Research Note

Oil and Blood in the Orient, Redux

Shimshon Bichler and Jonathan Nitzan [1]

Jerusalem and Montreal, December 2017

![]() bnarchives.net

/ Creative

Commons (CC BY-NC-ND 4.0)

bnarchives.net

/ Creative

Commons (CC BY-NC-ND 4.0)

Overview

This research note updates selected charts from three previous papers (Bichler and Nitzan 2012, 2015, 2017). The new data present a rather startling picture, suggesting that the Middle East – and the global political economy more generally – might face an important crossroads.

Our assessment here rests on the analysis of capital as power, or CasP. Beginning in the late 1980s, we suggested that, since the late 1960s, the Middle East was greatly influenced by the capitalized power of a Weapondollar-Petrodollar Coalition – a loose coalition comprising the leading oil companies, the OPEC cartel, armament contractors, engineering firms and large financial institutions – whose differential accumulation benefitted from and in turn helped fuel and sustain Middle East ‘energy conflicts’. [2] These conflicts, we argued, reverberated far beyond the region: they affected the ups and downs of global growth, the gyrations of inflation and, in some important respects, the very evolution of the capitalist mode of power. [3] And this impact, it seems to us, is now being called into question.

Historically, the main force holding the Weapondollar-Petrodollar Coalition together was the price of oil, and over the past few years, this price – along with the Coalition’s revenues and profits – has fallen perceptibly. Judging by past patterns, this massive collapse should have triggered a significant energy conflict, leading to sharply higher oil prices, soaring petroleum revenues and the rapid build-up of oil profits. So far, though, none of this has happened. The region is replete with hotspots, but these have not developed into a major war capable of arresting, let alone reversing, the Coalition’s downward spiral.

In our view, the decline of the Weapondollar-Petrodollar Coalition mirrors several related processes. The first is the broader descent of the U.S., a process that makes it more difficult for the U.S. government – traditionally the main bulwark of the Weapondollar-Petrodollar Coalition – to sustain and manage Middle East energy conflicts. The second is the ascent of a global Technodollar Coalition, a constellation of capitalist interests concentrated primarily in information, communication, automation and biotechnology whose members are highly averse to oil crises, stagflation and regime change – the very processes that make the Weapondollar-Petrodollar Coalition tick. And the third is rising ecological concerns associated with climate change/peak oil and the growing realization that humanity is bound to reduce its reliance on fossil fuel in general and petroleum in particular.

Paradoxically, though, these counterforces are unlikely to pacify the Middle East any time soon. First, although the Weapondollar-Petrodollar Coalition is down, it is by no means out. Given the massive collapse of its earnings, it needs higher oil prices more than ever before; and this urgent requirement means that a major Middle East conflict – for example, a direct or proxy war between Saudi Arabia and Iran (with or without backing from other countries) – remains a distinct possibility. But even if the Weapondollar-Petrodollar Coalition does not have its way – i.e., even if inter-state conflict in the region remains contained or otherwise fails to prop up the price of oil – the Middle East is unlikely to quiet down. Many of the region’s autocratic regimes have already disintegrated or face the prospect of disintegration, and the slump in oil prices and earnings is bound to hasten this process even further.

