If you listen carefully, you can hear Jeff Bezos getting richer. There’s the sound again. Another billion in Bezos’ coffers.

Let’s put some numbers to this sound of money. Since 2017, Bezos’ net worth has grown by about $4 million per hour — roughly 500,000 times the US minimum wage.1 This accumulation of wealth would be absurd during normal times. Today, as many workers lose their jobs to a brutal pandemic, it’s obscene.

While Bezos is the pinnacle of capitalist excess, his wealth is part of a larger story. Over the last 40 years, stock prices have surged while wages have stagnated. What does this trend mean?

In this post, I take a deep dive into the stock market. I’ll first tell you what the stock market is not. It’s not an indicator of ‘productive capacity’. Nor is it ‘fictitious capital’. So what is it?

The stock market, argue Jonathan Nitzan and Shimshon Bichler, is how capitalists quantify their power. To understand what Nitzan and Bichler are talking about, we’ll unmask the ritual that defines our social order — the ritual of capitalization. Read on to take the red pill and lift the veil of capitalist ideology.

What do stock prices mean?

When it comes to the stock market, many people believe they have original insight. Often, however, they’re parroting old ideas. Noting this tendency, economist John Maynard Keynes wrote:

[T]he ideas of economists and political philosophers … are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist.

(Keynes in The General Theory)

When it comes to interpreting the stock market, there are two big ideas. Both come from ‘defunct economists’. The first big idea is that rising stocks are good for everybody. I’ll call this the ‘good-for-GM’ worldview (for reasons explained below). This big idea owes not to any single economist, but to an entire defunct school: neoclassical economics.

The second big idea is that the stock market is disconnected from the rest of the economy. I’ll call this the ‘fictitious-capital’ worldview. It’s an idea that dates back to Karl Marx (who had a defunct view of capital).

Let’s unpack these ideas.

What’s good for GM …

I’ve named the ‘good-for-GM’ worldview after a phrase that’s become infamous: ‘What’s good for GM is good for the country’. Here’s the back story.

In 1953, President Eisenhower selected Charles Wilson to be his Secretary of Defense. At the time, Wilson was the President of General Motors. The problem was that Wilson owned $2.5-million worth of GM stock, which he (initially) refused to divest. When the Senate questioned Wilson about this conflict of interest, he replied:

I cannot conceive of [a conflict of interest] because for years I thought what was good for our country was good for General Motors, and vice versa.

Although he probably didn’t know it, Wilson was essentially summarizing neoclassical economics. In neoclassical theory, a firm’s market value (its stock-market capitalization) is supposed to indicate its productive capacity. And since this productive capacity is good for everybody, what’s good for the firm is good for the country.

Here’s the theory behind this claim. It starts with the idea that ‘capital’ has two sides. Capital is finance — a firm’s value on the stock market. But capital is also a productive asset — a ‘real’ stock of goods. If the market works ‘correctly’ (i.e. as described by neoclassical theory), the two sides should mirror one another. In this case, a firm’s value on the stock market should represent its ‘productive capacity’, measured in units of ‘utility’ (pleasure). And since utility is universally good, a rising stock market is good for everybody. What’s good for GM is good for the country.

Fictitious capital

Not everyone believes the neoclassical fable. Some people (including me) think that corporate interests rarely align with societal interests. So if the stock market doesn’t represent productive capacity, what does it indicate?

Nothing, claim some critics. The stock market is fictitious capital.

This idea comes from Karl Marx. To understand his thinking, we need to unpack his theory of capitalism. According to Marx, workers alone create value. But because capitalists own the ‘means of production’, they can extract a surplus from workers. So although capitalists don’t produce anything (according to Marx), they still earn a healthy income.

So in Marx’s eyes, capitalists aren’t productive. But what about capital? Here Marx agrees with neoclassical economists. Capital goods are productive. That’s because they are ‘dead labor’ — the embodiment of former work. When workers create goods, Marx argues that they (workers) transfer some value-creating ability into the goods. When these goods are used in production, they became productive ‘capital’.

So Marx, like his neoclassical enemies, thought that capital had both a monetary side and a ‘real’ side. But whereas neoclassical economists thought that the two sides were united by ‘utility’, Marx argued that they were united by ‘embodied labor’.

For Marx, however, there was one more twist. He looked at stock markets and balked. Stock markets didn’t capitalize ‘real’ goods, he argued. They capitalized a claim on earnings. This practice meant that the stock market had no connection to ‘actual’ capital. And so Marx dubbed the stock market ‘fictitious capital’.

Here’s how the Marxist geographer David Harvey describes the concept. ‘Fictitious capital’ is:

money that is thrown into circulation as capital without any material basis in commodities or productive activity.

(David Harvey in The Limits to Capital)

Although the term ‘fictitious capital’ is not well known (outside Marxist circles), the sentiment behind it is common. Many people bemoan that the stock market is disconnected from the ‘real’ economy. When they do, they’re echoing Marx.

