Hype

The Capitalist Degree of Induced Participation

YURI DI LIBERTO

April 2022

Abstract

Power is usually considered as either a ‘positive’ or ‘negative’ construct, as in the power to force action versus the power to forbid it. This paper explores a hybridized approach to power based on the idea of ‘induced participation’. Building on Bichler and Nitzan’s theory of ‘capital as power’, I argue that capitalism reinforces its hold on society through the strategic use of ‘hype’. The idea is that capitalists counteract resistance by boosting confidence in the promise of reward, a process that can be better understood using the concept of hype.

Keywords

capital as power, chreods, epochal changes, finance, hype, reward, social paradigm

Citation

Di Liberto, Yuri. 2022. ‘Hype: The Capitalist Degree of Induced Participation’. Review of Capital as Power, Vol. 2, No. 2, pp. 1–16.

1 Power: neither positive nor negative

THERE are two ways to conceive a theory of power. First, we can assume that ‘power’ means the ability to obstruct. In this case, we say that A has power over B if A can impede an action undertaken by B. This is a negative concept of power. Second, we can conceive power as a positive ability. In this case, we say that A has power over B if A can induce B to take some form of action. In other words, ‘positive’ power is the ability to allow, while ‘negative’ power is the ability to disallow.

Traditionally, philosophers have considered these two forms of power to be opposites. And even in cases where the dichotomy seems less pronounced, the tendency is usually to privilege one concept of power over the other. The debate over the nature of power has a long history, and my aim here is not to reconstruct the whole story. Instead, I want to move beyond the positive-negative dichotomy. The weakness of this dichotomy is that it ignores the possibility of having it both ways. We can have positive and negative power at the same time.

We can think of it this way: A has power over B if A induces some form of action from B (at time t) and B can do only that action (again at time t). In other words, I can exert power over someone by making them do something, and thus not allowing them to do anything else. When we look at power in this light, we see that the positive and negative sides tend to occur together. That is because the doing of one action precludes the doing of another.

With the duality of power in mind, this paper uses the theory of capital as power to investigate the role of ‘hype’ in modern capitalism.

1.1 Capital as power

According to Shimshon Bichler and Jonathan Nitzan’s theory of ‘capital as power’, capitalism is a ‘mode of power’ which mixes both the positive and negative aspects of power. On the one hand, capitalism has a centrifugal tendency to extend itself into every corner of society. And on the other hand, it has a centripetal tendency to reinforce the power of dominant actors.

Bichler and Nitzan argue that capitalism normally operates through the strategic limitation of industrial capacity — a process they call ‘business as usual’ (2009, pp. 236-237). They show that business (embodied by Veblen’s notion of the absentee owner) is related to industry (the production of goods and services by society’s coordinated efforts) through a process of top-down control.

The control of industry by business, Bichler and Nitzan observe, involves a delicate balancing act. If the productive/creative potential of industry “came to a complete standstill, capitalist earnings would be nil. … But capitalist earnings would also be zero if industry always and everywhere operated at full socio-technological capacity”. In this latter case, “industrial considerations rather than business decisions would be paramount, production would no longer need the consent of owners, and these owners would then be unable to extract their tribute of earnings”. And so capitalists strive for a Goldilock’s level of capacity that is ‘just right’. This capacity is then normalized in economics textbooks as ‘the natural rate of unemployment’ or ‘unemployment equilibrium’ (2009, pp. 243-244).

1.2 Power as ‘creorder’

It is here that my treatment of power as both negative and positive enters the picture. According to Bichler and Nitzan, society is a ‘creorder’ — a fusion of creation and order (2009, p. 305). The idea is that society is a system of power that balances both the possibility of novelty (creation) and the imposition of top-down order (power). Since the act of ‘creordering’ implies both creation and limitation, Bichler and Nitzan argue that power is neither solely negative nor solely positive.