1. Clear and Present Danger

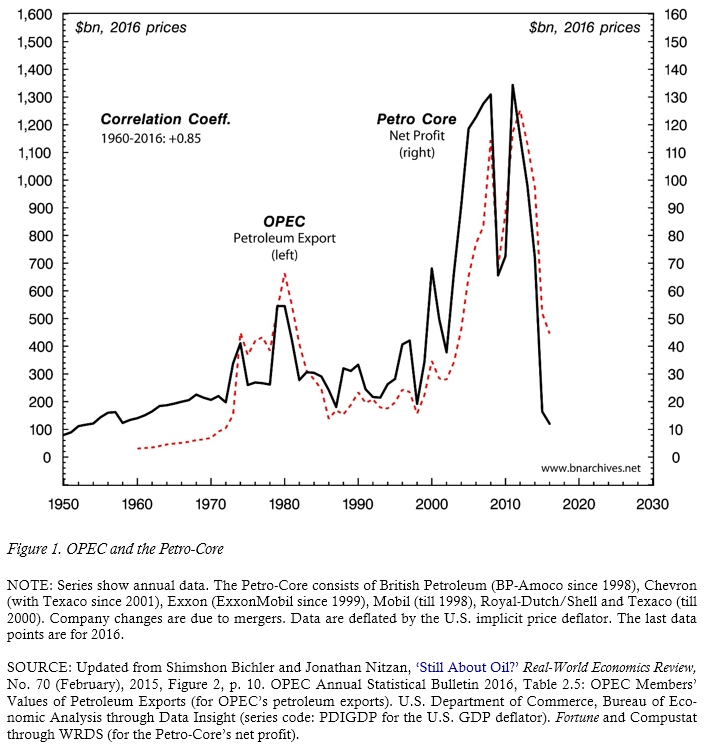

Begin with income. Figure 1 contrasts the net profits of the large oil companies, approximated here by a Petro-Core of leading publicly listed firms, with the export revenues of OPEC (both expressed in 2016 prices). And as the data show, the two groups face a serious threat.

Over the past few years, the Petro-Core has seen its net profit plummet by over 90 per cent, falling from record highs in the early 2010s to lows last seen in the 1950s. The situation for OPEC is not much better. The organization’s overall petroleum exports, which reached record levels in the early 2010s, are now down by nearly two-thirds. The impact of this decline is greatly exacerbated by the organization’s rapid population growth – roughly 350 per cent over the past 55 years. Taking this latter growth into account means that, on a per capita basis, oil exports, expressed in constant dollars, are now back to where they were in the early 1970s, before the first oil crisis.

Clearly, this situation is unsustainable. To recover, the oil companies and oil exporting countries must see their incomes rise significantly. And such a recovery, if it were to happen, would require higher oil prices.

2. The Price Pivot

Indeed, when it comes to changes in global oil profits and petroleum export revenues, the volume of oil production matters little. The key is variations in price. [4]

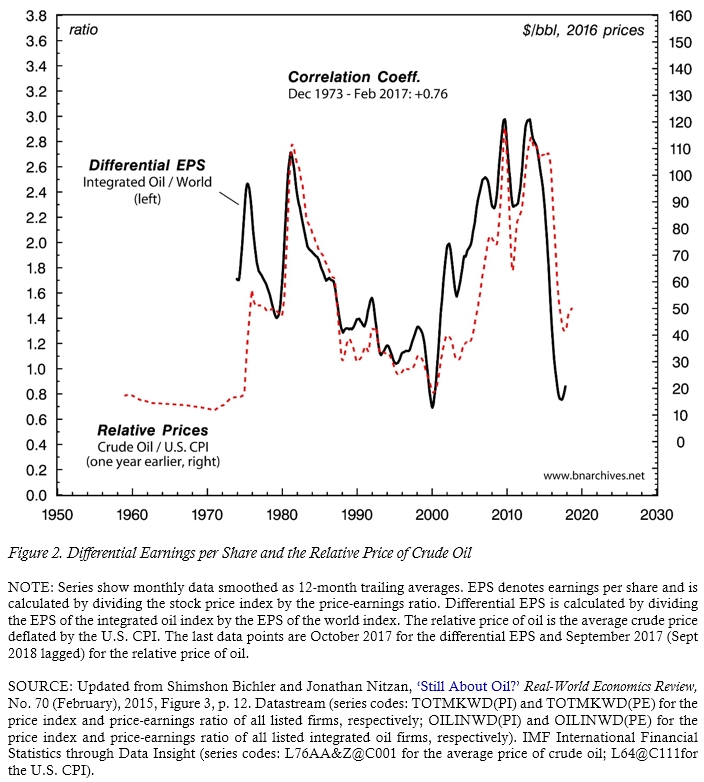

Figure 2 illustrates this latter impact. The chart contrasts the differential earnings per share (EPS) of the global integrated oil sector (i.e., the sector’s EPS relative to the world’s EPS) with the relative price of oil 12 months earlier (dollars per barrel deflated by the U.S. CPI). [5] It shows that, for nearly half a century, the correlation between the two series has been positive, tight and highly persistent (Pearson Coefficient = +0.76). And this pattern continues to hold today: over the past five years, the relative price of oil fell by 55 per cent, while the oil companies’ differential EPS sank by 71 per cent.

