. And we should certainly hope that this option materializes, because the alternative is a far more ruthless regime reminiscent of Jack London’s Iron Heel (1907), where significant increases in sabotage-backed power become the new business-as-usual.

Endnotes

[1] Shimshon Bichler and Jonathan Nitzan teach political economy at colleges and universities in Israel and Canada, respectively. All their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net). Work on this paper was partly supported by SSHRC. We thank Daniel Moure for his proofreading.

[2] The CasP acronym was coined by DT Cochrane.

[3] The most detailed accounts of CasP are given in our books Capital as Power. A Study of Order and Creorder (Nitzan and Bichler 2009) and The Scientist and the Church (Bichler and Nitzan 2015). Additional overviews and interviews are provided in Bichler and Nitzan (2018, 2020b), Bichler, Nitzan and Di Muzio (2012) and Bichler, Nitzan and Dutkiewicz (2013). On the asymptotes of power, see Bichler and Nitzan (2012, 2016, 2020c).

[4] We write ‘real capital’ and ‘productivity’ in inverted commas because, in our view, they are impossible concepts (see Nitzan 1992: Ch. 5; Nitzan and Bichler 2009: Part III; Fix, Bichler, and Nitzan 2019).

[5] Discounting formulae may be more involved than our simple equation here, but their gist can always be reduced to our four elementary particles.

[6] To wit, gravity is a quantitative relationship between masses; electromagnetism is a quantitative interaction between electrically charged particles; the weak nuclear force is a quantitative interaction between subatomic particles; and the strong force is a quantitative interaction between the fundamental particles of matter.

[7] Veblen (1904, 1923). For some of the differences between CasP and Veblen’s analysis of capitalism, see Bichler and Nitzan (2019a).

[8] According to Ulf Martin (2019), the imposition of capitalized power – which capitalists view as ‘rationalization’ – always generates resistance. Since capitalists deem this resistance ‘irrational’, they impose more power in order to ‘rationalize’ it. Their added power, though, elicits even more resistance, which in turn leads to more power, eliciting more resistance, and so on in a never-ending ‘autocatalytic sprawl’. In other words, according to Martin, the very attempt by capitalists to capitalize-rationalize everything makes that goal impossible to achieve.

[9] This chart first appeared in Nitzan and Bichler (2000: 80) and was updated in subsequent publications. In its early incarnations, the horizontal axis rose from right to left. In Bichler and Nitzan (2014: Figure 2, p. 2), we inverted its direction to increase from left to right, which is how we present it here.

[11] In his paper, Kalecki also observed that fascist governments, having substituted the concentration camp for unemployment, were relieved of this liberal concern.

[12] As Thorstein Veblen showed in his sardonic Theory of the Leisure Class (1899), even consumption, which capitalists often engage in excessively, is usually conspicuous in nature. Its ultimate purpose is to display their greater differential earnings relative to lesser capitalists.

[14] According to Alston, Kearl and Vaughan (1992: 205), over 68 per cent of economists agree – either generally or with some provisions – that ‘[t]here is a natural rate of unemployment to which the economy tends in the long run’. Based on a more recent study by Fuller and Geide-Stevenson (2003: 373), this number fell from 75 per cent in 1990 to 67 per cent in 2000.

[15] To illustrate the importance of earnings for capitalization, note that, over the 1871-2006 period, the Pearson correlation coefficient between the price and earnings per share of the S&P 500 group of companies measured 0.94 out of a maximum value of 1 (Nitzan and Bichler 2009: Figure 11.1, p. 186).

[16] Nitzan and Bichler (2009: Ch. 16).

[17] Nitzan and Bichler (2009: Figure 16.4, p. 377). The long-term tendency of inflation to coincide with crisis is narrated in Fischer (1996).

[18] For more on this latter subject, see Nitzan and Bichler (2009: Part V).

[19] Nitzan and Bichler (2009: Figure 16.3, p. 373).

[20] See Nitzan and Bichler (2009: Figure 15.2, p. 338 and Figure 17.1, p. 384), Francis, Bichler and Nitzan (2013) and Francis (2018).

[21] For more on this difficulty, see Bichler and Nitzan (2012, 2020a).

[22] Our emphasis here is on the long-term trends of the two series. Note, though, that their short-term fluctuations are also inversely correlated. When the political economy goes into recession, employment falls relative to the adult population, causing the top series to decline. The average compensation per employee, though, does not tend to drop in a recession – and even when it does, usually the drop is smaller than the decline in the average income per adult – which causes the bottom series to rise. The same counterforces operate in a boom – only in reverse.