Interestingly, the word ‘creorder’ resonates (both phonetically and conceptually) with the morphogenetic concept of a chreod. This idea, first introduced by the biologist Conrad Waddington in 1957, refers to the developmental path of a living system as it forms structure (for example, the path of a cell as it forms part of a specialized organ). Now, the crucial aspect of chreods is that they are not pre-established schemes of development. Instead, they involve both contingency and necessity (La Mantia, 2020, pp. 69-73). At each step, the chreod’s ‘blueprint’ interacts with its surroundings to shape the resulting structure.

As a metaphor for this process, consider the formation of a river. The initial stream of water encounters no pre-determined path. Instead, what lies ahead is a web of cracks into which it could flow. However, the moment the water takes a specific path, the river’s flow becomes self-reinforcing: the water erodes the soil, deepening and widening the path until it forms a river bed, at which point the water’s route is fixed. In this example, the contingent initial conditions gradually give rise to necessity. The result is a process in which ‘order’ is created through the activity itself.

We can extend this metaphor to the concept of ‘capital’. Capital is a chreodic power that must avoid both maximum congestion (maximum order and minimum creativity) and maximum capacity (maximum creativity and minimum order). What concerns me here is how capitalism is able to maintain itself in spite of society’s constant attempts to overturn its order.

There are different ways in which capitalism fights resistance. The most common (largely ‘negative’) method is to incarcerate large swaths of the population. On this front, Bichler and Nitzan note that the United States is both an archetypical liberal democracy and the world’s biggest penal colony. It has more incarcerated people (both in absolute and relative terms) than any other country (Bichler, Nitzan, 2014). The reason for this mass incarceration is simple: as society becomes more unequal, it must reinforce itself against bottom-up resistance. Bichler and Nitzan reflect:

From the viewpoint of capital as power, penality and unemployment are not distinct aspects of politics and economics, respectively. Instead, they are different forms of capitalized resistance and sabotage. Human creativity is a positive form of resistance to capitalist power, and the threat of unemployment is the means by which the ruling class tries to strategically sabotage and subjugate this creativity to capitalist ends. Similarly with crime and punishment. Illegality is a negative form of resistance to capitalist power (a ‘primitive rebellion’ as Engels called it), and penality is the major institution that keeps this resistance from undermining the capitalist creorder.

(Bichler and Nitzan, 2014, p. 269)

This canonical way of dealing with resistance has a long history. The correlation between income inequality and mass incarceration was famously highlighted by Friedrich Engels in his 1845 book The Condition of the Working Class in England. More recently, Bernard Harcourt (2011) discussed how ‘free market’ theorists have reinforced the penal system.

Incarceration can be placed under the negative ‘order’ side of the capitalist ‘creorder/chreod’. Under the positive ‘creative’ side, I argue that you can counter resistance from below not only by augmenting the degree of exclusion, but also (paradoxically) by increasing the degree of participation.

Returning to the river bed example, consider how we might deal with an impending flood. One option would be to increase ‘order’ by reinforcing the river bed with a dike. Alternatively, a ‘creative’ option would be to dig a new path down which the floodwaters can disperse.

2 Hype as chreodic power

To identify ‘creative’ power that is based on participation rather than exclusion, we should start with the work of Steven Lukes. In his book Power: A Radical View, Lukes observes that power is not solely an act of domination. Power also involves voluntary submission, or what Lukes calls “compliance to domination” (Lukes, 2005).

The problem of ‘compliance to domination’ was first described by Étienne De La Boétie in his sixteenth-century treatise Discourse on Voluntary Servitude. Why, he asks, do the dominated willingly comply with established power? Indeed, De La Boétie observes that in some circumstances, power is exerted without any need for violence or coercion.

2.1 Cyrus the Great

As an example of non-coercive power, De La Boétie tells the story of Cyrus the Great, who wielded power over the Lydians without using weapons. La Boétie recounts how Cyrus, after conquering Croesus (the capital of Lydia), heard that a revolt was imminent. Given his military power, Cyrus could have crushed the rebellion. Nonetheless, Cyrus opted for a different strategy, one which would not ruin “such a beautiful city” (De La Boétie, 2014, p. 52). Instead of stationing an army within the city (which would have been costly), Cyrus took a more cunning approach: he opened brothels, taverns, and gambling halls, and issued an order which forced the population to go to those places (2014, p. 53). The results were so satisfactory that Cyrus never had to resort to the sword.