Big ideas … big problems

We have two big ideas about the stock market. Stock prices either represent ‘productive capacity’ (measured in utility), as neoclassical economists claim. Or stocks are ‘fictitious capital’, as Marx argued.

Both big ideas, it turns out, have big problems.

Let’s start with neoclassical theory. When Charles Wilson claimed that ‘what’s good for GM is good for the country’, he was ridiculed. His problem, basically, was that he articulated neoclassical theory too clearly. Stripped of its mathematical mystique, neoclassical logic is obvious bullshit. When Amazon stock prices triple, that’s good for Amazon owners (i.e. Jeff Bezos). But for everyone else, the benefit is hard to see.

Given the dubious social benefit of rising stocks, Marxist theory swings to the opposite extreme. Stock markets, Marxists claim, are disconnected from the ‘real’ economy. They’re ‘fictitious capital’.

If you don’t own stock, this Marxist claim is comforting. After all, there’s no better way to defang an (imaginary) monster than to call it ‘fictitious’. But what if the monster is real? Then calling it ‘fictitious’ is foolish. The next time Amazon buys out one of its competitors, try telling your friend that the transaction was ‘fictitious’. They’ll likely laugh. That’s because the effects of the stock market are real.

So it seems we have a problem. It’s foolish to think that the stock market reflects ‘productive capacity’. But it’s equally foolish to dismiss the stock market as ‘fictitious’. So how, then, should we understand stock prices? Jonathan Nitzan and Shimshon Bichler have an answer.

Capital as finance

In Capital as Power, Nitzan and Bichler exhaustively document the problems with neoclassical and Marxist theory. The discussion above is my short summary. Now let’s get to their diagnosis.

Economists, Nitzan and Bichler argue, don’t understand capital. Whether neoclassical or Marxist, economists agree that capital is a duality. It’s both ‘money’ and ‘machines’. This duality, Nitzan and Bichler argue, is a mistake. Capital, they claim, is one thing only. Capital is finance.

At first, this view seems ultra modern. It’s only in the 21st century, after all, that hedge funds came to dominate society. But when Nitzan and Bichler use the word ‘finance’, they mean something more expansive than hedge funds and investment banks. They mean any quantification in money.

What’s important is that this expansive view of finance is not modern, but ancient. The monetary definition of ‘capital’ long predates the physical one:

[’Capital’] comes from the Latin caput, a word whose origin goes back to the Fertile Crescent in the Middle East. In both Rome and Mesopotamia capital had a similar, unambiguous economic meaning: it was a monetary magnitude. There was no relation to produced means of production. Indeed, caput meant ‘head’, which fits well with another Babylonian invention — the human ‘work day’.

(Nitzan and Bichler in Capital as Power)

The idea that ‘capital’ reflects a stock of ‘real’ wealth came much later, during the industrial revolution. It was created, Nitzan and Bichler note, by political economists. The problem is that capitalists have never thought of capital as a duality. Their goal has always been singular — to accumulate money.

The right to exclude

Capitalists want more money. On this, all political economists agree. But to get this money, don’t capitalists need to invest in production? That’s what Marx concluded. In fact, he enshrined this connection in a formula:

Here’s how the formula works. A capitalist invests money M into ‘real’ capital C (machines and infrastructure). This ‘real’ capital is used to produce commodities, which the capitalist then sells. If all goes well, the capitalist gets back even more money, M′. That, according to Marx, is capital accumulation.

When you think like Marx, it seems that the accumulation of money hinges on the accumulation of ‘real’ capital. But this is an illusion. Physical property isn’t necessary. All that’s needed is property rights.

To be fair to Marx, in the 19th century the distinction between ‘property’ and ‘property rights’ was difficult to see. That’s because the things that were owned (railroads, steel mills, etc.) were tangible. It was easy to conclude that owning ‘things’ is what causes capitalist income. But that’s a mistake. It’s actually property rights that matter.

Today, this fact is more obvious. To understand the importance of property rights, ask yourself — what does a patent troll own? A patent troll, if you’re not familiar, is someone who buys a patent for a product that they neither invented nor produce. The patent troll owns nothing tangible. Yet they still earn income. How? By enforcing the patent … their property right.

Here’s an example. In 2015, Martin Shkreli made headlines when his hedge fund bought the rights for Daraprim, a drug used to treat the parasite disease toxoplasmosis. Shkreli did not invent Daraprim, nor did his hedge fund have anything to do with its manufacture. The drug was invented by Nobel-prize-winning scientist Gertrude Elion and had been available since 1953. None of this history concerned Shkreli, whose goal was to turn a profit. With that in mind, Shkreli bought the rights to Daraprim and promptly raised the drug’s price by 5500%.