Note, though, that in the last few months, both series show a small uptick. Could this uptick be the inflection point the Weapondollar-Petrodollar Coalition has been anxiously waiting for? The answer is likely to depend crucially on future hostilities in the region.

3. Differential Earnings and Energy Conflicts

As we have seen, higher differential profitability requires rising relative oil prices; and as we shall now show, historically, relative oil prices tended to increase on the back of Middle East energy conflicts.

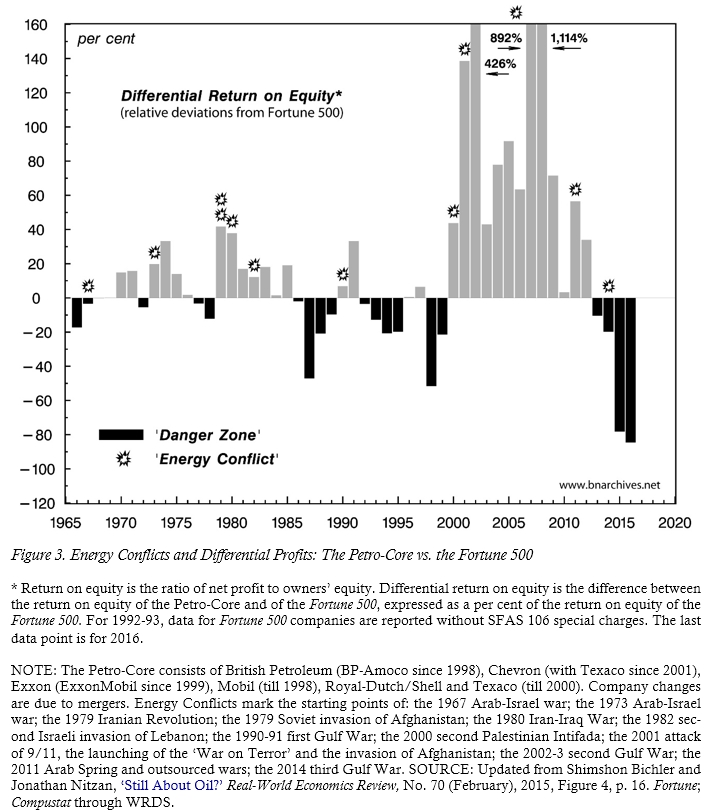

Figure 3 demonstrates this relationship. The chart plots the differential return on equity of the Petro-Core relative to the Fortune 500: when the bars are grey, the Petro-Core beats the average (having a higher return on equity than the Fortune 500); when the bars are black, it trails the average (showing lower returns than the Fortune 500). These latter periods denote ‘danger zones’, indicating that the region is ripe for a new energy conflict. The actual eruption of such conflicts is marked by an explosion sign.

The figure paints three important regularities:

1. Every energy conflict save one was preceded by the Petro-Core trailing the average. In other words, for a Middle East energy conflict to erupt, the large oil companies first have to differentially decumulate (trail the average). [6] The sole exception to this rule was the 2011 burst of the Arab Spring and the subsequent blooming of ‘outsourced wars’. [7] This round erupted without prior differential decumulation – although the Petro-Core was very close to falling below the average. In 2010, its differential return on equity dropped to a mere 3.3 per cent, down from 71.5 per cent in 2009 and a whopping 1,114 per cent in 2008. [8]

2. Until 2014 – a crucial turning point to which we turn in Section 4 – every energy conflict was followed by the oil companies beating the average. [9] As we have seen, differential oil profits are intimately correlated with the relative price of oil; the relative price of oil in turn is highly responsive to Middle East risk perceptions, real or imaginary; these risk perceptions tend to jump in preparation for and during armed conflict; and as risks mount, they raise the relative price of oil and boost the differential returns of the oil companies.