Eventually, the ‘miserable people’ of Lydia (as La Boétie calls them) became so engrossed in their games that the Romans came to see them as hopeless addicts. Thus, ludi, which means ‘games’ in Latin, seems to derive from ‘Lydia’ itself (at least by La Boétie’s account). In short, La Boétie argues that activities such as theater, games, feasts, public spectacles, exotic beasts, medals, drugs, and other forms of entertainment functioned as decoys, allowing Cyrus to restrict social liberty without using violence.

2.2 Ordinary hype

Today, the situation is not that different from ancient Lydia. The twenty-first century has witnessed the profusion of betting shops (sports betting and now e-sports betting). In fact, growing inequality seems to coincide with a spread of gambling culture (Comaroff and Comaroff, 2000, p. 295). Perhaps we can think of big sporting events as a form of power through what I will call ‘ordinary hype’.

The Marxist philosopher Louis Althusser characterizes sports clubs as part of the ‘ideological state apparatus’. He argues that sports help reproduce the social relations between capitalists and laborers (Althusser, 1995). More recently, Robert Pfaller noted that sport events lead to what he calls ‘self-forgetfulness’ (Pfaller, 2014, p.182). When ritually watching televised sports, viewers enter a hypnotic state:

They remain motionless – with the possible exception of small mimetic gestures that are copied from or preempt the actors shown (in that the audience shows the actors how they should perform), or short, intensive explosions of emotion, such as joy, disappointment, or swearing at some of the players. A massive amount of social power is condensed in this area, without ever having touched the bodies of those who have been taken by it.

(Pfaller, 2014, p. 184)

In addition to sports, we can include within ‘ordinary hype’ such things as concerts and the release of new tech gadgets. I distinguish these forms of ‘ordinary hype’ from what I call ‘systemic hype’, which is a peculiar feature of the capitalist mode of power. (I discuss ‘systemic’ hype in the next section.)

La Boétie’s example of ordinary hype tells us two things. First, it sheds light on the difference between force and power. Specifically, one can have power without using force. As Elias Canetti notes, force coincides with its use in a specific time and place. Power, in contrast, is the constant possibility of force. Reflecting on this difference, Canetti writes:

Power is more general and broader than force, it contains more, and it is not as dynamic. It is more complex and it even implies some degree of patience. The word itself derives from the ancient gothic root ‘magan’ which means ‘to be able to’, and doesn’t have any relationship with the theme ‘machen’ (to do).

(Canetti, 2015, p. 339)

Second (and more relevant for the concept of chreodic/creordering power), is the fact that many ancient regimes used ‘participation’ to deal with resistance. That is, the tyrants of old understood that they could cement their power by funneling a rebellious populace into innocuous activities.

Philosopher Paul Virilio sees this chreodic power to ‘make do’ as the hallmark of the modern state. Virilio speaks of a ‘dromocratic’ revolution in which the ‘execution of governance’ becomes a matter of ‘pure logistics’ (2007, p. 19). For Virilio, a key strategy for avoiding a congestion of dissent was the diffusion of automobile culture:

The stroke of genius will consist in doing away with the direct repression of riots, and the political discourse itself, by unveiling the essence of this discourse: the transportation capacity created by the mass production of automobiles (since 1914 with Ford) can become a social assault, a revolution sufficient and able to modify the citizen’s way of life by transforming all the consumer’s needs, by totally remodeling a territory that (need we be reminded of it?) at the beginning had no more than 400 kilometers of road.

(Virilio, 2007, p. 50)

2.3 From ordinary to systemic hype

Hype serves many purposes. It secures some degree of what Lukes calls ‘compliance to domination’. Hype eases social tensions by funneling them towards innocuous (for the powerful) activities. And it creates social cohesion by allowing people to bond over a shared object of hype. What unifies the various aspects of hype, however, is a shared sense of time. Hype is always future oriented. For this reason, we might consider hype the quintessential capitalist passion.