This price hike, as you might imagine, caused an uproar. And today, happily, Shkreli is jail. But he’s not there for price gouging. He’s in jail for unrelated securities fraud. Let’s reflect on this fact. Yes, the Daraprim price hike was outrageous. But it was also completely legal. In fact, Shkreli’s price hike demonstrates property rights in their purest form. Property rights are not about producing things. They’re about the power to exclude.

This power was inherent in the patent for Daraprim. The patent enshrined the right to exclude other firms from manufacturing the drug. And it enshrined the right to exclude people from using the drug. From this power to exclude comes the power to earn income. In that regard, Shkreli broke no law. He simply used property rights for their intended purpose.

Although Shkreli is certainly a reprehensible human, his callousness did at least one good thing. It demonstrated the true nature of capitalist income. Capitalist income doesn’t come from property, but from property rights — the institutional right to exclude.

The ritual of capitalization

Back to the stock market. For centuries, political economists have asked — how does the stock market relates to ‘real’ capital? The answer, according to Nitzan and Bichler, is that it doesn’t.2 What matters for capitalist income, they argue, is not property, but property rights — the institutional power to exclude. Capitalists use this power to earn an income.

That’s nice, you say. But we’ve moved the goal posts. We wanted to explain the stock market. But now we’re talking about capitalist income. How does that get us anywhere?

It gets us somewhere because this is the move that capitalists themselves make. Capitalists, Nitzan and Bichler observe, quantify property rights using income. How? Using the ritual of capitalization.

Here’s how the ritual works. Suppose that in his thirst for data, Jeff Bezos acquires a startup company, Your Info Inc. The company owns nothing but an algorithm for harvesting consumer data. Bezos doesn’t care that there’s nothing ‘real’ under the company’s hood. He wants the rights to the algorithm. The question is, how much are these property rights worth?

To quantify these rights, Bezos will turn to income. He’ll take the expected earnings (E) of Your Info Inc. and discount this income by the expected rate of return (r). The result is the firm’s capitalized value, K:3

Notice something interesting about this formula. Neither E nor r are known. E is future earnings, and r is the future rate of return. The problem, of course, is that the future is unknown (and unknowable). To solve this problem, Bezos will turn to the past. To guess future earnings E, he’ll look at earnings in the past. And to guess the future rate of return r, Bezos will look at the average rate of return in the recent past (usually the rate of interest).

Back to Your Info Inc. Suppose that each year, the firm earns roughly $1 million in profits. Bezos assumes this will continue. He further assumes a 5% rate of return (r = 0.05). Given these values, Bezos would offer to purchase Your Info Inc. for $20 million. This is its capitalized value:

Bezos has performed the ritual of capitalization. He’s taken an income stream and used it to quantify property rights.

If this ritual seems arbitrary, that’s because it is. There’s nothing objective about the capitalization formula. It doesn’t point to any fundamental truth about the world, either natural or social. The capitalization formula is simply a ritual — an article of faith.

This arbitrariness doesn’t lessen the importance of capitalization. Far from it. Rituals are always arbitrary. But their effects are always real. Just ask Bob, who’s about to be ritually sacrificed to appease the god of rain. The ritual is arbitrary — founded on a worldview that is false. Killing Bob won’t bring rain. But the rulers believe it will. And so Bob dies. The ritual is arbitrary. The effects are real.

The capitalization ritual works the same way. The formula is arbitrary, as are its inputs. But that doesn’t matter. What’s important is that people believe in the ritual. And on that front, the ritual of capitalization has an army of followers:

Faith in the principle of capitalization now has more followers than all of the world’s religions combined. It is accepted everywhere — from New York and London to Beijing and Teheran. In fact, the belief has spread so widely that it is now used regularly to discount not only capitalist income, but also the income of wage earners, governments, and, indeed, society at large.

(Nitzan and Bichler in Capital as Power)

Stock market order

With the ritual of capitalization in hand, we’re ready to understand the stock market. The rise of stock prices has nothing to do with the accumulation of ‘real’ capital. Instead, it’s about growing income. Let’s have a look.

According to the ritual of capitalization, a firm’s market value equals its earnings (profit) discounted by some rate of return. Most investors, though, aren’t interested in a firm’s total value. They’re interested in the stock price — the market value per share.

To gauge the ‘correct’ price of this stock, investors use the ritual of capitalization in a slightly different form. They divide both sides of the capitalization formula by the number of shares. Here’s what they find. The stock price (capitalization per share) should be proportional to earnings per share:

Like the previous version, this capitalization formula is an article of faith. It’s how capitalists have agreed to quantify property rights. And like any ritual, it’s application can vary. Capitalists debate which discount rate is ‘correct’. And they disagree about how present earnings will relate to future earnings. This debate injects noise into the capitalization ritual. But what’s remarkable is that over the long term, this noise is small.