3. With one exception, in 1996-97, the Petro-Core never managed to beat the average without a regional energy conflict. [10] In other words, the differential performance of the oil companies depended not on production, but on the most extreme form of sabotage: war. [11]

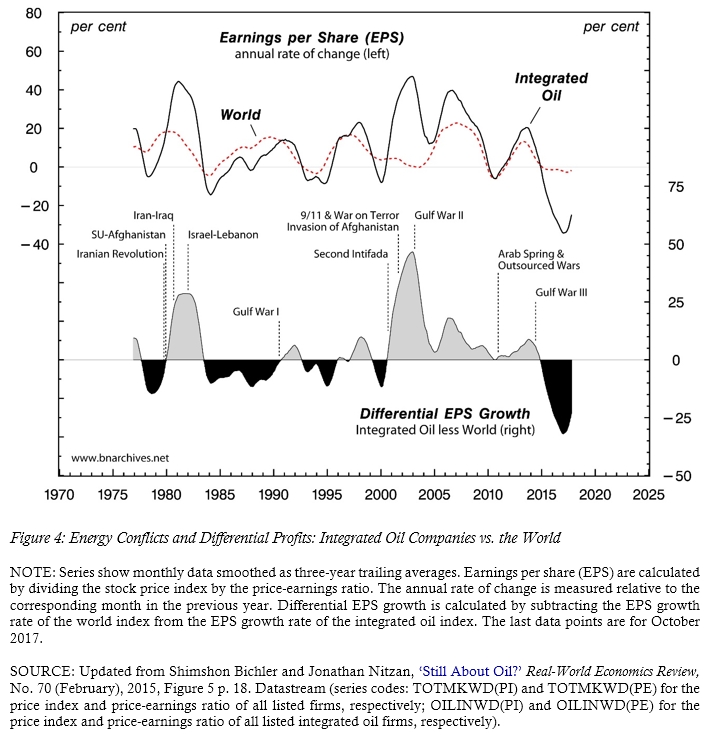

These regularities also seem to hold in Figure 4, where we focus not on the United States, but on the world as a whole; look not at the return on equity, but at the growth of earnings per share (EPS); and examine not annual but monthly data.

The top two series contrast the average EPS performance of the world’s listed integrated oil companies with the average EPS performance of all of the world’s listed companies. Each series measures the annual rate of change of the respective EPS, computed by comparing any given month with the same month a year earlier and expressed as a three-year trailing average. The bottom series shows the differential EPS growth of the integrated oil companies, computed by subtracting the EPS growth rates of the world index from the EPS growth rate of the integrated oil index and expressing the result as a three-year trailing average. As in Figure 3, grey areas indicate periods during which the integrated oil companies beat the average, while black areas show periods in which they trail the average (and therefore mark a danger zone).

Now although the definition and scope of these indices are rather different than those in Figure 3, the three stylized patterns – as well as the exceptions to these patters – are almost the same. Similarly to Figure 3, the chart shows that, since 1976: (1) all energy conflicts were preceded by the world’s integrated oil companies trailing the average (with the exception of the 2011 Arab Spring/outsourced wars and the 2014 third Gulf War, when differential accumulation was very close to zero, but still positive); (2) with the exception of the third Gulf war, all conflicts were followed by the integrated oil companies shifting to differential accumulation; and (3) except for the mid-1990s, the integrated oil companies have never managed to beat the average without a prior energy conflict.

4. The Current Crossroads [12]

Situated against these long-term regularities, the experience of the past three years is highly exceptional. In line with the first regularity, the danger zone that opened up in 2013 was dully followed by the 2014 onset of the so-called third Gulf War. But then, for the first time in half a century, the first regularity was not followed by the second. Despite the ongoing hostilities – in Syria, Iraq and Yemen, among other places – and notwithstanding mounting regional instabilities hastened by dwindling petroleum export revenues, oil prices have plummeted, and the oil companies continue to trail the average. Moreover – and ominously – the magnitudes of the price drops and differential losses are unprecedented.