In capitalism, I argue that we should distinguish between ‘ordinary’ hype (described above) and ‘systemic’ hype. The difference is a matter of degree, not kind. Capitalism extends and normalizes the use of hype as a mode of power. In other words, capitalism makes hype systematic rather than sporadic. I define ‘systemic hype’ as the cyclical frenzy that accompanies the introduction of new products and technologies. This form of novelty-driven hype depends on inflating the ‘revolutionary’ nature of innovative technology.

While new to capitalism, systemic hype has not replaced ordinary hype. Instead, Bichler and Nitzan note that ordinary hype has been strategically coupled with fear and made a means of accumulation. Hedonic consumption, they argue, is “usually spiced up with plenty of anxiety and unease” (2009, p. 160). This technique is reflected in the fear-oriented world of mainstream media:

The official news reels scare their audiences with uncertainty, loneliness, violence and disaster, the sports programmes elate them into ecstasy, and the blockbuster films give them their ‘two minutes of hate’ between the chainsaw massacres and end-of-the-world catastrophes. This simmering brew is then cooled down by the soothing solutions of commercial advertisements.

(Nitzan and Bichler, 2009, pp. 160-161)

To put a number to this ordinary hype, Bichler and Nitzan estimate that roughly 5% of global net corporate income comes from some form of advertising.

Back to systemic hype. How does systemic hype differ from its ordinary (hedonic) counterpart? A big difference is that systemic hype is part of the ritual of capitalization. In capitalism, Bichler and Nitzan note, hype can be defined as the ratio of expected earnings to actual future earnings (2009, p. 188-189). This hype is ‘systemic’ in the sense that it is a key ingredient of capitalization, an ingredient that shapes how actors behave.

As an example, consider the ‘active insider’. This is a person who has the power not only to ‘identify hype’ (by holding exclusive information), but who can also ‘shape its trajectory’. Commenting on the role of the active insider in creating the 2008 financial crisis, Bichler and Nitzan write:

The recent US sub-prime scam, for example, was energized by a coalition of leading banks, buttressed by political retainers, eyes-wide-shut regulators, compliant rating agencies and a cheering chorus of honest-to-god analysts. The active insiders leveraged their positions — and then stirred the capitalist imagination and frothed the hype to amplify their gains many times over.

(Nitzan and Bichler 2009, p. 191, my italics)

From the (in)famous case of Tulip-mania onwards, examples of induced hype are numerous. In fact, I propose that these cycles are necessary to perpetuate the social hierarchy of capitalism. Hype is also crucial to the redistribution of power.1

Unlike the kingships and theocracies of old (whose rule depended in large part on physical coercion), capitalism’s pecuniary nature makes the accumulation of power potentially boundless (Nitzan, 1998, p. 202). And because anyone can (in theory) own capital, resistance is subdued by stimulating inclusive trust in the future. Or as Nitzan writes, “instead of exerting punishment, [capital] expands mainly by extending reward” (p. 202).

To summarize, there is no better way to maintain power than to convince society that there is room for everybody on the financial bandwagon.

2.4 Cycles of hype and paradigm shifts

According to Carlota Perez, cycles of hype follow a specific historical pattern. Perez builds on the ideas of Soviet economist Nikolai Kondratiev, who proposed that capitalism works in ‘big waves’ that are about a half-century long. (Today, these cycles are often called ‘Kondratiev waves’ or K-waves.) Drawing on Kondratiev’s work, Perez explores the logic of these cycles. Her work demonstrates that ‘K-waves’ could arguably be called ‘H-waves’, where ‘H’ stands for ‘hype’.

In Perez’s theory, each hype wave is triggered by a new technology and has two phases. In the first phase, called ‘installation’, finance takes the lead. During this period, markets are usually kept as unfettered as possible, in order to propagate the technological revolution (Perez, 2012, pp. 19-20). As the installation phase nears its end (usually after about 30 years) there is a ‘major technological bubble’. When this bubble bursts, it ushers in the second phase, which Perez calls ‘deployment’. Frightened by the specter of a recession, governments intervene to bolster production. The result is a ‘Golden Age’ during which the new technology spreads (2012, p. 20).