Figure 1 tells the story. For a century and a half, US capitalists have applied the capitalization ritual with remarkable uniformity. And so over this period, stock prices have risen in (near) lock step with earnings per share. (Note: Fig. 1 updates Fig. 11.1 in Capital as Power.)

Let’s unpack the data in Figure 1, starting with stock market basics. There are many firms on the American stock market, each with a stock price that varies with time. At first glance, you’d think that capitalists would be interested only in the price of the stock that they own. (If I own Amazon stock, I care about the price of this stock.) But it turns out that capitalists also want a benchmark to gauge how their stock is doing. “Am I beating the benchmark?” they ask. If so, they’re winning the game of capitalism.4

There are many stock-market benchmarks, but the most popular is probably the S&P 500. The S&P 500 tracks the average share price of 500 large American firms. (The average is weighted by market capitalization, so ‘large cap’ firms dominate the index.) Figure 1 plots both the average share price of the S&P 500 and the average earnings (profit) per share. When earnings rise, so do share prices.

This trend is neither natural law nor social law. It is the ritual of capitalization in action.

Capital as power

Now that we understand the ritual of capitalization, let’s dive deeper into what it means. Capital, Nitzan and Bichler argue, is not a ‘thing’. It’s an ideology. Capital is the ritualistic quantification of property rights. And because property rights stem from the power to exclude, it follows that capital is the ritualistic quantification of power.

Nitzan and Bichler’s reasoning is simple and logical. Yet when confronted with it, many people balk. Why? Likely because we (humans) find it difficult to recognize our own ideologies. They’re so ingrained that they appear ‘natural’ … even ‘inevitable’.

To get over this hurdle, it’s helpful to look at the belief-system of another society. The goal, as anthropologists put it, is to ‘de-familiarize’ ourselves with our own culture. We look at the ideology of a foreign culture, and then turn this lens onto ourselves. The results are often unsettling.

To de-familiarize ourselves with our own ideology, let’s look at the worldview of ancient Hawaiians. Far from egalitarian, ancient Hawaiians lived in chiefdoms ruled by fierce hierarchies. Here’s how Peter Turchin describes their belief system:

The Hawaiian chiefly elite were different from commoners … because they were the vessels of mana — spiritual energy flowing from the gods that was necessary for the wellbeing of the overall society. The higher the rank of a chief, the more mana was concentrated in him, with the king as the central node in the “mana distribution network.”

(Peter Turchin in Ultrasociety)

It’s clear to us that Turchin is describing an ideology. Mana is a mystical euphemism for power. Hawaiian chiefs proclaimed that they had mana, which gave them the right to rule. And the commoners believed them.

Now here’s the uncomfortable truth. Capital is the same as mana — it’s a euphemism for power. Let’s run through the similarities. Hawaiian elites had power because they had mana. Capitalists have power because they have capital. Hawaiian elites proclaimed their power boldly. So do capitalists, who broadcast their power daily via stock tickers. Lastly, mana had mystical significance. So does capital. By controlling mana, Hawaiian elites became ‘vessels of spiritual energy’. By controlling capital, modern elites (we are told) become ‘vessels of productivity’.

The similarities between mana and capital are unsettling. But there is an important difference between the two ideologies. Hawaiian elites didn’t quantify their power. But modern elites do. Capitalists use the ritual of capitalization to give their power a number. This ritual, Nitzan and Bichler observe, does something unique. It makes capitalism the first social order that is quantitative.5

For anthropologists of capitalism, this quantification is a boon. It means that we don’t have to work hard to study capitalist power. Why? Because elites do the measurement for us. They quantify their power using the ritual of capitalization. Then they broadcast this power to the world in the form of stock prices. To analyze capitalist power, we need only to remove our ideological shackles.

The power index

Stocks are up. Wages are down. What this means, Bichler and Nitzan argue, is that capitalist power has increased.

Let’s unpack this claim. Capitalists, Bichler and Nitzan observe, quantify their power using the ritual of capitalization. But this ritual has no significance on its own. That’s because power is always differential. (You have power in relation to and because of others.) So to make sense of capitalization, we have to compare it to something else.

What should we compare it to? That depends on what we’re interested in. Here, we’re interested in the power of the whole capitalist class. So it makes sense to compare the capitalization ritual to the income of the opposing class — workers.

This thinking leads Bichler and Nitzan to propose a simple metric of capitalists’ power over workers. We take a stock price index and divide it by the average wage. The result is Bichler and Nitzan’s power index:6

On the surface, the power index is a simple ratio of two prices — the price of corporate property rights relative to the price of wage labor. But if we pay attention to capitalist ideology, the ratio has added significance. The stock price is the ritualistic quantification of capitalist power. And the average wage is the countervailing quantification of workers’ power.