What do these latest developments mean for the Middle East and the global political economy more generally? In our view, the answer might depend crucially on the conflict within the global ruling class. The potential significance of such intra-class conflicts was illustrated half a century ago by Michael Kalecki (1964, 1967). According to Kalecki, the fate of U.S. involvement in Vietnam – and, by extension, the evolution of the U.S. political economy more generally – hinged on a clash between the ‘old’, largely civilian business groups located mainly on the East Coast, whose interests did not sit well with U.S. involvement in Vietnam, and the ‘new’ militarized business concerns, primarily the arms contractors of the West Coast, that thrived on it.

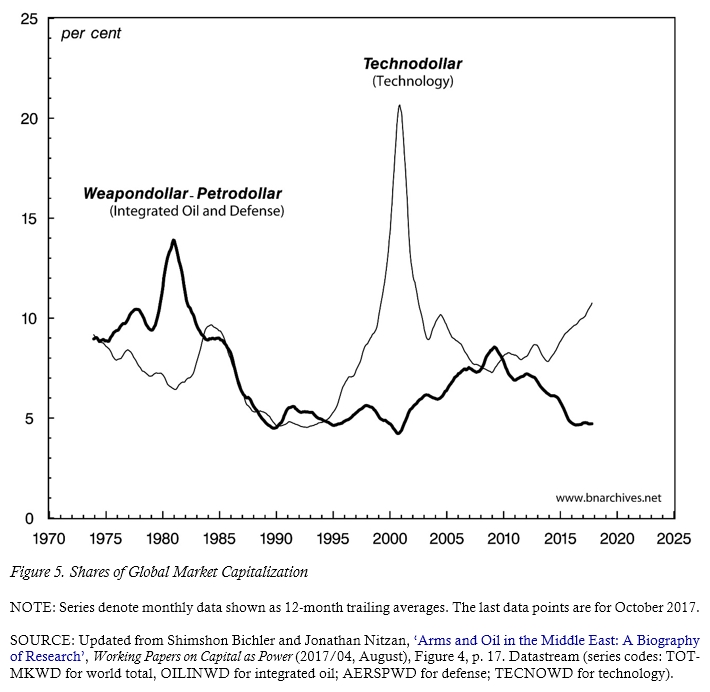

Is there a similar intra-class conflict affecting the ebb and flow of Middle East wars? To contextualize this question, consider Figure 5, where we juxtapose two global coalitions: the Weapondollar-Petrodollar cluster, made up of listed integrated oil and defence corporations, and the Technodollar Coalition, comprising listed technology firms, both hardware and software. Each series measures the market capitalization of the relevant coalition, expressed as a per cent share of the global market capitalization of all listed firms.

The figure shows a clear inverse relationship: since the mid-1970s, the global market capitalization shares of the two coalitions have moved in opposite directions (with only a brief exception in 1985-90). Now, since relative capitalization reflects differential profit expectations and risk assessments, and since these expectations and assessments hinge on the broader trajectories of the global political economy, one can argue there is an inherent conflict between these two coalitions: conditions that favour one coalition undermine the other, and vice versa.

The significance of this structural conflict is best assessed in historical retrospect. The classical imperialism of the early twentieth century was spearheaded by the leading oil companies, whose activities dominated and often dictated the foreign policies of the old powers. In the wake of the First World War, these companies helped draft various regional agreements – from Sykes-Picot (1916), San Remo (1920) and Cairo (1921) to Red Line (1928) and Achnacarry (1928) – carving and shaping the Middle East in line with their own interests. During that period, their main concern was the ‘free flow’ of oil – i.e., political stability, open access to oil at low prices and minimal royalties to the region’s rulers.

This free-flow era ended in the late 1960s and early 1970s. The demise of imperialism undermined the oil companies’ former autonomy. Instead of calling the shots, they now had to negotiate and align with oil-producing oligarchies, elements in their own parent governments and armed forces, and other corporate coalitions, particularly in armament and finance. The centre of this complex network was the Weapondollar-Petrodollar Coalition. Unlike during the free-flow era, the interests of this coalition now lay in limiting the flow of oil. The main purpose was to raise the price of oil to boost oil incomes on the one hand and augment military spending and arms exports into the region on the other. And that goal was best served by a divide-and-rule strategy that kept the Middle East embroiled in a never-ending string of managed energy conflicts, stoked the Cold War and the arms race and pushed the world into reoccurring stagflation crises.