Perez observes that each technological wave usually starts as an explosion of hype:

Each great surge is initiated with a big-bang, a publicly recognized innovative breakthrough that inflames the imagination of entrepreneurs and launches the entrepreneurial swarming in restricted sectors and geographic regions, so much so that it is likely to go unnoticed in economic statistics.

(Perez, 2011, p. 19)

Famous examples of such technological ‘big bangs’ are the invention of the Cromford mill, the Model T, and most recently the invention of the microprocessor. Perez continues:

From the big-bang on, there is an ever more intense process of diffusion and assimilation that in a few decades ends up encompassing the bulk of activities in the core country or countries.

(ibid)

Table 1 shows examples of these hype waves. Note that the second UK hype cycle is particularly significant because it marks the formal birth of the modern corporation. For details, see Paddy Ireland (1996) and Perez (2009, p. 782).

| Country | Start Date | Surge | Tech Bubble | Collapse Date |

|---|---|---|---|---|

| England | 1771 | Industrial revolution | Canal mania | 1793 |

| UK | 1829 | Railway age | Railway mania | 1847 |

| US | 1908 | Automobile, oil, petrochemical | Roaring Twenties | 1929 |

| US (and global) | 1970 | Information and digital communications | Internet mania | 2008 |

The twofold nature of hype cycles is important. During the first half of the wave (the ‘installation’ period), the price of the new technology is prohibitive, and so the tech is confined to a small corner of society. During the second half of the wave (the ‘deployment’ period), the technology is commercialized and included into daily life, thus becoming part of social reproduction. Finally, during the ‘deployment-normalization’ period, a new technology (which will likely cause the next hype cycle) starts to incubate.

Note that each hype wave has its root in a fairly narrow spatio-temporal milieu. The countries and dates reported in Table 1 represent the place and moment within which the new technology spreads with the greatest intensity. In other words, the possibility for a new technology dominating the process of what Schumpeter (1911) called ‘creative destruction’ depends heavily on how it performs locally against the many competing alternatives. Overcoming material resistance is just the initial phase of the cycle. The other crucial factor that characterizes each technological bubble is that they tend to succumb to over-evaluation. Take the example of Railway mania. In 1847, right before the collapse of the bubble itself, it is estimated that the UK’s investment in railways reached 7% of its national income (Mitchell, 1964, quoted in Perez, 2009, p. 784).

Looking at the scale of these technological cycles, Perez concludes that they cause real paradigm shifts:

… the installation period ends with a financial collapse, after having accomplished this task, including the replacement of the industries – and firms – that act as the engines of growth of the economy, the installation of the new infrastructure providing externalities for everybody and the general acceptance of the ‘common sense’ criteria for best practice of the new paradigm.

(Perez, 2011, pp. 19-20)

2.5 Intellectual hype

Thorstein Veblen observed that human ‘industry’ is an interlocking process of synchronized techniques. As such, if a new technology is to be adopted, it must fit into the wider process of production. Still, the spread of technology is not completely bottom-up. Certain key sectors tend to determine the speed and direction of technological change (Veblen, 1923, p. 254; Bichler and Nitzan, 2009, pp. 223-227). Importantly, once a new technology is established, it often generates enough hype that it captures the imagination of prominent intellectuals, who then contribute to the hype cycle.

As an example, consider the internet boom and the birth of the so-called ‘New Economy’. In their book The New Spirit of Capitalism, Boltanski and Chiapello note how the arrival of information technologies, personal computers, and digitalization contributed to an intellectual shift toward a ‘network’ paradigm (Boltanski and Chiapello, 2007, p. 143). Inspired by this shift, Marxist thinkers like Antonio Negri (2011) couldn’t resist basing their metaphysical ideas on new ‘relational properties.’2 Everywhere they looked they saw ‘multitudes’, ‘bio-political labour’ (i.e. creative IT ‘prosumers’), ‘rhizomes’, ‘horizontal connections’, and ‘networks’.