What’s most interesting is not the value of the power index, but its oscillation over time. To see this oscillation, let’s calculate the power index in the United States. Bichler and Nitzan define the US power index as:

Figure 2 shows how the US power index has changed over the last century and a half. The historical oscillations are interesting (we’ll discuss them in a moment). But what stands out is the present. The power index is now at an all-time high.

Let’s unpack the data in Figure 2. The oscillations in the power index are caused by the rat race between stocks and wages. Sometimes stocks win the race, causing the power index to increase. Other times wages win the race, causing the power index to decrease.

I’ve labeled, in Figure 2, some events of interest. It’s notable, for instance, that the power index rose in the late 19th century when Rockefeller was building his Standard Oil empire. And the power index began to fall in the early 20th century when minimum wage legislation first appeared. The power index reached a low after World War II. During this time, the welfare state expanded and the government invested in massive public works like the interstate highway system.

From the Reagan years onward, the power index increased. Ironically, history would be made shortly after Francis Fukuyama proclaimed the end of it. Eight years after his 1992 book The End of History was published, the power index reached new heights. Then Trump took office and all records were smashed.

Eras of capitalism

Perhaps the clearest way to understand the oscillations of the power index is to look not at singular events, but at historical eras. To see these eras, let’s smooth the power index to illustrate the long-term trend. Figure 3 shows the results. Four eras of capitalism emerge.

Let’s take a trip through history. We begin in the late 19th century with the era of robber-baron capitalism. At the time, capitalists like Rockefeller and Carnegie were consolidating power. Unsurprisingly, the power index rose steadily.

At the turn of the 20th century, the power index began to ebb. Why? Probably because workers began to organize and government started to break up monopolies. The labor movement and antitrust era was born. The effect on capitalist power was drastic. By the 1940s, the power index had collapsed to an all-time low.

If you believe capitalist cheerleaders, this stock-market low should have been calamitous. But it was not. Instead, the power-index low coincides with the golden age of capitalism. Lasting roughly from the mid-1940s to the mid-1970s, this era was the most prosperous in US history. It was a time of immense public spending and immense material expansion.

By the 1980s, the power index began to rise. Enter the neoliberal era. Gone were politicians promising government expansion. In came politicians promising austerity. Ronald Reagan got government ‘off of the people’s back’, claiming everyone would benefit. A convenient lie. Under Reagan, wealth didn’t trickle down. It poured upwards … to capitalists. We can see this deluge in the power index, which exploded during the 1980s and 1990s. By 2016, the power index was near an all-time high. Then Trump took office, and all records were shattered.

And that brings us to today. Stocks are up. Wages are down. Here’s what it means: capitalist power is at a pinnacle.

Uncharted territory

The year 2020 has been unprecedented in so many ways that it’s hard to keep track. Never before has a pandemic shut down the world economy. Never before have US workers been in such a precarious position. And never before has the stock market been so high.

This disparity escapes few people. How, they ask, can stocks be so disconnected from the ‘real’ economy? The question is understandable, but ultimately misguided. In fact, it speaks volumes about capitalist ideology (and our inability to see it). The stock market has never been connected to the ‘real’ economy. It has always been a quantification of capitalist property rights. Now, as ever, stock prices are the ritualistic quantification of power.

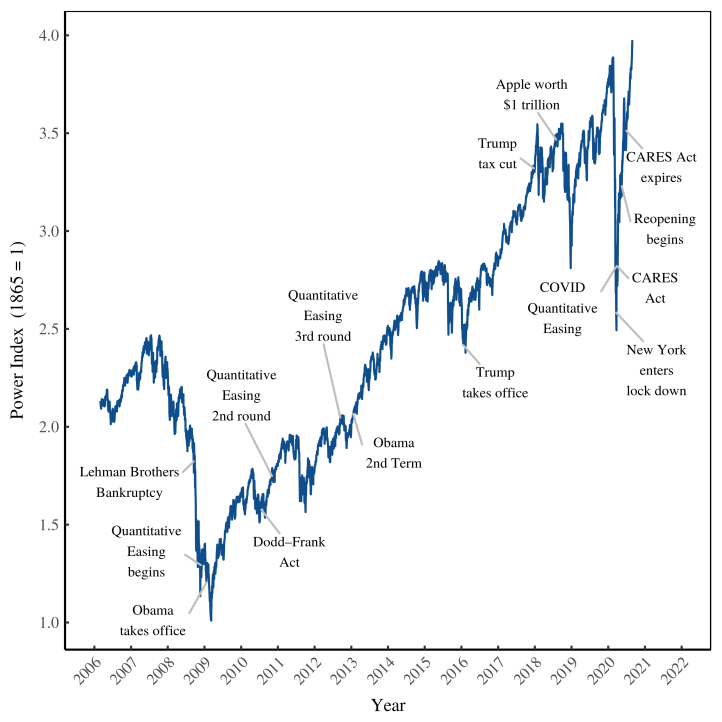

What’s different today is that capitalist power is at an all-time high. To see this fact, let’s zoom in on recent history. Figure 4 shows the daily movement of the US power index from January 2, 2006, to August 28, 2020.