[23] Bichler and Nitzan (2019b: Figure 4, p. 10).

[24] Bichler and Nitzan (2012: Figure 15, p. 47; 2019b).

[25] Núñez, and Sweetser (2006).

[26] For the difference between ‘fundamentalist’ and ‘neo’ Marxists, see Sherman (1985).

References

Bichler, Shimshon, and Jonathan Nitzan. 2012. The Asymptotes of Power. Real-World Economics Review (60, June): 18-53.

Bichler, Shimshon, and Jonathan Nitzan. 2014. Nonlinearities of the Sabotage-Redistribution Process. Research Note (May 19): 1-5.

Bichler, Shimshon, and Jonathan Nitzan. 2015. The Scientist and the Church. World Economics Association Books: WEA.

Bichler, Shimshon, and Jonathan Nitzan. 2016. A CasP Model of the Stock Market. Real-World Economics Review (77, December): 119-154.

Bichler, Shimshon, and Jonathan Nitzan. 2018. The CasP Project: Past, Present, Future. Review of Capital as Power 1 (3, April): 1-39.

Bichler, Shimshon, and Jonathan Nitzan. 2019a. CasP's 'Differential Accumulation' versus Veblen's 'Differential Advantage' (Revised and Expanded). Working Papers on Capital as Power (2019/01, January): 1-12.

Bichler, Shimshon, and Jonathan Nitzan. 2019b. Making America Great Again. Real-World Economics Review (90, December 9): 2-12.

Bichler, Shimshon, and Jonathan Nitzan. 2020a. Can Capitalists Continue to Squeeze the Income Share of Employees? Research Note (November): 1-4.

Bichler, Shimshon, and Jonathan Nitzan. 2020b. The Capital as Power Approach. An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan. Working Papers on Capital as Power (2020/02, June): 1-58.

Bichler, Shimshon, and Jonathan Nitzan. 2020c. Growing Through Sabotage: Energizing Hierarchical Power. Review of Capital as Power 1 (5, May): 1-78.

Bichler, Shimshon, Jonathan Nitzan, and Tim Di Muzio. 2012. The 1%, Exploitation and Wealth: Tim Di Muzio Interviews Shimshon Bichler and Jonathan Nitzan. Review of Capital as Power 1 (1): 1-22.

Bichler, Shimshon, Jonathan Nitzan, and Piotr Dutkiewicz. 2013. Capitalism as a Mode of Power: Piotr Dutkiewicz in Conversation with Shimshon Bichler and Jonathan Nitzan. In 22 Ideas to Fix the World: Conversations with the World's Foremost Thinkers, edited by P. Dutkiewicz and R. Sakwa. New York: New York University Press and the Social Science Research Council, pp. 326-354.

Fix, Blair, Shimshon Bichler, and Jonathan Nitzan. 2019. Real GDP: The Flawed Metric at the Heart of Macroeconomics. Real-World Economics Review (88, July): 51-59.

Francis, Joseph. 2018. An Open Source Update of the Buy-to-Build Indicator. Joseph Francis: History, Numbers and Some Theory, September 4. http://www.joefrancis.info/buy-to-build-indicator/.

Francis, Joseph, Shimshon Bichler, and Jonathan Nitzan. 2013. The Buy-to-Build Indicator: New Estimates for Britain and the United States and a Comment. Review of Capital as Power 1 (1): 68-78.

Friedman, Milton. 1968. The Role of Monetary Policy. The American Economic Review, Papers and Proceedings 58 (1): 1-17.

London, Jack. 1907. [1957]. The Iron Heel. New York: Hill and Wang.

Martin, Ulf. 2019. The Autocatalytic Sprawl of Pseudorational Mastery. Review of Capital as Power 1 (4, May): 1-30.

Nitzan, Jonathan. 1992. Inflation as Restructuring. A Theoretical and Empirical Account of the U.S. Experience. Unpublished PhD Dissertation, Department of Economics, McGill University.

Nitzan, Jonathan, and Shimshon Bichler. 2000. Capital Accumulation: Breaking the Dualism of "Economics" and "Politics". In Global Political Economy: Contemporary Theories, edited by R. Palan. New York and London: Routledge, pp. 67-88.

Nitzan, Jonathan, and Shimshon Bichler. 2009. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Veblen, Thorstein. 1899. The Theory of the Leisure Class. An Economic Study in the Evolution of Institutions. New York and London: The Macmillan Company.

Veblen, Thorstein. 1904. [1975]. The Theory of Business Enterprise. Clifton, New Jersey: Augustus M. Kelley, Reprints of Economics Classics.