In the 1990s, though, the capitalist mode of power was again transformed. First, the end of the Cold War accentuated the gradual decline of the United States and the former Soviet Union relative the former periphery, particularly in Asia. Second, the ongoing global wave of corporate mergers and acquisitions gave rise to a new and highly complex power hierarchy of giant transnational corporations whose activities, although deeply embedded in state structures, gradually work to undermine the very notion of ‘state sovereignty’. Third, and crucially, the pivotal political-economic role of oil has been challenged by the dual threats of peak oil and climate change, the development of renewable alternatives and, most importantly, the emergence of new power hierarchies built not on raw materials, but information – hence the Technodollar Coalition.

The rise of this new, information-based power is illustrated in Figure 5. Between 1990 and 2000, the global market capitalization of the Weapondollar-Petrodollar Coalition continued its long-term slide, hitting a record low of 4 per cent of the total in 2000, down from 14 per cent in 1980. By contrast, the market capitalization of the Technodollar Coalition more than quadrupled – rising to 21 per cent of the total in 2000, up from a mere 5 per cent in 1990.

In the early 2000s, the Weapondollar-Petrodollar Coalition embarked on a last-ditch attempt to resurrect its capitalized power, pushing the U.S. White House toward yet another Gulf War. And for a while, the effort succeeded: the Technodollar Coalition’s market capitalization dropped to a mere 7 per cent of the total – the experts called it a ‘burst bubble’ – while the Weapondollar-Petrodollar Coalition’s share doubled to 8 per cent.

This comeback, though, was partial and short-lived. In 2010, with the Middle East still in flames and the analysts predicting the imminent arrival of peak oil, the price of oil started to plummet. And as the plunge continued, the market capitalization of the Weapondollar-Petrodollar Coalition again fell below 5 per cent of the total, while that of the Technodollar Coalition resumed its uptrend.

5. There Will be Blood

On the face of it, then, the cards seemed stacked against the Weapondollar-Petrodollar Coalition. The capitalized ascent of the Technodollar Coalition since the 1990s reflects its tightening grip over the hearts, minds and everyday lives of the global population, as well as its increasing informational and ideological symbiosis with governmental and military organs. And this fusion makes it harder for the Weapondollar-Petrodollar Coalition to stir global politics in general and Middle Eastern affairs in particular – certainly in comparison to the 1970s and 1980s.

Moreover, the U.S. government – historically the principal backer of the Weapondollar-Petrodollar Coalition – might find it increasingly difficult to support the interests of this coalition, even if it wanted to. Of course, Washington can still instigate a major conflict in the region, but it can no longer easily manage it – certainly not on its own. To do so, it needs the support and cooperation of allies and vassals, and that support and cooperation, which seemed relatively easy to master in the 1990s and early 2000s, can no longer be taken for granted.