Unfortunately, what remains of these ‘subversive’ scenarios is just more capitalism — things like ‘smart cities’ and Big Tech. Indeed, the consolidation of internet platforms stands in stark contrast to the democratic scenarios envisioned by hype-driven post-capitalist theories (Srnicek 2017).

2.6 Paradigm blindness

While new technology has yet to give rise to a post-capital world, that does not mean that capitalists always welcome technological change. Instead, Perez notes that capitalists are often either hostile to new technology, or blind to its implications:

… it is not evident that the truly experienced financiers will be capable of understanding the essence of the new technologies or of visualizing the implicit change in direction.

(Perez, 2011, pp. 23- 24)

Perez reminds us of the case of J.P. Morgan who — at the height of his power — rebuffed Henry Ford by calling automobiles ‘rich men’s toys’ (p. 24). This paradigm blindness, Perez argues, arises from the ‘over-adaptation’ experienced by society as it “engages in the full deployment of a particular technological revolution”.

More relevant for our purposes, however, is the fact that each major technological bubble tends to induce a corresponding ‘easy liquidity bubble’. For instance, the internet mania of the 1990s ended with the NASDAQ collapse in 2000. The ensuing liquidity bubble ended with the financial crisis of 2008.

Although hype waves are typically started by a new technology, they usually end by being dominated by finance. That seems to be because new technologies lead to increasingly sophisticated forms of finance, which drive a corresponding asset bubble. Curiously, the extension of credit then sows the seeds of its own destruction. As credit expands, the ‘quality’ of asset titles degrades, debt levels explode, and risk is offloaded onto society. And so the seeds of the next financial crisis are planted (Durand, 2014, p. 43).

Information technologies facilitate these hype cycles by allowing instant and large-scale ‘participation’. The promise of easy gains creates an ‘irrational exuberance’ (Perez, 2009), which is stoked by free-market liberals (such as Ian Brickell, formerly of J.P. Morgan and then head of the International Swaps and Derivatives Association) who are always ready to champion ad hoc theories of the ‘self-regulating’ market.

2.7 Hype hormones

Intriguingly, irrational exuberance appears to be so deeply rooted in our biology that it has a hormonal component. Or put another way, there seem to be ‘neurological correlates of hype’.