The good times (for capitalists) began in 2009. Obama took office, promising to rein in Wall Street. He did not. Instead, the Fed policy seems to have been to prop up asset prices. Beginning in November 2008, the government started to print money — and lots of it. The official (Orwellian) term for this printing press was ‘quantitative easing’.

Economists warned that printing money would cause inflation. But there’s no sign that it did … among consumer commodities. But check out asset prices. Since 2009, they’re way up relative to wages, as Figure 4 shows. So it seems that the implicit goal of quantitative easing was to prop up capitalist power.

By the time Trump took office, the power index was at an all-time high. His massive 2017 tax cut (for corporations) kept the train rolling. Today, the power-index is in uncharted territory — headed to 4 times the 1865 baseline. This value has never been reached before — not even during the pinnacle of robber-baron capitalism.

Profiting from crisis

That the stock market should rise amidst a crisis is difficult to swallow. But if you’re a student of anthropology, it makes sense. Anthropologists have long known that when disaster strikes, elites don’t help commoners. Elites help themselves.

I’ll close on this point, because it reminds us that we’re not as removed from the past as we might think. Here’s archaeologist Brian Hayden remarking on how Mayan elites attempted to profit from crisis:

I was completely astonished at the results from village after village … that showed that the local elites provided essentially no help to other members of the community in times of crisis, but instead actually devised means of profiting from the misfortunes of others.

(Brian Hayden in Richman, Poorman, Beggarman, Chief. Emphasis in original)

Commenting on the anthropological model of elites that emerged, Brian Hayden and Suzanne Villeneuve write:

… stored food was used to ensure the survival of elites while the poor starved.

(Hayden and Villeneuve in Who Benefits from Complexity?)

While not yet starving, many Americans are going hungry. And like the Mayan elite before them, American elites are attempting to profit. And they are succeeding.

Still, there is hope. No social order is immutable. The more powerful American capitalists become, the closer they get to a reckoning.

When will this reckoning come? What will it look like? Hard to know. But we can say one thing: hastening this reckoning surely involves lifting the veil of capitalist power. That means understanding the stock market. Stock prices don’t represent ‘productive capacity’, nor are they ‘fictitious capital’. They are the ritualistic quantification of power — ‘mana from heaven’ in number form.

Support this blog

Economics from the Top Down is where I share my ideas for how to create a better economics. If you liked this post, consider becoming a patron. You’ll help me continue my research, and continue to share it with readers like you.

Stay updated

Sign up to get email updates from this blog.

Sources and methods

Figure 1. S&P 500 price and earning’s per share data are from Robert Shiller.

Figures 2 and 3. Data for the US power index is from:

- 1865–2016: Bichler and Nitzan’s A CasP Model of the Stock Market

- 2016–present: S&P 500 price is from FRED, series SP500. The average US wage is from BLS series CEU0500000003, Average Hourly Earnings of All Employees, Total Private

- In Figure 3, I create the smoothed trend using a locally weighted polynomial regression.

Figure 4: Daily S&P 500 prices are from the Wall Street Journal. Monthly US wage data is from BLS series CEU0500000003. To calculate a daily power index, I interpolate the wage data to give it a daily value. Wage data hasn’t yet been reported for August 2020, so I use the July wage to calculate the power index in August. I’ve indexed the series so that it aligns with Bichler and Nitzan’s data, indexed to 1 in 1865.

Notes

- On August 26, 2020, Jeff Bezos’ net worth hit $200 billion. He first crossed the $100 billion mark on Nov. 17, 2017. Over this 1013 day period, Bezos earned on average $4.1 million per hour ($100 billion / 1013 days / 24 hours per day). Meanwhile the US federal minimum wage is $7.25 per hour. So Bezo earned about 560,000 times more per hour than a minimum-wage worker.↩

- Not only does ‘real’ capital not relate to the stock market, the quantity of ‘real’ capital can’t be measured objectively. This was the shocking realization revealed by the Cambridge capital controversy. For a nice demonstration of the problem, see Figure 8.1 in Capital as Power.↩

- Wondering where the capitalization formula comes from? Nitzan and Bichler explain in Chapter 9 of Capital as Power.↩

- The desire to ‘beat the average’, argue Nitzan and Bichler, is capitalism’s motivating force. Capitalists’ goal is differential accumulation — to accumulate capital (money) faster than others.↩

- The use of money, of course, long predates capitalism. (For a good history of money, see David Graeber’s Debt: The First 5000 Year.) But while many ancient societies used prices, capitalism is unique in the extent of monetary quantification. Today, anything that can be owned has a price.↩

- For a detailed discussion of the power index, see Bichler and Nitzan’s A CasP Model of the Stock Market.↩

Further reading

Bichler, S., & Nitzan, J. (2016). A CasP model of the stock market. Real-World Economics Review, (77), 119–154.