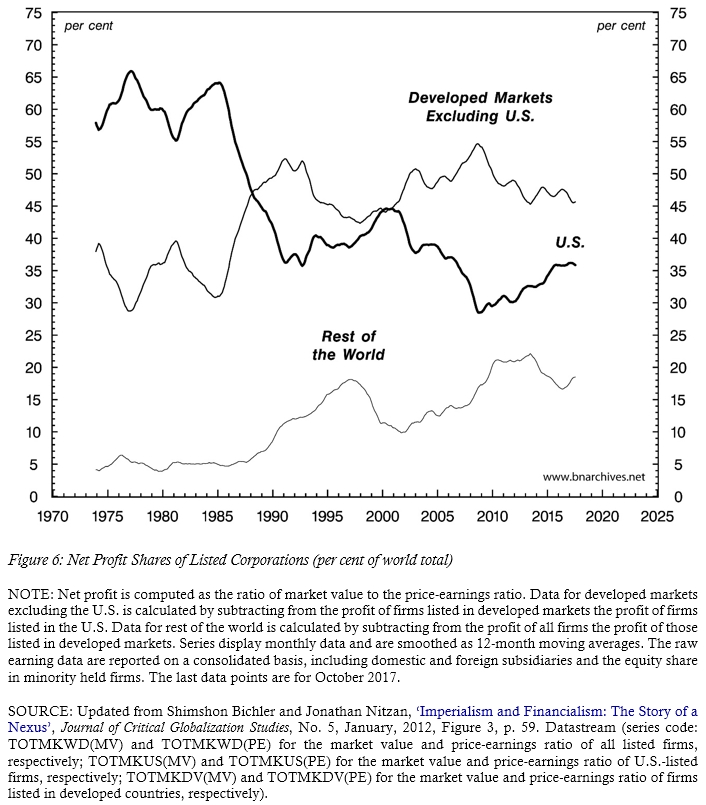

This difficulty is part and parcel of the capitalized decline of the United States, evident in Figure 6. The chart contrasts the shares of global profit earned by corporations listed in the United States with those listed in other developed markets as well as the rest of the world (developing countries). The data show that U.S.-listed firms currently appropriate only 30 per cent of all global profit, down from 60 per cent in the 1970s and 1980s – a decline mirrored partly by the rising share of firms listed in other developed markets, but mostly by the rapid growth of firms listed in the former periphery, primarily in Asia.

This dual decline, though, will probably do little to pacify the Middle East. With the Weapondollar-Petrodollar Coalition now a shadow of its former self, and with the U.S. government increasingly reluctant and decreasingly able to manage shifting alliances and inter-state conflict in the region, ‘mini powers’ such as Turkey and Iran, along with Russia, have stepped into the void, trying to realign their positions and expand their regional spheres of influence. These realignments and expansions, though, are likely to remain volatile and unstable, primarily because the inner state structures of the region, erected after the First World War, are now crumbling. The states of Algeria, Libya, Sudan, Iraq, Syria, Lebanon and Yemen have all failed, while others, such Saudi Arabia’s, Egypt’s and Iran’s, face mounting inner challenges to their legitimacy.

In this volatile context, with the oil and armament companies, the region’s oil-exporting autocracies and various non-state groups all keen on seeing their oil incomes rise, the prospects of a new energy conflict, whether premeditated or coincidental, seem extremely high.

Endnotes

[1] This paper is titled after Lev Nussimbaum’s gripping novel Blood and Oil in the Orient (Bey 1932). Shimshon Bichler teaches political economy at colleges and universities in Israel. Jonathan Nitzan teaches political economy at York University in Canada. All of their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net). Research for this paper was partly supported by the SSHRC. The article is licenced under Creative Commons (Attribution-NonCommercial-NoDerivs 4.0 International).

[2] See for example, Bichler, Nitzan and Rowley (1989), Bichler, Rowley and Nitzan (1989), Nitzan, Rowley and Bichler (1989), Rowley, Nitzan and Bichler (1989), Nitzan and Bichler (1995) and Bichler and Nitzan (1996).

[3] Cf. Bichler and Nitzan (1995), Nitzan (1996), Nitzan and Bichler (2001), Bichler and Nitzan (2004) and Bichler and Nitzan (2006).

[4] Unlike the highly volatile price of oil, the global volume of oil production tends to rise rather gradually and with relatively small short-term oscillations.

[5] The reason for the time lag is that ‘current’ EPS represents earnings recorded over the past year.

[6] In the late 1970s and early 1980s, and again during the 2000s, differential decumulation was sometimes followed by a string of conflicts stretching over several years. In these instances, the result was a longer time lag between the initial spell of differential decumulation and some of the subsequent conflicts.

[7] Our term for the ongoing fighting in Lebanon, Syria and Iraq, which is financed and supported by a multitude of governments and organizations in and outside the region.

[8] The disproportionately high values for 2002 (+426%), 2007 (+892%) and 2008 (+1,114%) are due to the Fortune 500’s very low rates of return in those years.