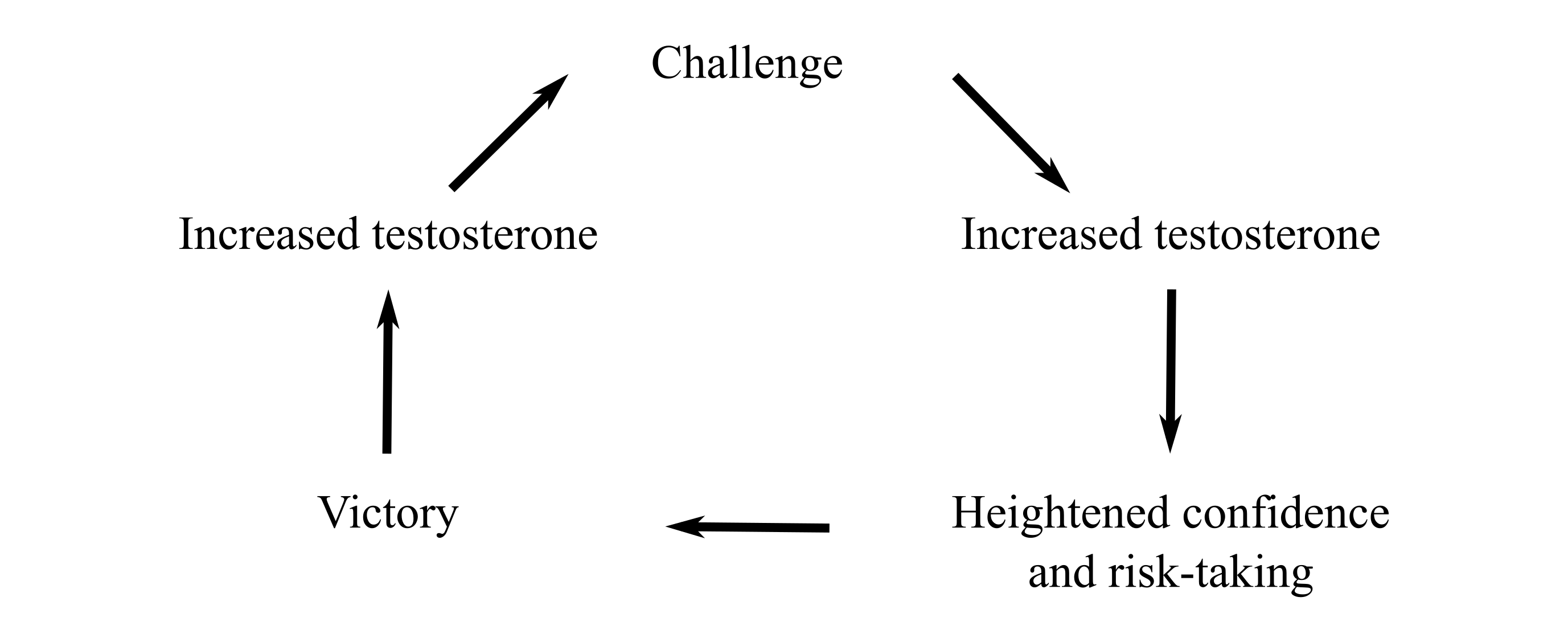

In a 2010 study, Coates, Gurnell and Sarnyai found evidence for a ‘feedback loop’ between steroid hormones (testosterone) and market activity. In particular, they discovered the ‘hormonal hype cycle’ (my expression) illustrated in Figure 1.

Figure 1: A hormonal hype cycle

This figure illustrates the hormonal feedback cycle discovered by Coates et al. (2010).

It seems that regardless of the context (sports, finance, video games, etc), ‘winning’ causes people’s testosterone to rise. With higher testosterone levels, individuals become more willing to engage in risky behavior, and become more confident that the financial outcomes will be positive (for them). In the long run, though, this feedback loop actually impairs rational decision making. Commenting on how this relates to mainstream economic theory, Coates et al. observe: “economic agents are more hormonal than is assumed by theories of rational expectations and efficient markets” (p. 339).

Continuing, Coates et al. note that mainstream economics assumes that prices in financial markets “accurately reflect all available information”. However, it seems that when confronted with the same information, a trader’s interpretation is affected by their hormone levels:

[A] trader with high levels of testosterone may see only opportunity in a set of facts; while the same trader with chronically elevated cortisol [testosterone’s counterpart] may find only risk.

(Coates, Gurnell and Sarnyai, 2010, p. 339)

In other words, hype may be driven not by facts, but by hormones.

3 Conclusions

Today, as we are threatened by a global pandemic and ecological collapse, we can speculate about the next hype wave. Indeed, it may already be unfolding in the form of the ‘ecological transition’, which is hyping investments in rare earth ETFs and other strategic metals. Regardless of the specifics of the next hype cycle, it seems likely that the two forms of hype discussed in this paper (‘ordinary’ and ‘secular’) will continue to drive contemporary capitalism.

On a more theoretical note, the pervasiveness of hype cycles calls for a serious questioning of free-market dogmas, especially the idea of the ‘rational agent’ endowed with ‘perfect information’.

To conclude, capitalism’s ability to secure social obedience through ‘induced participation’ (backed by the promise of short-term and/or long-term reward) reminds me of artist Jenni Holzer’s famous truism: ‘Protect me from what I want’.

Notes

Yuri Di Liberto obtained his PhD in Philosophy at the University of Calabria (2020). He has studied with Italian philosopher Felice Cimatti and American philosopher Adrian Johnston at the University of New Mexico. His research focuses on the relationship between politics, contemporary philosophy and psychoanalysis. His recent book, Asimmetria: Lotta di classe alla fine di un mondo (‘Asymmetry: Class Struggle at the End of a World’, Mimesis, 2022), investigates the social consequences of the Covid-19 pandemic and climate change. Email: yuridiliberto@yahoo.it.

References

Althusser, Louis. 1995. Sur la Reproduction. Paris: PUF.