Glattfelder, J. B., & Battiston, S. (2009). Backbone of complex networks of corporations: The flow of control. Physical Review E, 80(3), 036104.

Graeber, D. (2010). Debt: The first 5,000 years. New York: Melville House Pub.

Hayden, B. (2001). Richman, poorman, beggarman, chief: The dynamics of social inequality. In Archaeology at the millennium (pp. 231–272). Springer.

Hayden, B., & Villeneuve, S. (2010). Who benefits from complexity? A view from futuna. In Pathways to power (pp. 95–145). Springer.

Nitzan, J., & Bichler, S. (2009). Capital as power: A study of order and creorder. New York: Routledge.

Turchin, P. (2016). Ultrasociety: How 10,000 years of war made humans the greatest cooperators on earth. Chaplin, Connecticut: Beresta Books.

Vitali, S., Glattfelder, J. B., & Battiston, S. (2011). The network of global corporate control. PloS One, 6(10), e25995.

Wow, insightful and sobering. The simplicity of the Power Index is amazing.

While there are a lot of interesting phenomena inherent in the stock market and capitalism, what strikes me most is the human psychology, and the implications of it for the future. Especially the psychology of self-appointed elites.

Most elites are self-appointed, or at least seek elite-hood: they are self-serving. Elites are, by definition, “better” than average people. Society is run by elites. Therefore, society is designed to serve elites, often at the expense of everyone else.

Occasionally, there are elites, in power, who serve the public interest. But they are rare. What conditions make it more likely that elites who value the public interest are in power? And what strategies will self-serving elites follow to prevent that from happening?

If self-interest (self-serving behaviour at the expense of others) follows a normal distribution, what mechanisms convert that to a power-law distribution of power? Government laws and priorities. Including laws around business, monopolies, taxation, finance, and the stock market.

What are the chances that, even if more people learn about and understand the power-centric nature of capital, that the self-reinforcing behaviours of self-serving elites—including regulatory capture, campaign finance, lobbying, gerrymandering, etc.—can be checked without some kind of radical, possibly violent—or at least destructive and disruptive—change?

Is society always going to be a viciously competitive struggle for power? Will average people always pay the price? Is it inherent in the human condition?

LikeLike

Big questions … I think that humans have an innate self-serving element to our nature. But unlike neoclassical economists, I don’t believe this is all there is to human behavior. We can also be empathetic and altruistic.

I think the point of revolutionary struggle is to try to build a system that stimulates selfless behaviour and punishes selfishness. As it stands today, US capitalism does the opposite … with the disastrous results available for all to see.

Elites will help themselves only to the degree that they can … the degree that they are not held to account by the rest of society. So the struggle that you’re speaking of, as I see it, is the struggle to build a more accountable society.

Obviously, there’s much to this topic, but that’s all I have time for now …

LikeLiked by 1 person

If Marx had substituted “energy” for “labor”, his analysis would have been spot on. Capital is embodied energy (albeit from numerous sources including human and animal labor and fuels).

It seems to me that the “right to exclude” is just a more cumbersome way of saying “owns”.

I think a better measure of the power index would be total corporate earnings over total wages because I find it hard to understand why a reduction in the discount rate, which increases stock prices, could cause a power differential between wages and capital. A change in the discount rate should affect the net present value of wage and profit streams equally. Also, for any given amount of earnings, as the discount rate declines toward zero, stock prices increase to infinity. How can such an event mean that wage earners have become completely powerless? And why should asset price rises affect the value of wages, particularly if those wages buy the same amount of (non-asset) goods and services that they did before?

And finally, discount rates need not be entirely arbitrary. There is indeed a “natural discount rate” related to the efficiency with which energy is converted into useful materials by nature. Photosynthetic efficiency limits the rate at which resources can be extracted from the natural world and converted to human use without destroying the future productivity of that natural world. A typical maximum discount rate should therefore be on the order of typical plant net photosynthetic efficiency, about 0.5%. Higher rates may seem attractive, but they can only be realized by destroying natural capital.

LikeLike

Joe,

This power index is just one benchmark of capitalist power. Many others are possible and should be explored.

About discount rates. Yes, the capitalization will become infinite as the discount rate tends to zero. But nothing real is infinite. And remember that we’re talking about a ritual. Today we effectively have negative interest rates, yet capitalization is not infinite.

Another thing to remember is that capital gains are real money. So when stock prices go up, that has a real effect on the social order.

About discount rates from nature. I’m skeptical of bringing anything physical into this, because we are talking about symbolic meaning. That’s what capital is. Yes, there are limits to physical processes, but there is no limit on the accumulation of symbolic meaning.