[9] It is important to note here that the energy conflicts have led not to higher oil profits as such, but to higher differential oil profits. For example, in 1969-70, 1975, 1980-82, 1985, 1991, 2001‑02, 2006-07, 2009 and 2012, the rate of return on equity of the Petro‑Core actually fell; but in all cases the fall was either slower than that of the Fortune 500 or too small to close the positive gap between them, so despite the absolute decline, the Petro‑Core continued to beat the average (see also Figure 4 below).

[10] Although there was no official conflict in 1996-97, there was plenty of violence, including an Iraqi invasion of Kurdish areas and U.S. cruise missile attacks (‘Operation Desert Strike’).

[11] For the details underlying the individual energy conflicts, as well as a broader discussion of the entire process, see Bichler and Nitzan (1996), Nitzan and Bichler (2002: Ch. 5), Bichler and Nitzan (2004) and Nitzan and Bichler (2006).

[12] Sections 4 and 5 extend and develop the argument made in Bichler and Nitzan (2017: Section 11).

References

Bey, Essad. 1932. Blood and Oil in the Orient. Translated from the German by Elsa Talmey. New York: Simon and Schuster.

Bichler, Shimshon, and Jonathan Nitzan. 1995. The Great U-Turn: Restructuring in Israel and South Africa. News From Within XI (9, September): 29-32.

Bichler, Shimshon, and Jonathan Nitzan. 1996. Putting the State In Its Place: US Foreign Policy and Differential Accumulation in Middle-East "Energy Conflicts". Review of International Political Economy 3 (4): 608-661.

Bichler, Shimshon, and Jonathan Nitzan. 2004. Dominant Capital and the New Wars. Journal of World-Systems Research 10 (2, August): 255-327.

Bichler, Shimshon, and Jonathan Nitzan. 2012. Imperialism and Financialism: The Story of a Nexus. Journal of Critical Globalization Studies (5, January): 42-78.

Bichler, Shimshon, and Jonathan Nitzan. 2015. Still About Oil? Real-World Economics Review (70, February): 49-79.

Bichler, Shimshon, and Jonathan Nitzan. 2017. Arms and Oil in the Middle East: A Biography of Research. Working Papers on Capital as Power (2017/04, August): 1-21.

Bichler, Shimshon, Jonathan Nitzan, and Robin Rowley. 1989. The Political Economy of Armaments. Working Paper 7/89, Department of Economics, McGill University, Montreal, pp. 1-34.

Bichler, Shimshon, Robin Rowley, and Jonathan Nitzan. 1989. The Armadollar-Petrodollar Coalition: Demise or New Order? Working Paper 11/89, Department of Economics, McGill University, Montreal, pp. 1-63.

Nitzan, Jonathan. 1996. Israel and South Africa: Prospects for Their Transitions. Emerging Markets Analyst 4 (10, February): 12-18.

Nitzan, Jonathan, and Shimshon Bichler. 1995. Bringing Capital Accumulation Back In: The Weapondollar-Petrodollar Coalition -- Military Contractors, Oil Companies and Middle-East "Energy Conflicts". Review of International Political Economy 2 (3): 446-515.

Nitzan, Jonathan, and Shimshon Bichler. 2001. Going Global: Differential Accumulation and the Great U-turn in South Africa and Israel. Review of Radical Political Economics 33: 21-55.

Nitzan, Jonathan, and Shimshon Bichler. 2002. The Global Political Economy of Israel. London: Pluto Press.

Nitzan, Jonathan, and Shimshon Bichler. 2006. New Imperialism or New Capitalism? Review XXIX (1, April): 1-86.

Nitzan, Jonathan, Robin Rowley, and Shimshon Bichler. 1989. Changing Fortunes: Armaments and the U.S. Economy. Working Paper 8/89, Department of Economics, McGill University, Montreal, pp. 1-27.

Rowley, Robin, Shimshon Bichler, and Jonathan Nitzan. 1989. The Armadollar-Petrodollar Coalition and the Middle East. Working Paper 10/89, Department of Economics, McGill University, Montreal, pp. 1-54.