Bichler, Shimshon, and Jonathan Nitzan. 2004. ‘New Imperialism or New Capitalism?’. Review (Fernand Braudel Center), Vol.29, No.1, 2006. pp. 1-86.

—— 2009. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

—— 2012. ‘Capital as power: Toward a new cosmology of capitalism’, Real-world economics review, n.61. pp. 65-84.

—— 2014. ‘No way out: crime, punishment and the capitalization of power’. Crime, Law and Social Change, No. 61. pp. 251-271.

—— 2015. The Scientist and the Church. World Economics Association.

—— 2020. ‘Growing Through Sabotage. Energizing Hierarchical Power’. Review of Capital as Power, Vol.1, No.5. pp. 1-78.

Boltanski, Luc, and Ève Chiapello. 2007. The New Spirit of Capitalism. London-New York: Verso.

Canetti, Elias. 2015. Massa e potere. Milano: Adelphi.

Coates, John M., Mark Gurnell and Zoltan Sarnyai. 2010. From molecule to market: steroid hormones and financial risk-taking. Philosophical Transactions of the Royal Society B: Biological Sciences, 365(1538), pp. 331-343.

Comaroff, Jean, and John L. Comaroff. 2000. ‘Millennial Capitalism: First Thoughts on a Second Coming’. Public Culture, 12 (2), pp. 291-343.

Deleuze, Gilles, and Félix Guattari. 1982. Anti-Oedipus: Capitalism and Schizophrenia. Minneapolis: University of Minnesota Press.

Durand, Cédric. 2014. Le Capital Fictif. Comment La Finance S’Approprie Notre Avenir. Paris: Les Prairies Ordinaires.

Harcourt, Bernard H. 2011. The Illusion of Free Markets. Punishment and the Myth of Natural Order. Cambridge: Harvard University Press.

Ireland, Paddy. 1996. ‘Capitalism without the capitalist: the joint stock company share and the emergence of the modern doctrine of separate corporate personality’. The Journal of Legal History, 17:1. pp. 41-73.

De La Boétie, Étienne. 2014. Discorso della servitù volontaria. Milano: Feltrinelli.

La Mantia, Francesco. 2020. ‘Chreod’ in Vercellone F. and Tedesco S. (eds.), Glossary of Morphology, Springer. pp. 69-73.

Lukes, Steven. 2005. Power: A Radical View. London: Palgrave Macmillan.

Mitchell, Brian S. 1964. ‘The coming of the railway and United Kingdom economic growth’, The Journal of Economic History, Vol. 24, n. 3, September, pp. 315-336.

Negri, Antonio, and Michael Hardt. 2011. Commonwealth. Belknap Press.

Nitzan, Jonathan. 1998. ‘Differential accumulation: towards a new political economy of capital’. Review of International Political Economy, 5:2. pp. 169-216.

Pfaller, Robert. 2014. On the Pleasure Principle in Culture. Illusions Without Owners, London: Verso.

Perez, Carlota. 2009. ‘The double bubble at the turn of the century: technological roots and structural implications’. Cambridge Journal of Economics, 33, pp. 779-805.

—— 2011. ‘Finance and Technical Change: A Long-term View’. African Journal of Science, Technology, Innovation and Development, Vol.3, No.1. pp. 10-35.

—— 2012. ‘Technological Revolutions and the Role of Government in Unleashing Golden Ages’. Journal of Globalization Studies, Vol.3, No. 2. pp. 19-25.

Schumpeter, Joseph A. 1911. The Theory of Economic Development. Oxford: Oxford University Press.

Srnicek, Nick. 2017. Platform Capitalism. Cambridge: Polity Press.

Veblen, Thorstein. 1923. Absentee Ownership and Business Enterprise in Recent Times. The Case of America. London: George Allen & Unwin, LTD.

Virilio, Paul. 2007. Speed and Politics. An Essay on Dromology. Los Angeles: Semiotext(e).

Waddington, Conrad H.. 1957. The Strategy of the Genes. A discussion of some Aspects of Theoretical Biology. London: George Allen and Unwind Ltd.