Yes, photosynthesis efficiency is a good benchmark for the energy that can be extracted from the sun. But you’ll have to explain to me how this relates to a discount rate on symbolic meaning.

LikeLike

You claim that capitalization has only symbolic meaning but then admit that it affects capital gains. I admit that capital gains are measured by money, but unless one is willing to say that money has only a fictitious relationship to resource distribution, then capitalization has real effects. But money does indeed have some relationship to the real world (however hard it may be to pin down), not least from its “power to exclude” some people from resources more than others.

The discount rate is related to the real world because it affects the real behavior of people who then affect the growth of the economy. The discount rate is the expected rate at which capital can be expected to grow. Again, although the units of monetary creation are arbitrary, money does represent ownership of real resources. If those ownership claims are believed to be able to grow faster than they actually can grow sustainably, then it is very likely that resources will be extracted at a faster than sustainable rate because it will be considered “normal”. If the return on capital of a fishing pole is expected to be 10 fish per day from a given lake, but the lake can only continuously provide 5 fish per day, the resource base will be destroyed.

As you say, people look to the recent past for estimating the discount rate. If their estimates are considerably higher than the sustainable rate, then the potential for damage is very high. Ever since the invention of the heat engine, use of the fossil fuel stock has created very high rates of growth, far higher than that which is sustainable over centuries and millennia. Capitalists have gotten used to these high rates of growth and think them natural and appropriate. They (we) are rapidly destroying our resource base. That destruction is not symbolic. This is why we must look to our relationship with the natural world to determine a realistic discount rate and act accordingly.

LikeLike

Thanks Joe,

Some thoughts:

Yes, I don’t see a contradiction here. Money is something that has only symbolic meaning. As long as humans agree on that, then money (or lack thereof) will affect our actions. So the consequences of this purely symbolic entity are very real. So yes, flows of money have real world effects, including on how resources flow. I would never deny that. It’s actually central to my research.

What I deny is that resource flows somehow limit the quantity of money that we can imagine into existence. They cannot. That being said, if we make the (subjective) decision to tie money to something physical, like gold, then the quantity of money is limited. However, the actual value that weassign to the gold is a subjective decision, not a property of the gold itself.

About ownership claims vs. real resources. It seems like you are echoing Soddy’s argument. Ownership claims tend to grow exponentially (due to compounding interest), while resources (at least before the last 200 years) did not. This is probably worth a whole post to untangle the problems here. But to get to the heart of it, Soddy didn’t consider prices. Ownership claims can grow exponentially — even if resources do not — as long as prices grow exponentially too. And guess what. In the last century prices have grown exponentially.

I agree that we’re rapidly depleting resources. But we don’t need money (or capitalists discount formula) to analyze this depletion. Anyway, many ecological economists believe Soddy’s arguments, but I think they’re fundamentally flawed. But just to be clear, that doesn’t mean I believe in perpetual biophysical growth. I don’t.

LikeLike

Also, it should clarify that Nitzan and Bichler aren’t arguing that machines and infrastracture (physical ‘capital’) aren’t important. They’re hugely important for giving us the standard of living that we enjoy today. It’s just that the accumulation of these machines can’t explain the accumulation of financial capital (ownership claims). Ownership claims have a life of their own that speaks to the power structure of society, not the mode of production.

LikeLike

[…] Stocks Are Up. Wages Are Down. What Does it Mean? – Economics from the Top Down […]

LikeLike

[…] Stocks Are Up. Wages Are Down. What Does it Mean? – Economics from the Top Down […]

LikeLike

[…] Stocks Are Up. Wages Are Down. What Does it Mean? – Economics from the Top Down […]

LikeLike

[…] Stocks Are Up. Wages Are Down. What Does it Mean? – Economics from the Top Down […]

LikeLike

Not a word about the federal reserve in this article. I presume the author thinks that a small cadre of people in complete control of the most important price of anything on earth and using that control to jack up the curve on that ‘power chart’ is …..capitalism?

lmao. this is nothing but commie bullshit.

LikeLike

Nothing in the article suggests this conclusion. And you’ll have to be more specific about what the ‘most important price of anything on earth’ is.

LikeLike

“Today I want to talk briefly about the Fed at a first principles level so we can better appreciate what they’re doing and why.

Let’s start with some history. The 1800s were a mess of economic booms/busts with an average -22% GDP contraction every FOUR years. ”

LikeLike

Thank Naked Capitalism for linking to this post. Most insightful thank you. It explains why stock markets go up every time something awful happens to the masses. The stock market could equally fairly be called ‘The Misery Index’.

LikeLike

Thank-you for the kind words, Richard.

LikeLike

[…] struggle is not my own. It comes from political economists Shimshon Bichler and Jonathan Nitzan. In ‘Stocks Are Up. Wages Are Down. What Does it Mean?’, I summarized their thinking (as I understand it). Before you continue here, I recommend reading […]

LikeLike